Branches remain a vital part of the banking services offered in Canada. In-person banking, while declining in frequency with the steady growth and adoption of digital banking solutions, remains a valued method to conduct a range of transactions and many Canadians continue to rely on personal service.

As demand for in-person banking has decreased, branches have become more specialized, where a variety of financial products, services and advice are also available. The number of bank branches in Canada has remained relatively consistent, other than some temporary closures during the pandemic because of social distancing measures.

The decision to close a branch is never taken lightly by banks. In every case, there is careful consideration of the impacts to the community, their customers, and employees. Banks provide advanced notice of the closure and consultations take place with members of the community to help ensure that they are aware of the closure and that they will continue to have access to banking services. Branches are only closed after extensive analysis of a full range of factors. Learn more about banking services offered to consumers in Canada.

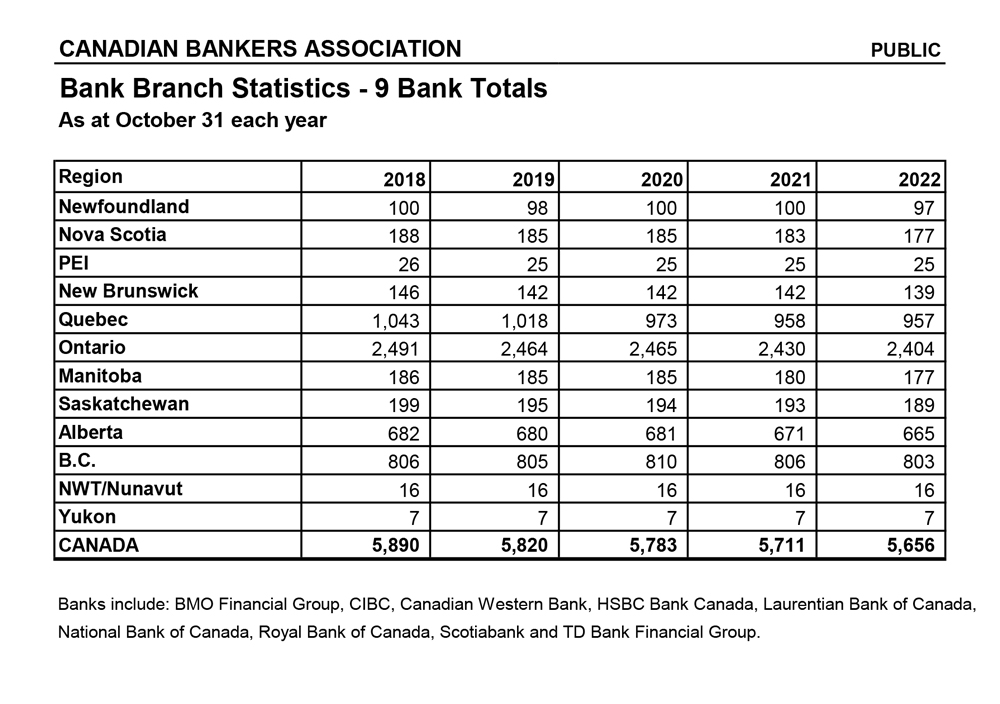

Chart: Statistics on the number of bank branches in Canada by province as of October 2022