Fast facts

- The majority of Canadians are shareholders in Canadian banks either directly through share ownership or indirectly through pension and mutual funds, including the Canada Pension Plan (CPP).

- Canada’s six largest banks paid $18 billion in taxes in Canada in 2022 to all levels of government.

The bottom line

When banks are profitable, they are stable. When banks succeed, the economy and communities prosper.

A profitable banking industry works for Canada and Canadians. Banks provide jobs directly and indirectly, create tax revenues, distributes dividend payments and donate to charities in Canada and worldwide. Profits also expand the capital base of banks, which in turn maintains the stability of the system, ensuring the safety and security of Canadians’ deposits.

What is the difference between revenues and profits?

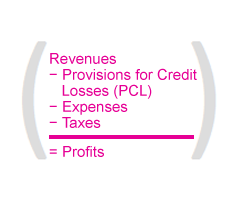

Revenues are generated from the selling of a business’ products and services before expenses and taxes. Profit, also known as net income, is left after setting aside funds for credit losses and accounting for expenses and taxes. The six largest banks’ net income in 2022 was $66.6 billion.

Where do bank profits come from?

Banks are involved in many business lines, such as personal and commercial banking, capital markets, wealth management and insurance, generating revenue from a variety of businesses.

This variety helps yield positive and stable financial results, which makes for a safe and secure banking sector that contributes significantly to Canada’s economy.

Banks categorize their revenue into two broad areas based on how it is generated – net interest income and non-interest income.

Net interest income is generated from what is known as the ‘spread’. The spread is simply the difference between the interest a bank earns on loans extended to customers and the interest paid to depositors and other creditors for the use of their money. Fifty-two per cent of bank revenue earned is net interest income.

Non-interest income accounts for 48 per cent of bank revenues. Banks earn this by providing a variety of value-added services, including trading of securities, assisting companies to issue new equity financing, commissions on securities and wealth management.

Added together, net interest income and non-interest income form total revenue. From total revenue, a number of items are subtracted, including expenses for its staff, locations, equipment and technology. Taxes must also be paid out of total revenues.

Net income (after expenses and taxes) is used, among other things, to:

- Expand the capital base of the bank;

- Make investments to improve the bank;

- Pay dividends to shareholders; and,

- Make acquisitions.

Who benefits from profitable banks?

Canadians do. The banking industry is a success story and its profitability is very important both to our economy and to individual Canadians.

- Banks and their subsidiaries contribute significantly to job creation and to the Canadian labour market, employing more than 280,000 employees in Canada.

- Canada’s six largest banks paid $18 billion in taxes in Canada in 2022 to all levels of government.1

- The majority of Canadians are shareholders in Canadian banks either directly2 through share ownership or indirectly through pension and mutual funds, including the Canada Pension Plan (CPP). Pension funds and RRSPs are some of the main beneficiaries of the billions of dollars that the banks pay in dividends each year.

- Suppliers to the banks, including businesses of all sizes, all over Canada and the world. Banks made purchases from outside suppliers totaling about $24.3 billion in 2022.

- Banks and their employees are also among Canada's top corporate donors and have a long tradition of community participation. Canada’s charities and non-profit community groups receive multi-million dollar support from banks and every year thousands of bank employees at all levels donate their time and talent to charitable initiatives. These contributions help support a broad range of programs, particularly in the areas of education, the arts, youth, the environment, disaster relief and health care.

1 CBA Tax Statistics, Estimates

2 About half of the shares of the top six banks in Canada are owned directly by individual retail investors. Source: TMX Group/S&P Capital IQ