The COVID‑19 outbreak was the most serious crisis Canada had faced in recent memory. And banks in Canada were committed to helping the country emerge from the crisis with a strong, sustainable economic recovery.

To confront the financial dimensions of pandemic, Canada’s banking sector worked in lockstep with the federal government, the Bank of Canada and regulators to immediately implement a series of relief initiatives to create tailored support plans for individuals and small businesses to help manage financial uncertainty and help blunt the economic impact of COVID‑19.

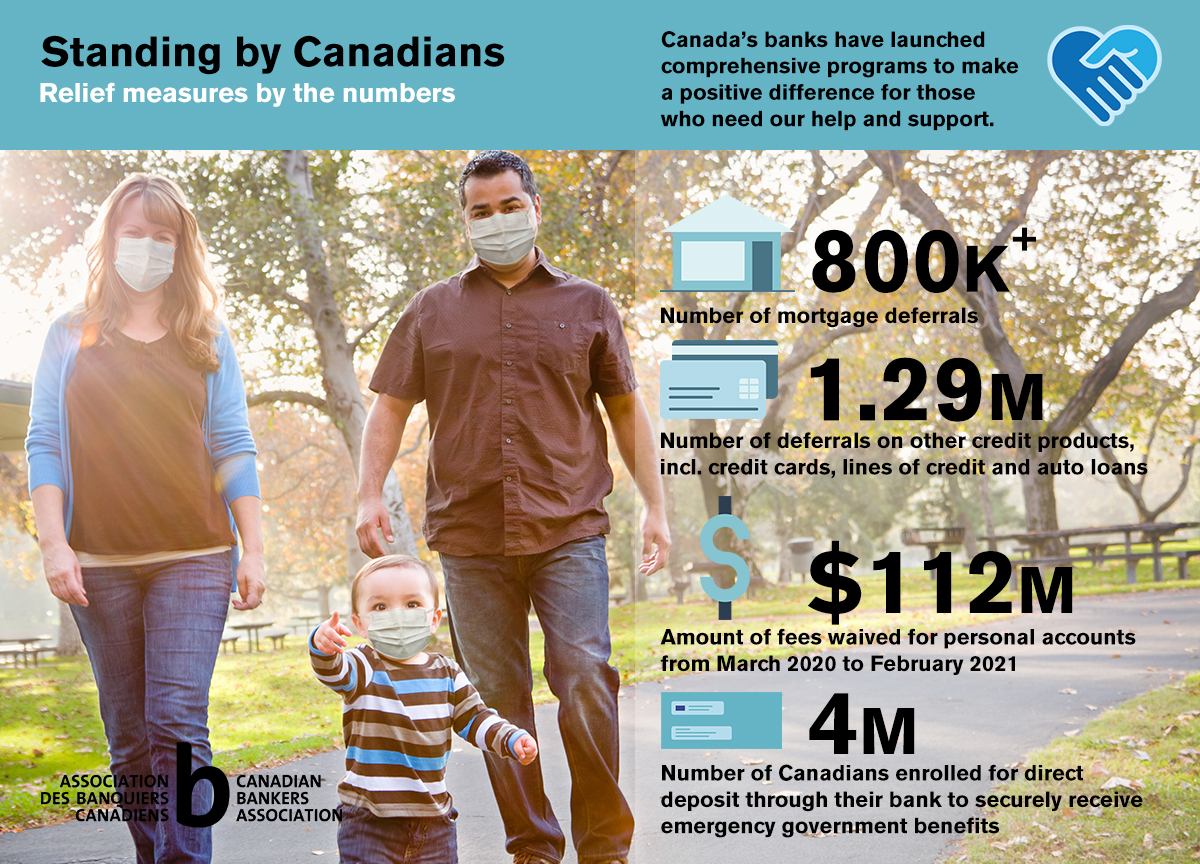

Through these efforts, Canada’s banks helped almost 800,000 homeowners with mortgage flexibility and provided more than 482,500 individuals with credit card payment deferrals. In total, Canada’s banks provided almost 2.1 million deferrals on all personal credit products, including mortgages, credit cards, lines of credit, personal loans and auto loans. We’ve worked with the Government of Canada to more efficiently and securely deliver the Canada Emergency Response Benefit to more than 4 million Canadians and have facilitated interest‑free loans to more than 898,000 small businesses through the Canada Emergency Business Account. And Canada’s six largest banks have waived more than $112 million in fees for personal bank accounts from March 2020 to February 2021. We’ve also made changes to our branches and customer service delivery methods to protect our employees and customers and provided more than $23 million in donations to support front-line workers and urgent community needs.

Personal customers

- Reduced credit card interest rates, deferred payments and instituted low minimum payments on credit cards, lines of credit and auto loans. As of January 31, more than 482,000 credit card deferral requests were completed by eight banks with close to 1.3 million deferrals on all personal credit products, excluding mortgages, including credit cards, lines of credit and auto loans.

- Canada’s six largest banks waived more than $112 million in fees for personal bank accounts from March 2020 to February 2021.

- Canada’s banks offered mortgage payment relief to customers by way of deferred mortgage payments. As of February 28,2021 13 CBA member banks provided help through mortgage deferrals or skip a payment to almost 800,000 Canadians, valued at more than $5.5 billion.

- Collaborating with the Government of Canada to offer online enrollment of Canada Revenue Agency’s (CRA) direct deposit to facilitate Canada Emergency Response Benefit payments. Over 4 million Canadians enrolled through their financial institution for CRA direct deposit.

- Instituted policies that prioritize seniors, frontline healthcare workers and vulnerable populations when they access in-branch services

Small business customers

- Canada’s banks serve three million self-employed, small and medium-sized enterprises across Canada and have authorized more than $254.6 billion in credit to this sector as of September 2020.

- Banks in Canada continue to lend to SMEs through the pandemic. According to the CBA’s most recent figures, loans and acceptances to SMEs in Q3-20 increased by more than three per cent compared to the same time last year.

- Banks delivered fast access to the Canada Emergency Business Account (CEBA) program, facilitating small and medium-sized companies interest-free loans of up to $40,000, including the recent expansion of the program.

- More than 898,000 CEBA loans were approved by financial institutions including banks, representing more than $49.2 billion in interest‑free credit for eligible businesses.

- As of February 2021, Canada’s six largest banks waived more than $4.9 million in fees for small business bank accounts since March 2020.

- Partnering with the Government of Canada to expedite access to the Canada Emergency Wage Subsidy (CEWS) for businesses. The new service allows eligible businesses to register their business payroll accounts for direct deposit with the Canada Revenue Agency directly through their bank business portals.

- Banks partnered with the Business Development Bank of Canada to offer a Co-Lending Program and with Export Development Canada to offer a Loan Guarantee Program for small and medium-sized enterprises through the federal government’s Business Credit Availability Program (BCAP).

- Banks also worked with the Government to deliver relief to particularly hard hit businesses through the Highly Affected Sectors Credit Availability Program (HASCAP) Guarantee.

- As of July 11,2021 more than 7,370 HASCAP loans were approved by financial institutions, including banks, representing more than $1.58 billion in guaranteed, low‑interest credit for eligible heavily impacted businesses.

- Worked with business clients to determine the best options to suit their specific circumstances. Banks introduced a range of flexible measures for existing loans, including deferrals and term extensions. More than 89,500 deferrals were extended to businesses (the majority of which are SMEs) with a total value of more than $3.3 billion.

- Provided advice and support of small business clients' immediate cash management or new lending needs.

Employees

- Implemented intensive cleaning programs to ensure that workplaces, including branches, remained as safe as possible for everyone.

- Paid bonuses and provided extra paid days off to customer-service employees who work in branches and call centers.

- Implemented broad-based work from home options for any roles that could be performed remotely to support public health efforts and the well-being of employees.

Communities

- Made gifts to Canadian charities such as BGC Canada, United Way Centraide Canada, Food Banks Canada and Breakfast Club Canada to provide essential services, community services and services for senior citizens.

- Seven banks donated more than $29 million to support frontline health care workers and community services urgently needed for vulnerable individuals affected by the public health, social and economic consequences of COVID-19.

Bank Announcements

Bank of Montreal

CIBC

Canadian Western Bank

Coast Capital Savings

Laurentian Bank

National Bank

RBC

Scotiabank

Tangerine

TD

February 10, 2022

BMO Business Xpress Exceeds $2 Billion in Credit Authorizations: Supporting Businesses through the Pandemic and Delivering Rapid Access to Capital for Entrepreneurs

December 1, 2021

BMO Launches Wrap the Good to Promote Small Business Recovery this Holiday Season

July 19, 2021

BMO Extends Wellness Services to Canadian Business Owners and Entrepreneurs

July 12, 2021

BMO Expands Grant Program for Women-Owned Businesses Across North America

May 13, 2021

BMO Survey: Canadians Lag Americans on Perceptions of Financial Progress but Strong Financial Habits Established During the Pandemic

May 3, 2021

BMO Announces $250,000 Donation to Organizations Supporting Global Emergency COVID‑19 Relief Efforts

May 3, 2021

Banks in Canada respond to urgent need for global COVID‑19 relief

March 8, 2021

BMO Issues C$750 million Women in Business Bond In Support of Women-Owned Businesses

February 16, 2021

BMO Launches Tailored Small Business Bundle as part of its Canadian Defence Community Banking Program

February 4, 2021

BMO Continues Support of Business Clients with Access to Highly Affected Sector Credit Availability Program

December 18, 2020

BMO Employees Rally Together to Combat Economic and Social Disparity

December 4, 2020

BMO Supports Small and Medium Business Clients with Access to Expanded CEBA Loan Program

November 5, 2020

BMO Launches New, AI Driven Insight to Help Customers with Everyday Monetary Decisions

October 28, 2020

The Move to Main Street: BMO Introduces Dedicated Business Banking Team Focused on Canada's Small and Emerging Businesses

October 22, 2020

BMO Housing Survey: COVID Has First-Time Homebuyers Leaning Towards Fixed Rate Mortgages and Many Will Look to Family for Financial Help

October 20, 2020

BMO Speeds Up the Home Buying Journey with Digital Pre-Approval Solution

October 14, 2020

BMO Introduces Dedicated Agriculture Banking Team

October 13, 2020

BMO Re-Imagines Chequing Account to Help Keep Money in the Pockets of Canadian Families

July 24, 2020

BMO Wealth Management Offers Tips for Stress Testing Estate Plans During Times of Uncertainty

July 8, 2020

BMO Announces $100,000 Grant Program for Women-Owned Businesses

June 25, 2020

BMO Continues Support for Women Entrepreneurs with New Grant Program

June 19, 2020

BMO Clients Can Now Access Expanded Financial Support with BDC's Mid-Market Relief Program

May 28, 2020

Kids Help Phone Never Dance Alone-a-thon powered by BMO in Support of Youth in Canada

May 25, 2020

BMO Creates Dedicated Online Resource Hubs for Canadians

May 14, 2020

BMO Transforms BMO Institute for Learning (IFL) into Rest Space for Front-Line Healthcare Workers

May 4, 2020

BMO Business Clients Can Now Enroll to Receive Funds Quickly and Securely from the Canada Emergency Wage Subsidy

April 23, 2020

BMO Business Clients Can Now Apply for the BDC COVID-19 Relief Program

April 19, 2020

BMO to Begin Accepting Applications for the EDC COVID-19 Relief Program

April 8, 2020

BMO Small and Medium Business Clients Can Now Apply for the New Canada Emergency Business Account

April 3, 2020

BMO Bank of Montreal Announces New Credit Card Rates For Consumers and Small Businesses Affected by COVID-19

April 3, 2020

Banks Facilitate Access to Relief Funds Through CRA Direct Deposit

March 27, 2020

Banks in Canada Step Up to Support Small Business

March 24, 2020

BMO Announces Dedicated Financial Relief for Canadian Businesses Affected by COVID‑19

March 20, 2020

BMO Financial Group Supporting United Way Community Fund to Fill Gaps for Community Services due to COVID‑19

March 17, 2020

Canada's Six Biggest Banks Take Decisive Action To Help Customers Impacted by COVID‑19

BMO Bank of Montreal Announces Actions to Support the Well-Being of Clients, Team Members, and Communities

October 18, 2021

Pandemic Paused but hasn't Derailed Canadians' Ambitions: CIBC Poll

October 1, 2021

CIBC Bolsters Support for Business Clients by Adding More Advisors and Promoting Local Merchants in New Campaign

June 24, 2021

CIBC to expand installment payment options for online credit card purchases with Visa Canada

May 23, 2021

CIBC Joins City of Toronto to Bring Ice Cream Trucks to Vaccine Clinic

May 12, 2021

CIBC and Goodfood Deliver Thousands of Meals to Hospitals on International Nurses Day

May 3, 2021

Banks in Canada respond to urgent need for global COVID‑19 relief

April 30, 2021

CIBC donates $100,000 to UNICEF to support COVID‑19 relief efforts in India

March 22, 2021

CIBC ready to assist business clients with CEBA applications on extended deadline

February 3, 2021

New CIBC Mobile Banking feature uses AI to give clients personalized, data-driven insights into their spending and saving

February 1, 2021

CIBC now accepting applications for the Highly Affected Sectors Credit Availability Program

January 4, 2021

Entering a pivotal year for Canadians' personal finances, CIBC helps Canadians keep their ambitions on track

December 10, 2020

CIBC launches AI-based Virtual Assistant to help clients bank digitally

December 9, 2020

CIBC clients can now tap for debit purchases up to $250 using their mobile wallet ahead of holiday shopping season

December 4, 2020

CIBC now accepting applications for the expanded Canada Emergency Business Account

November 3, 2020

CIBC launches new platform to help clients build their financial plans with ease

October 22, 2020

Pandemic's economic impacts leading many Canadians to worry about their retirement plans: CIBC Poll

September 30, 2020

CIBC expands Business Banking resources as demand for advice, solutions and support grows

September 21, 2020

CIBC Alerts that Help Clients Keep On Top of Finances Take Centre Stage in New CIBC Campaign

June 17, 2020

CIBC launches Revival Rewards™ to help restart the economy and support local restaurants

May 13, 2020

CIBC Recognizing Frontline Health Care Workers with 30 million Aventura Points to help them Recharge and Reconnect with Family

May 7, 2020

CIBC's financial relief measures providing $3 Billion in cash flow to over 200,000 clients impacted by the economic fallout of COVID-19

May 4, 2020

Banks Facilitate Access to Emergency Wage Subsidy Through CRA Direct Deposit

COVID-19 impact felt by 81 per cent of Canadian small business owners: CIBC Poll

April 27, 2020

CIBC launches Advice for Today, an online resource focused on financial advice and insight during COVID-19

April 24, 2020

Term loans available starting April 27 to help businesses with working capital

April 20, 2020

CIBC announces new loan program with Export Development Corporation to provide liquidity to Canadian businesses

April 8, 2020

CIBC accepting applications for the new Canada Emergency Business Account starting April 9

April 3, 2020

CIBC announces reduced credit card rates for Canadians experiencing financial hardship due to COVID-19

Banks Facilitate Access to Relief Funds Through CRA Direct Deposit

CIBC launches special call handling measures for 750,000 seniors

April 1, 2020

CIBC announces fully digital application process for the new Canada Emergency Business Account, expects over 150,000 eligible small business clients to apply

March 27, 2020

Banks in Canada Step Up to Support Small Business

March 24, 2020

CIBC announces additional measures to support seniors, our team, and the community during COVID‑19

March 19, 2020

CIBC announces support for small business owners

March 17, 2020

Canada's Six Biggest Banks Take Decisive Action To Help Customers Impacted by COVID‑19

March 16, 2020

CIBC announces proactive, precautionary measures to help slow the spread of COVID‑19 and support our clients and communities

August 23, 2021

CWB Financial Group introduces vaccination mandate

December 21, 2020

Being essential in a pandemic: Recognizing the frontline

October 14, 2020

CWB's first GTA location brings better full service business banking to Ontario

August 7, 2020

CWB to introduce mandatory mask usage at all locations effective August 10

June 22, 2020

CWB to open all branches five days per week effective June 29

May 19, 2020

CWB to expand branch hours in ten communities effective May 25

April 22, 2020

CWB launches Export Development Canada’s Business Credit Availability Program for business clients

April 9, 2020

Canada Emergency Business Account now available

March 27, 2020

CWB to close select branches and further reduce hours to foot traffic effective April 6

March 18, 2020

CWB backs business owners; announces additional support for business owners impacted by COVID-19

March 17, 2020

CWB to reduce hours for in-branch services effective March 19

March 12, 2020

How CWB is protecting our people – including clients – in the wake of COVID-19

October 26, 2021

Coast Capital introduces Employee COVID‑19 vaccination policy to protect employees, members and communities

April 9, 2020

Deferral of minimum Visa payments and reduced interest rate

May 3, 2021

National Bank donates $50,000 to support people affected by the COVID‑19 pandemic around the world

May 3, 2021

Banks in Canada respond to urgent need for global COVID‑19 relief

October 26, 2020

The Canadian Foundation for Economic Education and National Bank launch a financial literacy program for students

May 6, 2020

National Bank to donate $500,000 to ten mental health organizations

April 10, 2020

National Bank to Donate $1 Million to Food Banks, Vulnerable Groups and the Canadian Red Cross

April 8, 2020

Canada Emergency Business Account: National Bank Encourages SME Owners and NPO Managers to Apply Online Starting Tomorrow

April 3, 2020

National Bank Announces New Support Measures and a Special Approach for Seniors

Banks Facilitate Access to Relief Funds Through CRA Direct Deposit

March 31, 2020

COVID-19: National Bank Clients Can Now Request a Payment Deferral on Their Personal Loans Online

March 27, 2020

Banks in Canada Step Up to Support Small Business

March 26, 2020

National Bank Encourages its Clients to Stay Safe and Use Digital Banking Solutions

March 24, 2020

National Bank to donate $500,000 to the United Way Centraide Canada COVID-19 Community Response and Recovery Fund

March 18, 2020

National Bank Announces Temporary Branch Closures to Limit the Spread of COVID‑19

March 17, 2020

Canada’s Six Biggest Banks Take Decisive Action To Help Customers Impacted by COVID‑19

COVID-19: National Bank to Offer Support to its Clients

July 23, 2021

RBC launches Time for More to Bring Canadians Back to the Businesses they Love

June 17, 2021

RBC Insight Edge™ helps Canadian businesses plan for recovery and gain competitive edge with real-time market insights

June 10, 2021

RBC opens third agency bank to provide increased access to financial services for Nunavut’s Inuit communities

May 3, 2021

RBC commits $250,000 to the WHO Foundation in support of continued COVID‑19 community response efforts around the world

May 3, 2021

Banks in Canada respond to urgent need for global COVID‑19 relief

March 23, 2021

Financial optimism during the pandemic: Canadians discovering true value of advice and planning – RBC poll

February 9, 2021

Canadians re-evaluating how they spend, save and invest during the pandemic: RBC Insurance

February 8, 2021

A pandemic shouldn't hold young people back: RBC Upskill, now powered by AI, helps young people explore in-demand careers and build skills for the future

February 5, 2021

RBC Now Accepting Applications for the Government of Canada’s Highly Affected Sectors Credit Availability Program

December 4, 2020

RBC now accepting applications for the Government of Canada’s expanded CEBA loan program

November 19, 2020

Safely and conveniently connecting over 2 million Canadians to a stronger financial future: RBC’s MyAdvisor provides real-time access to personalized plans and live advisors

November 12, 2020

Nextdoor and RBC launch strategic partnership to connect local businesses with customers in their neighbourhoods

October 20, 2020

Royal Bank of Canada celebrates the impact of Canada United

September 8, 2020

RBC makes banking more accessible with fully digital account open processes

August 25, 2020

The RBC Future Launch Future Ready Summit will bring young people together virtually, helping them stay future ready and prepared for a post-COVID workforce

June 29, 2020

As Canada Begins to Re-Open, RBC Launches Points for Canada

June 15, 2020

The National Institute on Ageing and RBC Wealth Management Partner to Serve Older Canadians

June 1, 2020

RBC Helping Hand Program Enables Canadians to Support Frontline Healthcare Workers

May 28, 2020

RBC and Marriott Bonvoy collaborate to support first responders with up to 5,000 free room nights

May 20, 2020

RBCxMusic launches new series to support Canadian musicians and recording artists during pandemic

May 7, 2020

RBC keeping seniors safe by helping them bank from home

April 28, 2020

RBC Future Launch announces new virtual resource hub for Canadian youth

April 24, 2020

RBC helps business clients improve liquidity with the BDC Co-Lending Program

April 20, 2020

Demi Lovato, Royal Bank of Canada, Virgin Unite, and Draper Richards Kaplan Launch Coronavirus Mental Health Fund

April 17, 2020

RBC clients can now access the Export Development Canada Business Credit Availability Program

April 8, 2020

RBC announces that business clients can enroll for the Canada Emergency Business Account through the RBC Online Banking for Business channel

April 6, 2020

RBC Client Relief Program: Committed to helping Canadians when they need it most

April 3, 2020

RBC Cuts Credit Card Interest by 50% for Clients Facing Hardship Due to COVID-19

March 30, 2020

Royal Bank of Canada CEO pledges no cut jobs in 2020 due to COVID-19

March 18, 2020

RBC commits $2-million in support of COVID‑19 community response efforts

March 17, 2020

Canada’s Six Biggest Banks Take Decisive Action to Help Customers Impacted by COVID‑19

To slow the spread of COVID‑19 RBC announces temporary branch closures

October 28, 2021

Canadians Rethinking How They Spend With Pandemic Money Habits Here to Stay, New Scotiabank Survey

August 4, 2021

Scotiabank launches new credit card payment plan feature

May 7, 2021

Scotiabank supports residents of India through international COVID‑19 relief efforts

May 3, 2021

Banks in Canada respond to urgent need for global COVID‑19 relief

March 15, 2021

Canadian business owners optimistic about post-pandemic recovery, Scotiabank report finds

February 24, 2021

Scotiabank donates $200,000 to the Canadian Women's Foundation's Building Women's Economic Security in the Pandemic Project

February 1, 2021

Scotiabank ready to support Canadian businesses in highly impacted sectors through the HASCAP program

January 12, 2021

Scotiabank launches ScotiaRISE to help build economic resilience; foster stronger households and communities

December 4, 2020

Scotiabank small business customers can now apply for additional financing through expanded CEBA program

November 19, 2020

Scotiabank's top financial experts to address Canadians' most pressing investment concerns amid the COVID-19 pandemic during virtual event

November 18, 2020

Scotiabank Launches Global AI Platform to Provide Faster Insights and Better Advice to Customers

November 2, 2020

Scotiabank recognized for outstanding COVID-19 leadership by Global Finance magazine

October 26, 2020

Scotiabank ready to accept applications for expanded CEBA program

October 20, 2020

Send and Receive Money Faster with Scotiabank through Interac e-Transfer® for Business

October 14, 2020

Scotiabank provides further update on COVID-19-related customer assistance programs

October 7, 2020

Canadian small business owners cautiously optimistic about the future, Scotiabank report finds

October 1, 2020

Majority of Canadians believe COVID-19 pandemic has transformed health care system in Canada

September 21, 2020

Scotiabank Launches Advice+ to Help Canadians Navigate Their Financial Plans During COVID‑19

September 15, 2020

Scotiabank provides update on COVID-19-related customer assistance programs

June 26, 2020

Scotiabank ready to support more Canadian businesses through the expanded CEBA program

June 19, 2020

Scotiabank strengthens support for Canadian businesses with launch of BDC Mid-Market Financing Program

June 15, 2020

CMA, in collaboration with Scotiabank and MD Financial Management, launch new Wellness Support Line to help Canadian physicians and medical learners

June 1, 2020

Scotiabank Simplifies Digital Banking with a New Resource for Seniors - Bank Your Way

May 4, 2020

Banks Facilitate Access to Emergency Wage Subsidy Through CRA Direct Deposit

April 30, 2020

Audible.ca and Scotiabank Join Forces to Offer Canadians Free Scotiabank Giller Prize-Winning Audiobooks

April 29, 2020

Scotiabank, CMA and MD Financial Management commit further support to physicians during the COVID-19 pandemic

April 27, 2020

Scotiabank Launches Online Enrollment for CRA Direct Deposit of Canada Emergency Wage Subsidy Funds for Business Customers

April 25, 2020

Scotiabank and the Government of Canada support businesses with another relief program - BDC

April 24, 2020

Scotiabank and Tangerine Bank team up with MLSE, Rogers and Bell to prepare and deliver up to 10,000 meals per day for frontline healthcare workers, their families and community agencies

April 17, 2020

Scotiabank announces availability of the Canadian Government's Export Development Canada Business Credit Availability Program

April 8, 2020

Scotiabank launches Online Application Process for the Canadian Government's Canada Emergency Business Account

April 7, 2020

Scotiabank launches priority line for frontline healthcare workers and seniors

Scotiabank commits $2.5 million in support of COVID‑19 community response efforts

April 3, 2020

Scotiabank reduces credit card interest rates for customers experiencing COVID-19 financial hardships

Banks Facilitate Access to Relief Funds Through CRA Direct Deposit

March 31, 2020

Scotiabank hosts virtual fireside chat to provide company update

March 27, 2020

Banks in Canada Step Up to Support Small Business

March 18, 2020

Scotiabank announces support for customers, employees and communities impacted by COVID‑19

March 17, 2020

Canada's Six Biggest Banks Take Decisive Action to Help Customers Impacted by COVID‑19

November 24, 2020

Canadians say "bah humbug!" to COVID‑19: While rising debt is a concern for many, Canadians refuse to let it ruin the spirit of the holidays, Tangerine Bank survey reveals

January 26, 2022

TD awards $10 million to organizations tackling pandemic-related learning loss

July 12, 2021

Helping Address COVID‑19 Learning Loss: TD launches 4th Annual TD Ready Challenge

June 17, 2021

Post-pandemic to-do: Why in-person financial advice tops the list

May 25, 2021

TD renews its commitment to vulnerable communities

May 3, 2021

TD Donates $250,000 to the Canadian Red Cross to Support Global COVID‑Relief Efforts

May 3, 2021

Banks in Canada respond to urgent need for global COVID‑19 relief

January 26, 2021

TD Supports 15 Organizations Focused on Advancing COVID-19 Recovery

October 14, 2020

The TD Community Resilience Initiative will support United Way’s Atlantic Compassion Fund to help seniors, children, LGBTQ2+ youth and Black communities

September 15, 2020

#TDThanksYou: TD Celebrates and Rewards Making a Difference in Communities During COVID-19

June 16, 2020

TD Announces 3rd Annual TD Ready Challenge and Pledges $10 Million in Grants for Innovative Solutions in Response to COVID-19

May 4, 2020

Banks Facilitate Access to Emergency Wage Subsidy Through CRA Direct Deposit

April 29, 2020

The TD Community Resilience Initiative Allocates $25 Million to Organizations Engaged In COVID-19 Response and Community Recovery

April 8, 2020

CEBA Loan Application Available April 9th at TD

April 3, 2020

TD Steps Up Support for Canadians Impacted by COVID-19 with 50% Cut to Credit Card Interest

Banks Facilitate Access to Relief Funds Through CRA Direct Deposit

March 27, 2020

Banks in Canada Step Up to Support Small Business

March 25, 2020

TD encourages customers to stay home, bank digitally

March 18, 2020

TD Bank: "The most vulnerable in our communities require immediate support"

March 17, 2020

Canada's Six Biggest Banks Take Decisive Action to Help Customers Impacted by COVID‑19

TD announces additional customer and colleague response to COVID‑19