Fast Facts

- Abundant choice There are more than 80 domestic and foreign banks operating in Canada with more than 40 offering financial products and services to consumers.

- Accessible and affordable: 99.6 per cent of Canadian adults have an account with a financial institutions1

The Bottom Line

Canadian households and businesses enjoy the advantages of a competitive financial services sector that offers accessibility to a diverse range of banking services and providers at affordable value. The entry of new players can enhance these options, therefore it's crucial to establish consistent regulations for all market participants to ensure continued trust and confidence in Canada's secure and stable financial services industry.

Robust Competition and Market Dynamics

Canadian households and businesses continue to benefit from having access to a wide range of affordable financial services in a thriving and highly competitive sector. Canada boasts 80 banks which vary in size domestically and internationally. There are also hundreds of credit unions, caisse populaires and other financial institutions including insurance companies, investment firms and specialized finance companies, that compete for Canadians’ business. In recent years, other players with new business models and large multinational technology companies with strong brand presence have also entered the sector.

Canada’s banks are internationally recognized as well-regulated and Canada is home to one of the world’s most stable financial sectors. Banks provide affordable choice with innovative and reliable products and services and accessibility to customers. Competition is also bolstered by new entrants that offer diverse services like payment solutions, robo-advisors, and digital currency exchanges, reflecting the impact that technology is having on financial products and services.

Increased competition driven by technology and its impact

Advancements in technology have revolutionized the financial sector, fostering greater competition among traditional banks and non-bank financial institutions. These technological innovations have facilitated market entry and scalability, intensifying competition within the sector. To stay competitive, banks are increasingly investing in and integrating technology into their business models to enhance customer experiences.

Technological innovations have reshaped banking experiences, offering consumers enhanced accessibility, security, and convenience. With digital banking platforms and advanced payment solutions, consumers enjoy streamlined financial interactions, contributing to improved satisfaction levels. The proliferation of digital channels indicates a growing preference for tech-driven banking services among Canadians.

Concentration vs. competitive intensity

The structure of Canada’s banking system is similar to that seen in most developed countries – a core of large, national institutions supplemented by a number of smaller institutions that focus on specific regions or products, and a selection of foreign banks offering specialized services. According to the World Bank, the five largest banks account for 85 per cent of commercial bank assets in Canada in 2021, which is almost identical to the OECD average (83 percent). While the structure of the marketplace as measured by assets has remained relatively stable, the intensity of competition has increased considerably because of digitalization. The transformation of financial products and services have from physical to digital has enabled banks, other financial institutions, other players with new business models and large multinational technology companies with strong brand presence to offer products and services from coast to coast without the need of a physical presence in every region. As a result, banks and other competitors can now compete in every market for every consumer in a way that would have been unimaginable in prior eras.

Canadian banks consistently outperform in terms of customer satisfaction and service quality, positioning them favourably on the global stage. Moreover, the sector's stability and consumer confidence underscore its resilience, especially in comparison to global counterparts. Canadians have ranked their banks as the most sound in the world for eight straight years and in the top three for eleven straight years after coming out of the Global Financial Crisis. Furthermore, 86 per cent of Canadians state that they trust their bank to offer secure digital banking services and 87 per cent trust their bank to protect their personal information, based on a survey conducted recently by CBA.

Accessibility and satisfaction strong

Canadians have a wide variety of options for bank accounts, payments and mortgages. These products and services offer access to the financial system. In Canada, almost all working-age Canadians have an account with a financial institution and 96 per cent of working-age Canadians have a debit card, which is the highest among the G7 countries. Technology has evolved products and services offered over the years, thus increasing the demand for digital payments. In 2008, 55 per cent of all transactions were conducted in either cash or cheque, whereas by 2022, the number has reduced to only 12 per cent.

Supporting the small and mid-size businesses that drive the Canadian economy

For SMEs, access to financing is an important component for conducting business. Canadian financial institutions are supportive of businesses and provide the capacity and tools for businesses to seize growth opportunities and tackle challenges.

Banks have strong ties to SMEs including farmers and agricultural customers. In June 2023, banks authorized $282.3 billion in credit to small- and medium-sized enterprises (SMEs). Of this credit, SMEs have drawn close to $175.2 billion.

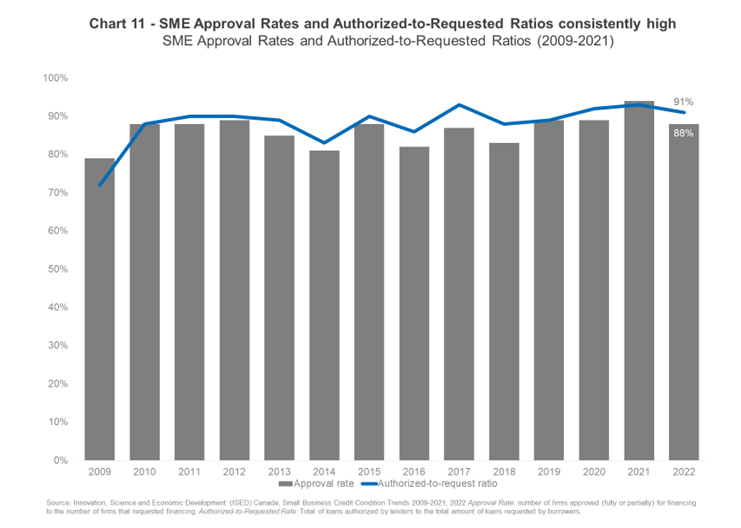

According to Statistics Canada, 88 per cent of SME’s debt financing requests were approved in 2022 with the approval rate consistently being above 80 per cent since the GFC. And of those SMEs that were approved for debt financing, the ratio of total funds authorized-to-requested was 93 per cent in 2021, with the funds authorized-to-requested consistently about 80 per cent since the GFC. The average amount authorized has increased for businesses of all sizes, regions and industrial sectors since the GFC (see chart below).

Challenges Posed by Tech Giants

Large multinational technology companies are making inroads into the financial services arena, posing challenges to traditional regulatory frameworks. Despite engaging in banking-like activities, these tech giants operate outside stringent banking regulations, raising concerns regarding consumer protection and systemic stability.

The financial sector in Canada experiences heightened competition driven by technological advancements, diverse market players, and evolving consumer preferences. Despite concentration among large banks, the sector remains robust and dynamic, offering innovative solutions and fostering consumer trust. As technology continues to shape the industry, maintaining regulatory frameworks that ensure both innovation and consumer protection will be paramount for sustained competitiveness and stability.

To read more about CBA’s recommendation on how to strengthen competition in the financial sector, please click here.

1 World Bank, Global Findex Database 2017: https://globalfindex.worldbank.org/sites/globalfindex/files/2018-04/2017 Findex full report_0.pdf pg. 123