Fast facts

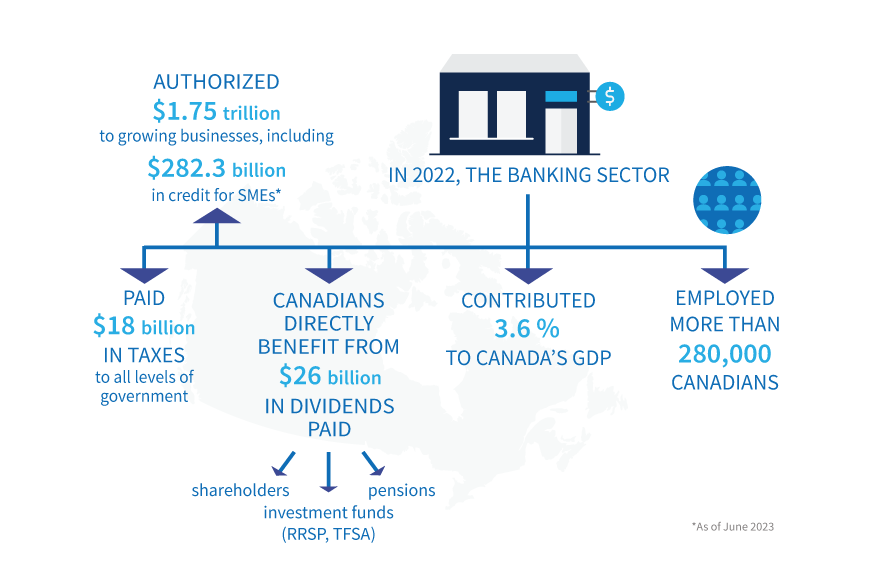

- Over 280,000 Canadians are employed by banks across Canada.

- Banks and their subsidiaries pay $30 billion in salaries and benefits on an annual basis.

- Canada’s six largest banks paid $18 billion in taxes to all levels of government in Canada in 2022.

- Canada’s profitable banks provided $26 billion in dividend income to millions of Canadians in 2022.

- The banking industry helps Canada grow, contributing 3.6% (or over $70 billion) to Canada’s gross domestic product (GDP).

The bottom line

Strong, sound banks help families buy a home and save for retirement, help small businesses to grow and thrive, and help drive the economy, providing economic benefits to all Canadians today and into the future.

Source: Statistics Canada, December 2022

Contributing to the Canadian economy

Canada’s banking industry is an essential contributor to the country’s economic growth and well-being. Banks are leading taxpayers, progressive employers and major purchasers of goods and services from Canadian suppliers as well as being good corporate citizens. And Canadians understand the industry’s importance to the country’s economy.

Serving small business

Banks provide small businesses with products and services that range from accounts and merchant payment processing solutions to payroll and international trade services. Banks also provide financing, such as lines of credit, term loans, mortgages, credit cards, overdraft protection, and leasing.

Domestic banks provide approximately 58 per cent of small and medium-sized enterprise (SME) business financing, with other sources including credit unions and caisses populaires, finance companies, portfolio manager, financial funds and insurance companies.1

During the economic downturn, banks continued to provide financing to both consumers and businesses, including small businesses. The banking sector also assists Canadian businesses by supporting knowledge and skill-based initiatives. Some examples include:

- CBA small business online information resources

- Bank websites offer numerous tools, including business planning and budgeting templates

- Participation by bankers in local workshops and ‘access to experts’ programs

- Support for entrepreneurial studies programs at post-secondary institutions

We’re good customers, too:

- The banking sector is a major purchaser of goods and services from outside suppliers, spending about $24.3 billion in 2022.

Banks as taxpayers

Banks are one of the largest taxpayers in Canada. Canada’s six largest banks paid $18 billion in taxes to all levels of government in Canada in 2022.

Canadians as shareholders

Most Canadians are shareholders in Canadian banks either directly through share ownership or through pension funds and mutual funds, including the Canada Pension Plan. Pension funds and RRSPs are some of the primary beneficiaries of the billions of dollars that the banks pay in dividends each year ($26 billion in 2022).

Successful exporters and international competitors

Canadian banks are successful exporters, with banks’ foreign operations contributing significantly to each bank’s bottom line. Approximately 41 per cent of bank income in 2020 was generated outside Canada, while 71 per cent of bank employees were located in Canada, and 68 per cent of taxes were paid in Canada.

Banks as employers

Canada’s banks and their subsidiaries contribute significantly to employment and job creation. In 20202, banks employed more than 280,000 Canadians.

Both the quality and the number of jobs are consistently high in the banking industry. Full-time jobs reached 88.9 per cent, the highest it has been in the past 20 years.

- And banks and their subsidiaries paid $30 billion in salaries and benefits in Canada in 2019.2 Banks and their subsidiaries pay $30 billion in salaries and benefits on an annual basis.

A diverse workforce

Canada’s banks have built workforces that reflect the diversity of the Canadian labour market. As of 2022, 54.5 per cent of the workforce at the large six banks was comprised of women, and 39.4 per cent of senior managers were women. As of 2022, about two in five bank employees (42.6%) are visible minorities, who are also increasingly represented in senior management.

In 2022, the major six banks employed just over 3,500 Indigenous people and representation of people with disabilities in the large six banks was 7.3 per cent. Banks are currently engaged in a number of initiatives to increase representation and advancement in employment of Indigenous people and people with disabilities.

Banks in the community

Banks and their employees are among Canada's top corporate donors and have a long tradition of community participation. Canada’s charities and non-profit community groups receive multi-million dollar support from banks and every year thousands of bank employees at all levels donate their time and talent to charitable initiatives. These contributions help support a broad range of programs, particularly in the areas of education, the arts, youth, the environment, disaster relief and health care.

1 Source: Survey of Suppliers of Business Financing, Statistics Canada, H1 2022. Domestic Banks and Other Banks

2 Total for seven banks: RBC, TD, CIBC, BNS, BMO, NBC and HSBC