It’s an exciting time to start a new business in Canada. As our economy evolves and society changes, new markets and opportunities open up every day. At the same time, there has never been so many resources to help get your business off the ground.

Everyone has a different reason for starting a business, but one fact remains the same – creating and running a successful business is hard work: it takes time, planning, discipline, money and perseverance.

There is no simple or standard formula for launching a successful business – each one is as unique as its owner. However, there are practical steps to take to ensure you give the business a solid foundation from which to build.

Before venturing into the world of entrepreneurship, you’ll need to do your homework. This means researching your idea and potential market, creating a business plan and operating strategy and working out financing details.

Know Your Market

It is important do market research to understand and evaluate the market for your product or service. The information you gather during your research will form a critical part of your marketing strategy and overall business plan.

What is the demand potential for your product or service? Who needs it? Take time to learn about your potential customer based. Look at who your competitors will be and what they are doing. Ultimately, your research will give you a good sense of whether you can make a success of your business idea.

After you’ve done your market research, you can begin planning your strategy. How you market your product or services will depend on the type of business you’re in and how much money you have to spend. Every company will have a different marketing strategy, but there are still some common elements.

Ask yourself these questions as you think about your marketing strategy:

Your product or service – What are the features or attributes of what you are selling? How will it be different than what your competitors are offering?

Market – How extensive is it? Is it a growth area? Where does your company fit in? How much of the market can you realistically capture?

Customers – Who are they? Can you define them by age, buying habits or other criteria? How are they currently being serviced?

Promotion – How will potential customers find out about your business? Will you actively promote it or rely on word of mouth? How do your competitors promote themselves? How about radio, print, television or online advertising? Will you go to trade shows or look for free publicity opportunities?

Pricing – How will you price your product? What will the price say to customers about your product or service i.e. will it been seen as high-end, moderately priced or inexpensive? Will your price be competitive?

Distribution – How will you deliver your product or service? Will your customers come to you or will you go to them? Will you sell directly to customers or use indirect methods (through a distributor or retailer)?

Setting Up Your Business

There are three ways you can go into business for yourself:

- Create a new enterprise;

- Take over an existing business;

- Buy into a franchise operation

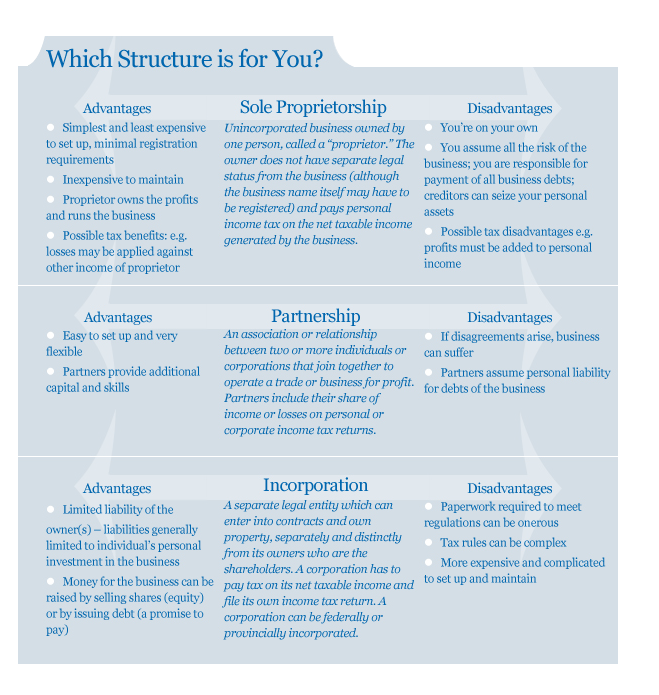

There are advantages and disadvantages to each, so it’s important to carefully research your options. Selecting the right structure for your business will depend on a variety of issues, such as tax implications and the degree to which you want to risk your personal assets in the business. To set up one of these structures, contact the appropriate provincial ministry or federal government department. Enlist the assistance of a lawyer or accountant.

How Will You Operate?

The planning phase for a new business must also take into account getting it ready for day-to-day business. Here is a checklist of things you’ll need to consider.

Office and Location

Where will your business be located? Where will you provide your product/service? Will you go to your customers or will they come to you? Some businesses rent or buy space in a building, some share with other businesses, while a growing number of others operate from home. Ultimately, a location will depend on the needs of your business, where your customers and competitors are, and such things as taxes, zoning restrictions, noise and the environment. For certain types of businesses, an appropriate location is critical.

Equipment, Supplies and Materials

No matter what business you’re in, you’ll need some or all of the following items: office furniture, a website, telephones, a fax machine, computer, software, printer, modem, other office machines (e.g., photocopier), and stationery. For some businesses, you’ll need to consider what raw materials will be required to produce your product or how much inventory you’ll need.

Financial Management

Good bookkeeping procedures are critical to a successful business, and they should be in place before you begin. Bookkeeping is the process of maintaining your accounts. Your accounts tell you how much money your business owes, how much it’s owed by others and your earnings. In addition to helping you measure your progress, they enable you to comply with federal, provincial and local tax codes. The Canada Revenue Agency, for example, requires accurate records of your company’s expenses and income. The provincial government requires accurate records of your corporate payroll and employee deductions. You may also have to tabulate provincial sales tax, Goods and Service Tax (GST), Harmonized Sales Tax (HST), workers’ compensation, Employment Insurance and Canada Pension.

Internally, accurate records help you plan for your company’s growth and determine trends in your business. Which customers are contributing more to your company than others? Why did revenues go up this month compared to the same month last year? Finally, with accurate financial records, you can tell if your business is meeting the objectives set out in your business plan.

There are many computer software programs available to help make bookkeeping and accounting easier.

Employees

You may need employees immediately or you may want to wait until the business is established before you hire people. In either case, employees present a number of issues – qualifications, compensation, training, salaries and benefits, payroll, taxes and accounting, and employment legislation. And getting the right people to work with is important – try to hire people to complement your skills.

Company Name and Identity

You need to choose a name for your business, ensure that it is not already in use, and register it. You also need to consider the image you wish to project on your business cards, signage, invoices, website, envelopes and letterhead.

Legal Issues

Do you need any licenses and permits to operate? What regulations must your business abide by? Legal issues vary by business, municipality and province. Governments and organizations such as chambers of commerce and boards of trade can provide general information, but you may need to consult with a lawyer.

Insurance

What about insurance? Although it will vary depending on your business, you will typically need to purchase some types of insurance for liability, property or even business interruption.

Advisers

Most business owners know they can’t do everything. You’ll probably need professional advisers in areas such as:

- Accounting and taxation

- Government regulations (e.g. labelling, import quotas, and health and safety standards)

- Banking and financial services

- Marketing and advertising

- Insurance

- The law (e.g., leases, patents, trademarks, copyright)

- Technology (e.g., installing and servicing computer systems and other technology)

Online Business

Getting on the Internet, or using social networking sites, can open up new market opportunities by expanding your customer base. Deciding on whether or not to have a presence on the Internet depends on a company’s goals and whether it makes business sense. Some businesses may want an online presence merely for exposure and to provide information, while others may want to engage in online selling. It’s also a good idea to see what the competition is doing – if they have a web presence, your company might be wise to get online.

The Business Plan

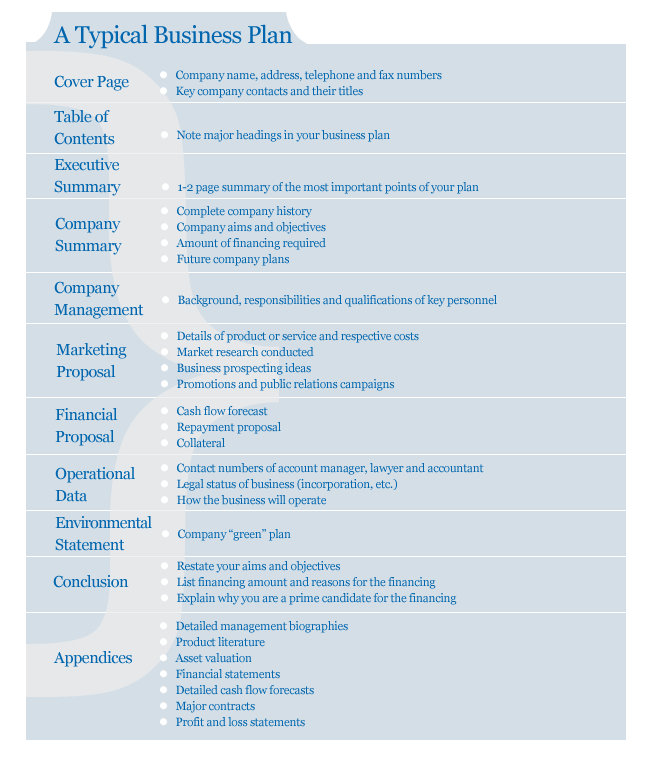

Proper planning for your business – financial, operational, marketing and managerial – is key to turning your idea into reality. A business plan is an important step in articulating your vision and putting your ideas and goals onto paper.

Business plans are often crucial when it comes to borrowing large amounts of money as many lenders and investors will want to see one. Many financial institutions offer free information kits and computer software to help you write a business plan and project a cash flow forecast.

Below is an outline of the typical components of a business plan.

A typical business plan will include a financial proposal, which includes an outline of your collateral, a repayment proposal, and a cash flow forecast for your business:

Collateral

Providers of debt financing often require collateral in the form of personal or business assts. This collateral works to secure the loan. An asset is simply anything of measurable value such as real estate, equipment, savings and investments. Unlike equity capital, whose providers acquire a share of your business and expect a return on their investment as the value of their share increases, debt capital must be repaid whether or not your business grows.

Repayment Proposal

When people consider investing in a small business they often regard the following elements as determining factors:

- Repayment ability — Investors will be interested in a plan that explains how you will repay them.

- Management — Investors will seek indications of how you manage your business plans and affairs.

- Investment — You need to assure investors that you are committed to your business, and that you will work hard to protect their investment.

- Security — What protection can you provide to investors if your business fails?

- Equity — Most lending institutions will require at least 25 per cent cash/equity contributed to the total capital cost of the project being financed.

Cash flow forecasting

A cash flow forecast ensures your financial stability. This forecast will help you predict the funds that you will receive and disburse and the resulting surplus or deficit. To create this forecast you will need to take into account the operating and capital budgets, the ratio of cash sales to credit sales, and the paying habits of your customers. A cash flow analysis will help you estimate:

- How much cash you need to operate your business every month.

- When you will need additional short term funds.

- When you will have surplus funds available to pay down your bank loans.

Checklist for Start-Ups

The following are some things you should think about as you prepare to start your own business:

- Are you ready to start a business? Know what you want and understand what’s involved, including the personal sacrifices. Be willing to devote long hours to endeavour.

- Have you done your homework? Conduct research to ensure there is a need for your product or service. Be sure market conditions can support your business. Talk with friends, family and advisers to obtain business information. Government agencies, trade associations and other organizations offer services and programs to help get businesses started.

- Are you aware of your obligations and do you have plans in place to comply with federal privacy legislation? The requirements under the Personal Information Protection and Electronic Documents Act (PIPEDA) require organizations to take reasonable steps to safeguard the personal information they collect. The Office of the Privacy Commissioner of Canada offers two guides to help: The Guide for Businesses and Organizations and Getting Accountability Right with a Privacy Management Program.

- How will you use your skills and compensate for your weaknesses? Evaluate your personal qualities and skills. Use your talents and recognize the areas you need help with.

- What form will your business take? Decide on a structure – incorporation, partnership or sole proprietorship.

- How will you promote and market your business? How are you going to distinguish yourself from the competition?

- What is your pricing strategy? What does the price say about your product and its quality versus the competition? Think about what you’ll charge for your product/service. Estimate your break-even point and revenues.

- Prepare a detailed business plan – it’s imperative.

- What funding sources will fuel your enterprise? Secure sufficient financial resources for start-up and operations.

- Where will you locate? Pick a business location that makes sense for you and your customers.

- How will your business operate on a daily basis? How will you deliver your product or service and manage your business? Figure out what you’ll need for the day-to-day smooth functioning of your business.