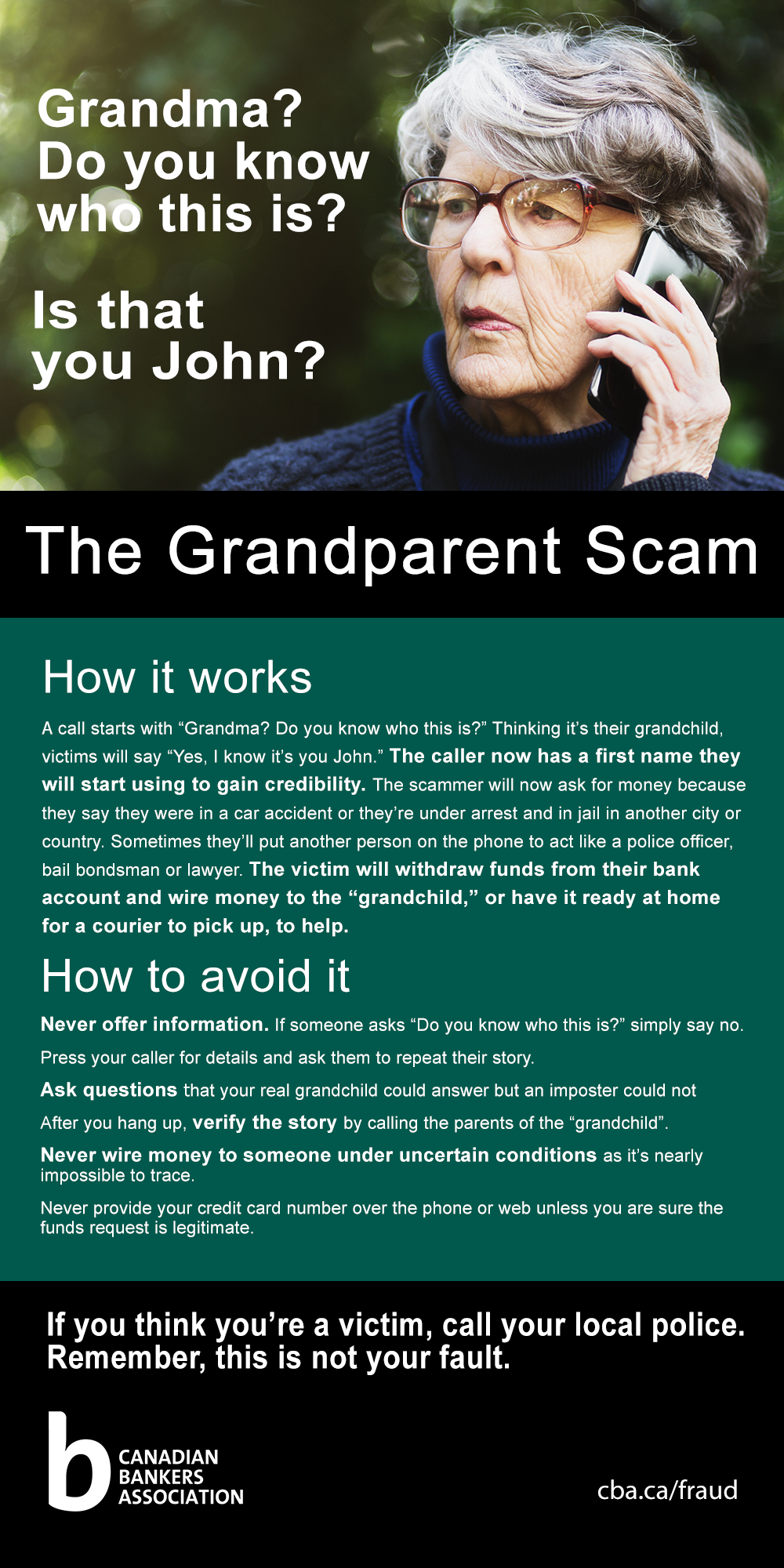

Has your phone ever rung and the person on the other end says they are your grandchild and that something terrible has happened, a car accident for example, and they need money?

Receiving a call like this could mean you’re a target of what's known as the “Grandparent Scam,” a version of the Emergency Scam. These scams are common and it’s important that you assess the situation carefully before deciding to help.

How the scam works

The exact details of this scam may vary but, in general, this is how it works:

The exact details of this scam may vary but, in general, this is how it works:

- A senior will receive a phone call from someone who starts the conversation with, “Grandma? Do you know who this is?”

- The victim, thinking it’s one of their grandchildren, will respond with, “Yes, I know it’s you (name of grandchild).” The caller will then start using this name to gain credibility with the victim.

- The caller will claim to be in trouble and will request money right away. Often they’ll say they were in a car accident with a rental car or they are under arrest and in jail in another city or country. The “grandchild” will tell the victim he doesn’t want his parents to know and ask the victim to keep it a secret.

- To make the story seem more credible, the caller might also put another person on the phone to act like a police officer, bail bondsman or lawyer.

- The victim, wanting to help, will withdraw funds from their bank account and wire money to the “grandchild”. The money will be sent through a money transfer service, such as Western Union or MoneyGram, where the criminal can then pick it up at any location across the world. The scammer might also arrange for a courier to come to the victim's home to collect the money.

How you can protect yourself

Fortunately, there are a few simple steps that you can take to avoid falling victim to this scam:

- Never offer information to the caller. If they prompt you with a question like, “Do you know who this is?” simply say no and have them tell you.

- Press your caller for details. If the person on the other end of the phone is explaining his/her story, ask them questions about their specific location or have them repeat their story. A criminal will have a hard time recalling details or coming up with them on the spot

- Ask the caller a few personal questions that a real grandchild could answer but an imposter could not

- After you hang up, verify the story by calling the parents or other relatives of the “grandchild”

- Never wire money to someone under uncertain conditions. It is nearly impossible to recover or trace money that has been wired

- Never provide your credit card number over the telephone or Internet unless you are sure about who you’re giving it to

If you’ve been caught in a scam like this one, call your local police department. Bank staff are aware of these kinds of scams and are trained to pay attention if a customer makes an unusual transaction — for example, withdrawing more money than usual. However, as the owner of the account, you are ultimately responsible for any funds that you withdraw from your own bank account. That’s why it’s especially important to ask questions and be 100 per cent positive about who you’re talking to before you send any money.

How you can protect others

If you are a senior, or you have a senior in your life, it’s important to spread the word about grandparent, or emergency, scams to protect those we care about from being victimized by these malicious phone calls.

Be generous with your time and if possible, assist older adult relatives and friends with additional cyber security and fraud prevention strategies. The CBA has tips on our website: Talking about cyber security with your family and friends.

Did you know?

The CBA offers a free fraud prevention seminar for seniors as part of its Your Money Seniors financial literacy seminar program.

The CBA offers a free fraud prevention seminar for seniors as part of its Your Money Seniors financial literacy seminar program.

Find out more and request a seminar for your seniors’ group at www.yourmoney.cba.ca/seniors.