Nothing in life stays the same - and retirement is no different. Consider that you could be retired for decades - during that time lots of things could change. Since many retired people are living on a fixed income, it’s important to make sure that you plan ahead so that the money you do have will last for as long as you need it.

What a longer life means for you

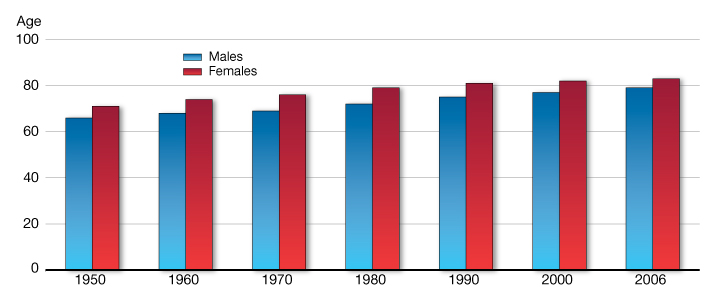

Canadians are living longer lives than ever before. Consider that back in 1950 the average life span of a Canadian man was 66 and 71 for women.

Today, however, the average man can expect to live to 79 while women live to 83. And, our lives are getting longer every year: you now have a 58% chance of living beyond 85, a 40% chance of living past 90 and a 19% chance of living past 95.

This involves good things, like more time to pursue hobbies, be with your family etc. But it also means we need more money to live on in retirement because we will logically spend more money in retirement.

Average Life Expectancy in Canada (Statistics Canada)

Not only do we need to save more before we retire, we also need to manage money very careful in retirement to make sure it doesn’t run out during our lifetimes.

It means that we have to plan more -- and understand and envision (as best you can) what your life will be like during all those years you're retired.

Preparing for financial challenges

You need to make sure you finances in retirement can weather at least some of the major changes that life might throw your way. Doing this means talking to your spouse and to a professional advisor about ways to make sure you can handle change. Insurance and estate planning are just some of the tools you can use to make sure that you’re ready for change in your retirement.

3 financial challenges you can plan for

Health - A change in your health status or your ability to live independently. What would happen if you or your spouse were unable to live without care? How would you handle a sudden need for costly but essential medication or treatment?

Death of a spouse or partner - It’s a major emotional hardship for anyone but it also affects your financial life. You could experience a drop in income when your spouse dies, whether through estate taxes, loss of pension income or even wages?

Unexpected financial hardship - A major home repair, a car accident or other unexpected event can lead to financial hardship if you’re not prepared to cover it. Ask yourself how you would cover a financial emergency in retirement if one arose.

Learn more - The Investor Education Fund has good information about how to financially plan for an emergency or unexpected expense.