Article

Fast Facts

- Eight per cent of Canadians report that they conduct the majority of their financial transactions at ABMs.

- There are over 60,000 bank machines1 in Canada and 18,482 of these are bank-owned ABMs.

The bottom line

While the use of online banking continues to grow, ABMs (automated banking machines) remain a popular method of

getting cash, making deposits, and paying bills for Canadians across the country.

The evolving banking relationship

The relationship Canadians have with their bank has changed in the last three decades. Thirty years ago, bank

services were available only in branches that were typically open from 10 a.m. to 3 p.m. You would line up to

deposit your paycheque and get cash for the week. If you didn’t make it to the bank on time, you could be stuck

without cash. Now customers can bank anytime, anywhere through a variety of banking services.

In fact, when asked to name the way they conduct the majority of their financial transactions, eight per cent

reported that they use ABMs, 47 per cent report that they bank primarily online, 30 per cent reported that they use

an app, and 12 per cent reported that they bank primarily in person at the branch.1

About the ABM market in Canada

There are over 60,000 bank machines2 in Canada and 18,482 of these are bank-owned ABMs.

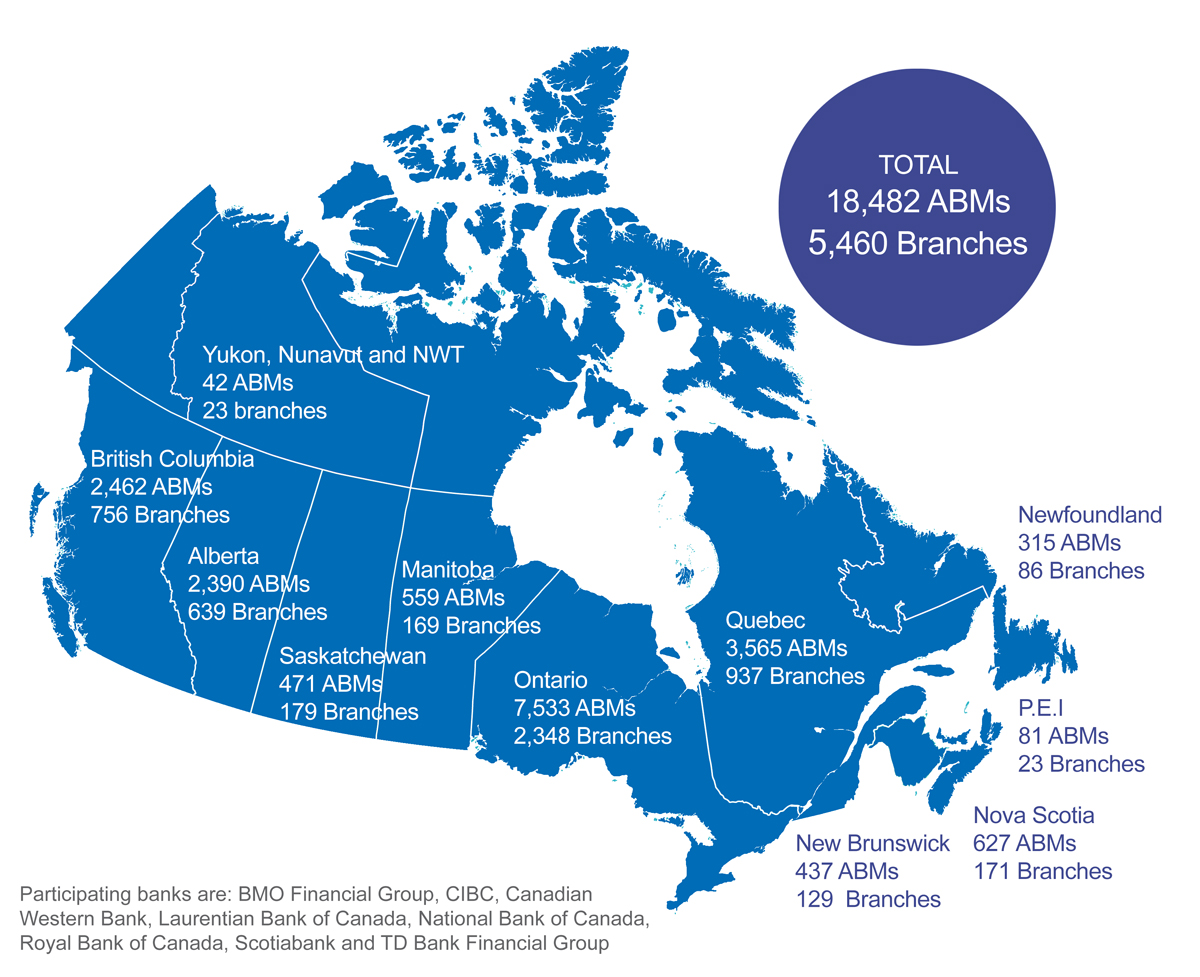

Number of Bank Owned ABMs3

- Total ABMs in Canada: 18,482

- Total Bank Branches: 5,460

- Yukon, Nunavut and Northwest Territories: 42 ABMs 23 Branches

- British Columbia: 2,462 ABMs 756 Branches

- Alberta: 2,390 ABMs 639 Branches

- Saskatchewan:471 ABMs 179 Branches

- Manitoba: 559 ABMs 169 Branches

- Ontario: 7,533 ABMs 2,348 Branches

- Quebec: 3,565 ABMs 937 Branches

- New Brunswick: 437 ABMs 129 Branches

- Nova Scotia: 627 ABMs 171 Branches

- Prince Edward Island: 81 ABMs 23 Branches

- Newfoundland: 315 ABMs 86 Branches

Participating banks are: BMO Financial Group, CIBC, Canadian Western Bank, Laurentian Bank of Canada, National

Bank of Canada, Royal Bank of Canada, Scotiabank and TD Bank Financial Group

How did the market develop this way? In Canada, the Interac network enables customers of one financial institution to

use ABMs owned by another operator. Originally, Interac was owned by the large Canadian banks but in 1996, the

Competition Tribunal expanded membership eligibility in Interac to increase competition in the market for electronic

payment services. This allowed a range of other ABM suppliers to enter the marketplace. Independent cash dispenser

operators are now competing aggressively with Canada’s major financial institutions for ABM locations.

Types of Automated Banking Machines

The types of ABMs can be grouped into the following three categories:

Full-service ABMs located on the premises of a financial institution: This kind of ABM typically

offers deposit, withdrawal, transfer, bill payment, and account balance information services to customers from their

financial institution and cash dispensing services to non-customers.

ABMs owned by a financial institution at an off-premises location: These machines do not generally

accept deposits, but typically offer most other services to customers of that financial institution along with cash

dispensing services to non-customers.

Independently operated cash dispensers: The vast majority of cash dispensers or “white-label

machines” are run by private businesses that compete directly with banks and other financial institutions. These

machines typically offer only cash dispensing services.

Types of fees

Regular transaction fees: These are fees paid by customers for services provided by their financial

institution and vary with the customer’s account package and the type of service provided. Some account packages

have a set number of free transactions per month and then transaction fees are charged for additional transactions;

many others offer unlimited transactions so customers do not pay any transaction fees.

Network access fees: These are fees paid by customers to their own bank to access their account when

they use an ABM not owned by their financial institution. For example, if you bank at Bank “A” and withdraw money

from an ABM owned by Bank “B,” you’ll need to pay a network access fee to your bank. Your bank has to pay a fee to

process your transaction through the Interac network, and the network access fee helps cover those costs.

Convenience fees: These are fees that are always charged by independently operated cash machines and

may be charged by financial institutions to non-customers that access their ABM. If a transaction is subject to a

convenience fee, the ABM or cash dispenser will display a message telling the consumer the amount of the fee prior

to the customer agreeing to proceed with the transaction. A portion of the revenue generated by convenience fees is

usually paid to the owner of the premises where the machine is located.

More about convenience fees

Banks locate ABMs where they believe the machines will be convenient for their customers. At many off-premises

locations, such as gas stations, airports, and convenience stores, banks must pay the owner of the location a fee to

place a machine on the property. Banks compete with independent cash dispenser operators for these locations and

over time this competition has resulted in increased costs for off-premises machines. While banks are willing to

absorb the additional cost to provide the service to their own customers, some banks may choose not to subsidize

non-customers who use these locations and charge them a convenience fee.

How to avoid extra fees

It’s important to note that consumers can avoid convenience fees and network access fees altogether by using an ABM

operated by their own financial institution. In fact, the majority of ABM transactions are done at a customer’s own

bank machine, avoiding convenience fees altogether. If your bank is a member of THE EXCHANGE® Network, you can also

withdraw cash at a participating institutions' ABM without being charged a fee.

1 Bank of Canada, Canadians’ Access to Cash 2023, March 2025

2 How Canadians Bank was conducted for the CBA by Spark Insights in 2024.

3 CBA – as at 2024.