Article

Introduction

Canada’s banks are an important part of a strong and stable economy. They provide the financial foundation that helps Canadians succeed, whether it’s buying a home, starting a business, saving for the future, or navigating life’s uncertainties. Banks are active partners, helping people reach their goals, and businesses of all sizes to grow.

Canada also has one of the most secure banking systems in the world. That kind of stability creates a solid foundation for growth and supports progress in every part of the country. But stability is not the whole story. What sets Canada’s banks apart is their ability to pair that strength with competition, innovation, and support for people and businesses.

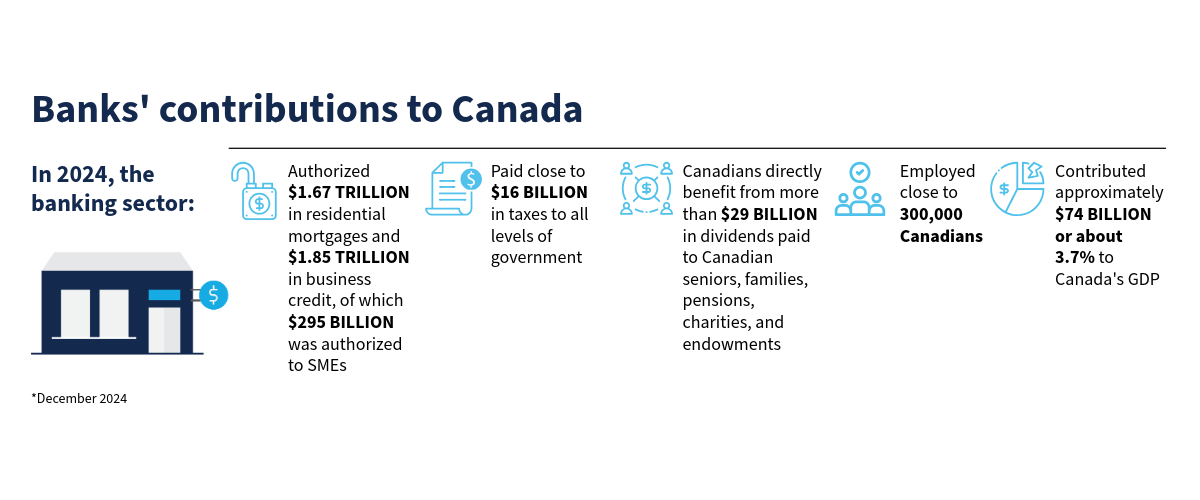

Banks help drive prosperity by supporting Canadians and the communities they live in. Banks:

- Employ close to 300,000 people in Canada

- Contribute approximately $74 billion to the country’s GDP, about 3.7% of the total economy

- Paid close to $16 billion in taxes to all levels of government

They also help Canadians:

- Buy homes and build equity, including lending more than $1.67 trillion in residential mortgages

- Start and grow businesses, with more than $295 billion in credit authorized for small and medium‑sized enterprises (SMEs)

- Save for the future, including generating more than $29 billion in dividend income that went to Canadian seniors, families, pensions, charities, and endowments1

A strong, competitive banking system that supports Canadians

In addition to being stable and secure, Canada’s banking system is also highly competitive. Canadians have access to a wide range of financial services providers, including banks, credit unions and caisses populaires, life and health insurers, and fintechs, that compete with each other, as well as with international players. Competition pushes all providers to offer better service, lower costs, and new innovations that respond to Canadians’ changing needs. By maintaining both strength and competition, Canada’s banking system helps drive progress and contributes to national economic resilience.

One economy, many strengths

Banks in Canada do more than just offer accounts, lend money, and facilitate payments. They’re part of the everyday economy in every province and territory. Whether it’s a small business in Moncton, a first‑time homebuyer in Regina, or a tech start‑up in Vancouver, banks help Canadians reach their goals.

Because they’re federally regulated, banks can operate in all provinces and territories, throughout the country. This allows them to provide a consistent and wide range of financial products and services to Canadians no matter where they reside.

Banks are also key partners in helping other sectors grow‑by financing innovation, backing entrepreneurs, and investing in communities. This broader role helps strengthen Canada’s economy as a whole.

How Canada’s banks can support Canadian prosperity now

We can take meaningful steps now to strengthen Canada’s economy. By improving internal trade, investing in national infrastructure, modernizing financial sector regulation and tax policy, supporting responsible innovation, and making additional efforts to combat scams and financial crimes, we can unlock growth, boost productivity, and build long‑term prosperity for Canadians.

Unlocking Canada’s full economic potential

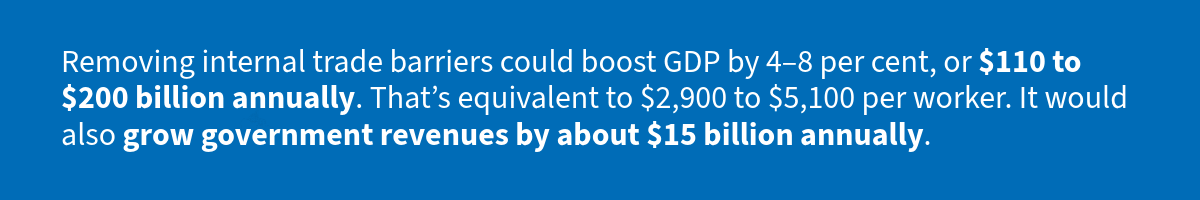

Internal trade barriers limit the flow of people, goods, services, and investment across the country, costing the Canadian economy billions of dollars each year. These inefficiencies drive up costs that can be passed on to consumers. Removing these barriers could deliver major benefits, including:

- More consumer choice

- Greater affordability through competition

- Higher productivity through larger‑scale operations

- A more resilient and connected national economy

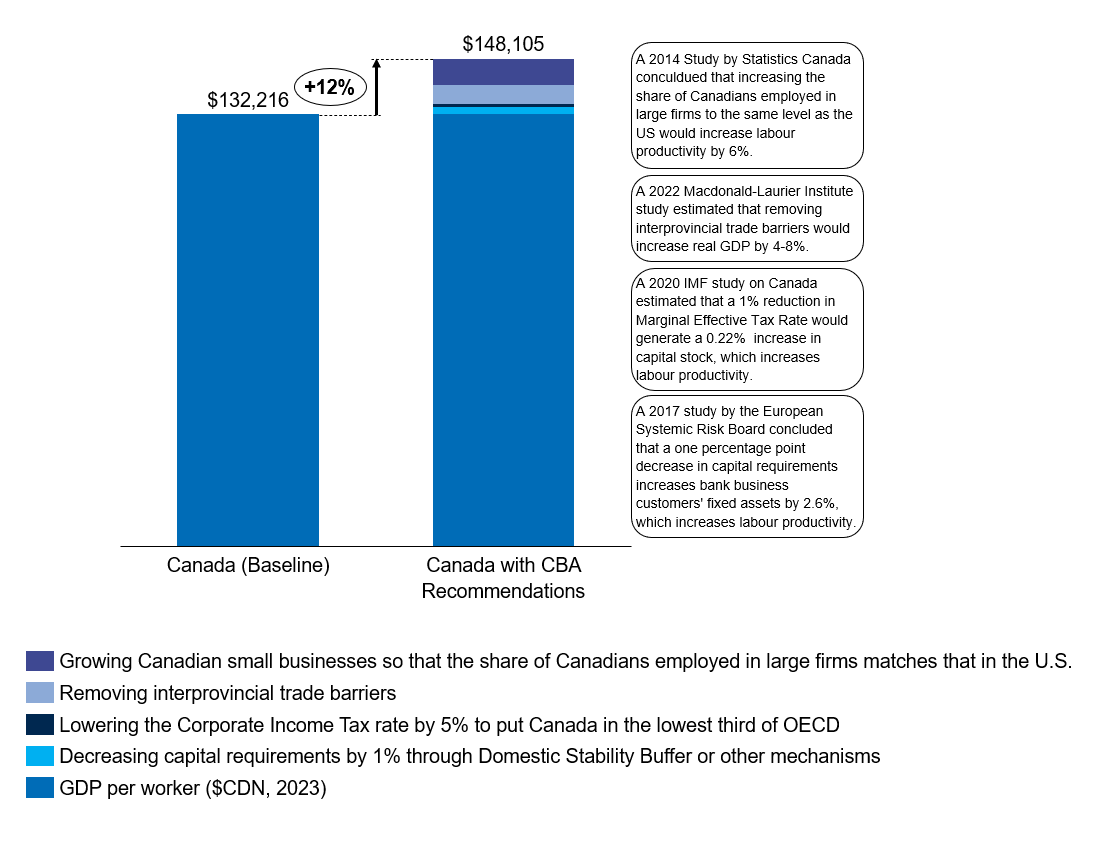

Removing internal trade barriers could boost GDP by 4 to 8%, or $110 to $200 billion annually. That’s equivalent to $2,900 to $5,100 per worker. It would also grow government revenues by about $15 billion annually.2

We recognize the important steps that governments across Canada have taken to reduce internal trade barriers in recent months. These efforts show what’s possible when governments work together to strengthen the Canadian economy. But there’s still more to do. We encourage continued momentum to remove the remaining barriers and make it easier for businesses to grow and compete across the country.

Building a stronger Canada through national infrastructure

Just as Canada’s strong, national banks provide the financial foundation that supports a resilient economy, large‑scale infrastructure projects can provide the physical backbone our economy needs to thrive. These nation‑building investments help strengthen connections across regions, improve access and opportunity, and support long-term growth. Examples include:

- Expanded digital networks

- A connected east‑west electricity grid

- Improved infrastructure in the Far North

An enormous amount of investment will be required in order to realize this vision. Some of that investment will need to come from capital markets through equity or debt, and some will need to come through credit extended by financial institutions. For the latter, capital requirements can and do influence credit availability and, by extension, business investment. Every dollar in capital supports over $7 in credit, so small changes in capital requirements can have a significant impact on credit availability and price.

Credit availability affects how much businesses can invest in things like new machinery, technology, and equipment. A 2017 study by the European Systemic Risk Board found that when banks face lower capital requirements, their business clients are more likely to borrow and invest in productivity‑boosting facilities and equipment. This increases labour productivity, which is key to helping the economy grow over the long term.3 That’s why it’s important to ensure banks have the flexibility to lend, especially when it comes to financing large-scale national infrastructure projects. These are the types of investments that can deliver lasting benefits across the country.

Modernizing the financial regulatory framework

Canada’s financial rules were built over many decades and are now complex, with oversight shared between federal and provincial governments. Today, there are 44 different federal and provincial regulators and self‑regulatory organizations in Canada addressing prudential and market conduct regulation for a range of financial services. At the same time, there are a growing number of new technology-based financial services providers that are unregulated or underregulated.

Good regulation follows the principle of "same activity, same risk, same regulation." If two institutions offer the same services, they should be subject to consistent rules, regardless of where they are based or how they are structured. This would make the system simpler, fairer, and easier for Canadians to navigate. In some areas we have made progress. For example, the federal credit union charter gives credit unions the option to acquire a national license so they can operate across provincial borders under federal oversight.

In addition, the federal Retail Payment Activities Act provides a national registration system for payment services providers. While that progress is helpful, much more can and should be done. For example, while Canada has created a registration system for payment services providers, it still lacks a set of consumer protection rules for those firms. Moreover, with the emergence of new payment forms like stablecoins, the regulatory environment will need to continue to evolve to keep pace with the marketplace.

Moving forward, we suggest that regulators embed competitiveness, growth and innovation as a priority in the regulatory sphere. This will encourage innovation and competition for the benefit of Canadian businesses and consumers. Updating Canada’s financial framework could:

- Reduce inefficiencies and streamline compliance

- Redirect resources toward innovation and growth

- Refocus efforts in strengthening Canada’s economy

Policy makers in the U.S. and the U.K. are already reassessing whether the regulatory balance has tipped too far towards augmenting stability at the expense of growth, competitiveness and innovation. If reassessment is timely for markets such as the U.S. and the U.K. then it is overdue for a market such as Canada, where no banks failed during the financial crisis and none required a capital injection from public sources.

While Canada’s regulatory system remains solid overall, and is something to be proud of, improvements can and should be made to make the regulatory system more consistent across the competitive landscape and efficient in meeting its regulatory objectives to ensure it is effective, compliant and helps to foster productivity and economic growth.

Updating the tax system

To boost productivity and prosperity, Canada needs a modern tax system that encourages investment, rewards entrepreneurship, and attracts and retains top talent. With global competition increasing, changes in U.S. tax policy, and tariffs, Canada must ensure its overall tax approach remains competitive and sustainable.

A full review of the tax system is overdue. Reforms should reduce complexity, eliminate distortions like sector‑specific taxes, and remove disincentives to saving and investing. By setting a bold target for tax competitiveness and aligning tax policy with long‑term growth goals, Canada can unlock capital, fuel innovation, and secure a stronger financial future for Canadians. One way is to find innovative solutions to increase the supply of risk capital to emerging businesses, such as expanding the application of flow‑through share tax treatment to sectors beyond mining and energy in order to support Canadian startups in AI, quantum computing, biotech, and advanced manufacturing. This would lower investment risk and accelerate capital flow into early‑stage venture companies.

If we set the right conditions for emerging businesses to grow, the rewards to the economy can be enormous. Growing small businesses into large ones is a key driver of productivity. A 2014 Study by Statistics Canada concluded that if Canada were to increase the share of workers employed in large firms to the same level as that of the U.S., Canada’s labour productivity would increase by 6%.4

Supporting responsible innovation together

Canada’s banks are investing in the technologies shaping our economy, from artificial intelligence (AI) to modernized payments to cyber security. They’re doing so responsibly, with a strong focus on trust, privacy, and safety. In fact, three Canadian banks were ranked among the top 10 globally for AI innovation in Evident AI’s Banking Index.

Banks are not just adopting new technology, they are helping others build it. They support AI start‑ups, work with fintech partners, and invest in research that brings new ideas to market. Explore recent announcements across Canada’s banks in our roundup on the CBA website.

To keep pace with this evolving landscape, Canada needs modern flexible, and technology‑neutral regulation. The regulatory framework should be:

- Harmonized across jurisdictions and between regulators

- Adaptive to innovation

- Focused on consumer protection

- Expanded to include emerging players, such as stablecoin issuers

At the same time, government policies should encourage investment in AI, digital infrastructure, and cyber security.

A practical step within the banking sector would be to improve the capital treatment of software intangibles (the value of internally developed software tools and systems such as secure banking platforms) which would help Canadian banks invest more in digital tools that improve services and drive efficiency. With the right policy environment, Canada’s banks can keep strengthening the financial system, boosting productivity, and supporting a dynamic digital economy that benefits everyone.

Combatting scams and financial crime

Fighting scams and financial crimes is a focus for the banking sector. Making progress in stopping scams requires the combined efforts of financial institutions, governments, law enforcement, telecommunications companies, and digital platforms. The CBA is currently working with over 50 organizations across public and private sectors to holistically protect Canadians from scams and other financial crimes through coordination, information sharing, and public education. Government has a key role to play in making sure that all players do their part to help protect consumers from falling victim to scams and, in doing so, ensure that financial crime does not pay.

Banks operating in Canada also continue to support the evolution of Canada’s anti‑money laundering and anti‑terrorist financing (AML/ATF) regime. The CBA and our members have actively supported some of the recent changes to the AML/ATF regime that help to drive continued alignment with international standards. In particular, the new ability for reporting entities to share information for AML/ATF purposes and the establishment of the federal beneficial ownership registry are two important developments. They are important steps forward that will help banks identify and disrupt money laundering. Going forward, the CBA and banks look forward to working with the federal government on additional adjustments to the AML/ATF regime to ensure it keeps pace with changes to Canada’s economy and remains focused on ever‑changing money laundering risks.

Working together for Canada’s economic future

Canada’s banking sector can offer a strong foundation for building future prosperity. With the right steps, such as removing internal trade barriers, reducing capital requirements, modernizing regulations, reducing corporate taxes, supporting innovation, and ensuring scams and financial crime are addressed, we can get more small businesses to grow into larger ones, attract investment, and help grow the economy in ways that benefit people across the country.

Investing in national infrastructure will also strengthen the physical backbone of the economy, while consistent financial rules across provinces can encourage more innovation and healthy competition in the financial sector.

The payoff? Higher labour productivity and a stronger economy for all Canadians.

1 Employment Statistics – Source: CBA Employment Statistics, 2024

GDP Statistics – Source: Statistics Canada, 2024

Tax Statistics – Source: CBA Tax Statistics, 2024

Mortgages Outstanding – Source: Bank of Canada, 2024

Business Credit (Total and SME) – Source: CBA Business Credit Statistics, December 2024

Dividend Data – Source: Bank Financial Statements, 2024

2 McDonald Laurier Institute. Liberalizing Internal Trade through Mutual Recognition: A Legal and Economic Analysis. September 2022

3 European Systemic Risk Board, "The real effects of bank capital requirements", Working Paper No. 47, June 2017. Among its findings, the study found that a one percentage point decrease in capital requirements increases bank business customers' fixed assets by 2.6%

4 Statistics Canada, "Canada–United States Labour Productivity Gap Across Firm Size Classes", The Canadian Productivity Review, January 2014