Article

September 5, 2025

Prudential Banking Team

HM Treasury

Horse Guards Road

London SW1A 2HQ

Prudential.Consultation@hmtreasury.gov.uk

Dear Prudential Banking Team,

Thank you for the opportunity for the Canadian Bankers Association (CBA)1 to contribute to HM Treasury’s consultation on Applying the Financial Services and Markets Act 2000 model of regulation to the UK Capital Requirements Regulation Policy Update 2025. We are specifically responding to Chapter 3 ‘Overseas Recognition Regimes’, particularly as it relates to Covered Bonds.

We strongly believe that the Canadian covered bonds market meets HM Treasury’s criteria of being material and liquid, as well as contributing to both financial stability and the safety and soundness of UK firms. It would also lead to improvements in the liquidity of the UK market for overseas covered bonds and enhancement of the UK’s competitiveness as a financial services hub. As the largest third country issuer in the UK, Canadian covered bonds offer diversification to the UK’s base of investors.

Overview of the Canadian Covered Bond Market and Structure

Canada’s eight largest banks – BMO Bank of Montreal, Bank of Nova Scotia (BNS), Canadian Imperial Bank of Commerce (CIBC), Equitable Bank, Laurentian Bank, National Bank of Canada, RBC Royal Bank of Canada, Toronto Dominion (TD) Bank – and the Fédération des caisses Desjardins du Québec have registered covered bonds programs.2 All of the banks are regulated by the Office of the Superintendent of Financial Institutions (OSFI), while Desjardins is regulated by the Quebec Autorité des marchés financiers (AMF). Canadian covered bond issuers are highly rated in a sound banking system within an AAA-jurisdiction and provide diversified liquidity opportunities for investors based on issuance size, frequency and overall supply volume.

Under the National Housing Act (NHA), the Canada Mortgage and Housing Corporation (CMHC) is responsible for maintaining a registry of covered bonds issuers and programs and acts as the administrator for the legislative covered bonds framework. Since 2012, the NHA has provided a legal framework for the registration of covered bond programs in Canada.

The NHA explicitly confirms that nothing in federal or provincial legislation relating to bankruptcy, insolvency or any order of a court made in relation to reorganization, arrangement or receivership, prevents or prohibits the making of payments to covered bond investors. This ultimately provides increased certainty to investors of the continuity of payment and recovery of their investment in the event of default by the issuer. With prudential supervisors in OSFI and the AMF and the CMHC providing dedicated covered bond oversight and policy‑development, Canada has a unique and strong supervisory framework for covered bonds.

The Canadian Registered Covered Bond Program establishes strict requirements for eligible assets. Eligible cover pools consist of CAD$‑denominated, first lien, uninsured (maximum 80% LTV at origination) residential mortgages (consisting of one‑to‑four residential units) and are not in arrears at the time of transfer to the Guarantor. These mortgages are compliant with OSFI’s mortgage Guideline B‑20 Residential Mortgage Underwriting Practices and Procedures.3

Operationally, the Canadian Registered Covered Bond Program requires the implementation of features that on par with the best of international comparables and contribute to superior credit quality. They are:

- Guarantor entities are required at all times, prior to issuer default, to hold/include only performing eligible residential mortgages and/or high‑quality liquid assets when calculating compliance with minimum overcollateralization requirements

- Collateral value is "marked to market" monthly by applying house price indexing to the underlying real estate

- Hedging for foreign exchange and interest rate risk are required to be in place for the benefit of the guarantor entity

- Monthly asset coverage tests prior to issuer default drive the amount of collateral to be held by the guarantor entity to maintain sufficient collateral levels to meet their guarantee obligations

- Deterioration in the issuer's credit ratings or performance can trigger a transfer of monthly mortgage cash collections to the standby bank, enhancing the guarantor entities’ position

- Covered bonds are dual recourse instruments ranked pari‑passu with deposits, providing bondholders with a claim on the issuer's estate as well as 100% of the collateral held by the guarantor entity

- Canadian covered bond programs are required to undergo annual specified procedure reviews performed by independent auditing firms

- Implementation of bail‑in/Total Loss Absorbing Capacity (TLAC) regimes provides further support to the credit quality of covered bonds because bail‑in/TLAC instruments are effectively subordinated to covered bonds

Size of the Canadian Covered Bond Market

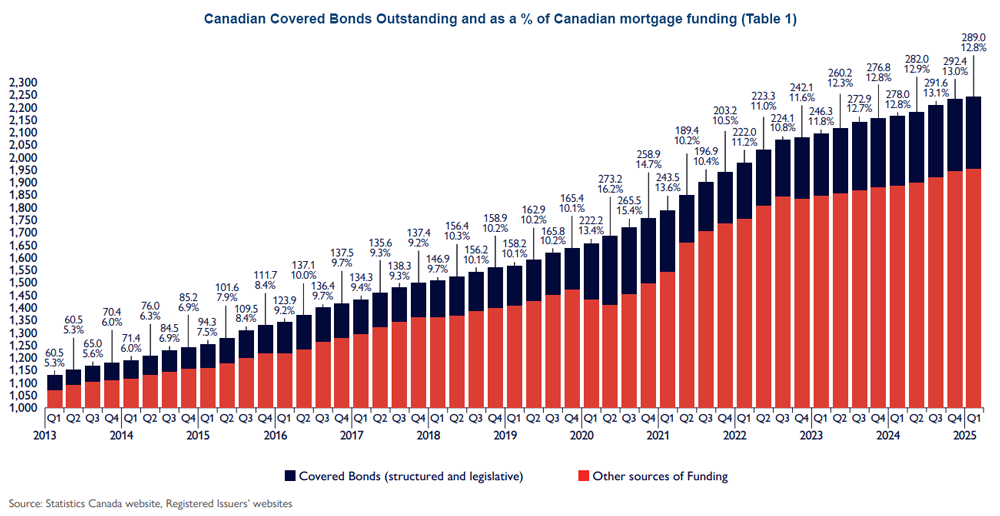

As a result of these legislative, regulatory and operational features, covered bond funding makes up close to 13% of the mortgage market (Table 1).

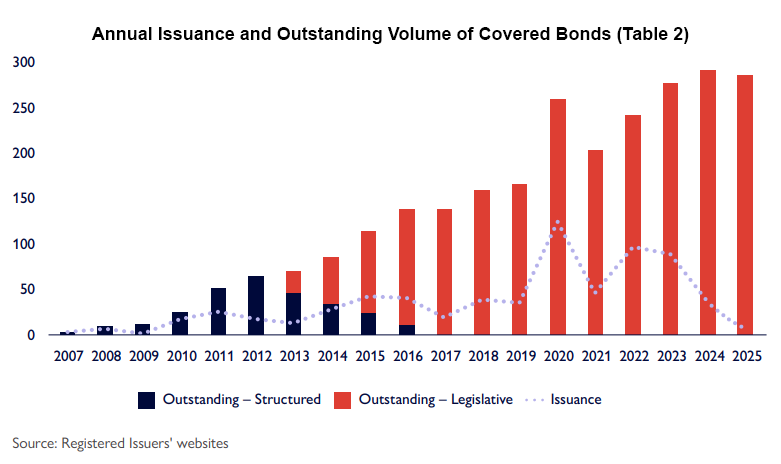

The amount of covered bonds outstanding issued by Canadian financial institutions has increased since 2007. As of March 2025, the amount of covered bonds outstanding issued under the legislative framework amounted to $289 billion with issuance amounting to $8.9 billion in 2024 (Table 2). This equates to over 11 per cent of total outstanding covered bonds – the largest non-European issuer of covered bonds.

Global issuance of Canadian covered bonds

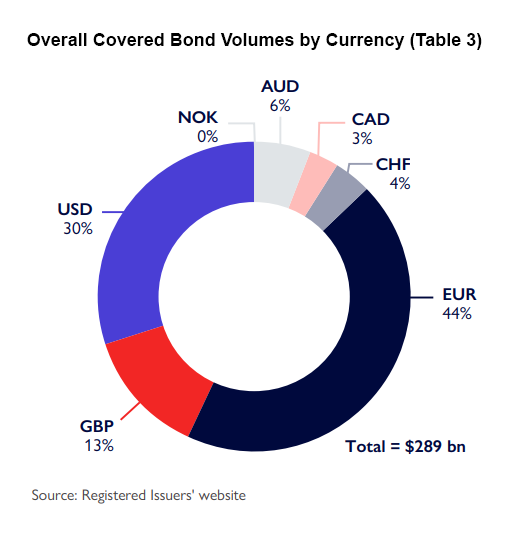

Canadian covered bonds are increasingly a significant investment as a high‑quality asset class across currencies. Canadian covered bond issuers have issued in 7 international markets (the EUR, USD, CAD, GBP, CHF, NOK & AUD markets). Of the total $289 billion of Canadian covered bonds outstanding, 13% of the amount have been denominated in sterling (Table 3) ̶ the third largest market for Canadian covered bonds behind EUR and USD.

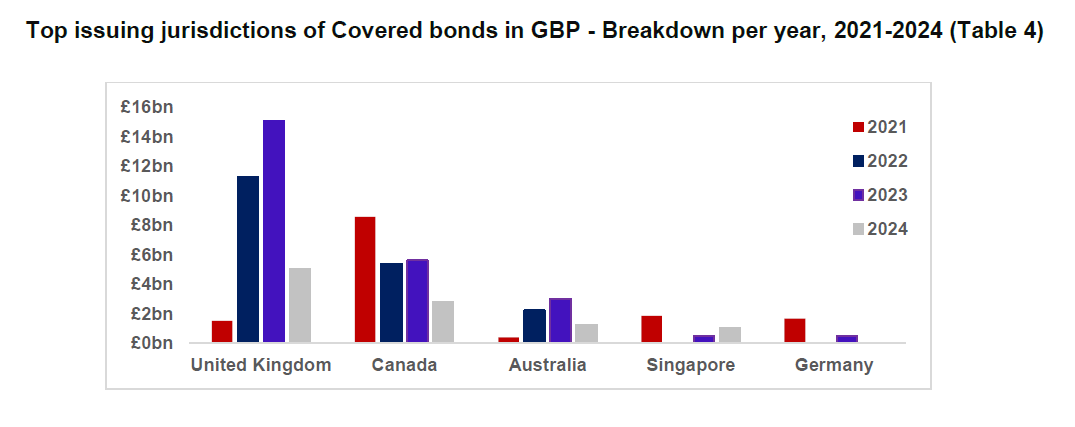

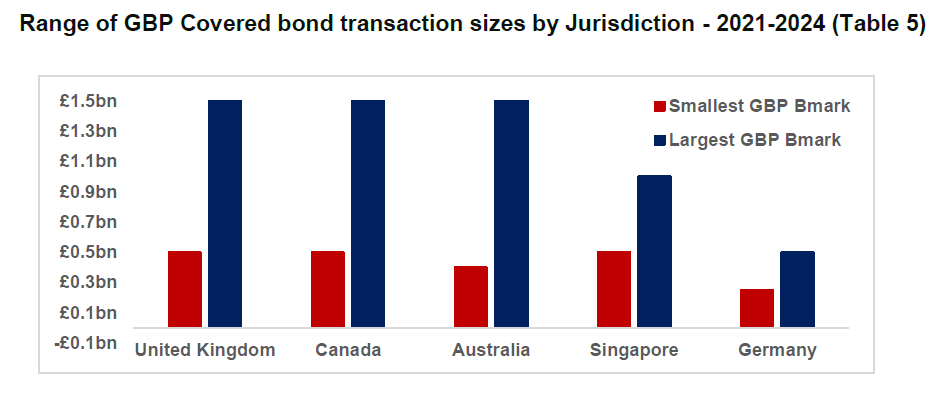

Canadian covered bond issuers are also the most active non‑UK sterling‑denominated issuers. Over the last five years, Canadian covered bond issuers have supplied between 17 and 61 per cent of sterling‑denominated covered bonds4 – typically the second most in any given year behind UK‑based issuers (Table 4) ̶ as well as among the largest transaction sizes for sterling‑denominated covered bond transactions (Table 5).

Canadian covered bond issuers are also the most prominent issuers of covered bonds in USD and AUD, as well as the fourth most in EUR. Further information on Canadian covered bond issuance in these markets can be found in the Appendix.

Benefits of including Canadian covered bonds into the Overseas Recognition Regime

As mentioned, we strongly believe that the Canadian covered bonds market meets the criteria for the Overseas Recognition Regime as it relates to covered bonds. Issuers believe there is a substantial amount of merit to its establishment including:

- Promotion of Global Integration and Investment – Canadian covered bonds that are deemed equivalent will increase investor demand for issuers and in turn increase issuers willingness to issue larger or more frequent issuance in the UK, ultimately promoting cross border investment globally

- Strengthen Investor Diversification and Protection – For UK bank investors for whom HQLA treatment and regulatory risk weighting is an important factor in investment decision‑making, recognizing Canadian covered bond issuers under the Overseas Recognition Regime would facilitate the ability to allocate capital based on merit, diversify risks and potentially improve investment returns, as they see fit without distortion of differing regulatory/liquidity treatment for holding covered bonds

- Increasing Choice for UK investors – Acceptance into the Overseas Recognition Regime equivalency regime would be very beneficial for small UK banks in expanding their investment choices, who otherwise cannot afford to spend time and resources in understanding specific features of covered bond issuance outside of the UK

- Enhanced Market Access for UK and non‑UK issuers – Acceptance into the Overseas Recognition Regime may serve as an impetus for establishing equivalent regimes in Canada and other third countries for UK covered bond issuers, giving them an ability to diversify their issuance and expand investor base. Similarly, by aligning with UK regulatory standards, non‑UK issuers can tap into a broader pool of investors and raise funding more efficiently.

Thank you for the opportunity to provide the views of Canadian covered bond issuers to the attention of HM Treasury. If you have any questions or comments, please do not hesitate to contact me.

Sincerely,

Alex Ciappara

Vice President, Head Economist

Canadian Bankers Association

Appendix

The strength of Canada’s registered covered bond program is further highlighted by its attractiveness to investors in many different markets. As a result, Canadian covered bond issuers have been issuing large and liquid covered bonds in many different geographies. Strong investor demand, secondary market liquidity, and central bank repo eligibility have been seen in Europe, United States and Australia, in addition to the United Kingdom.

Europe

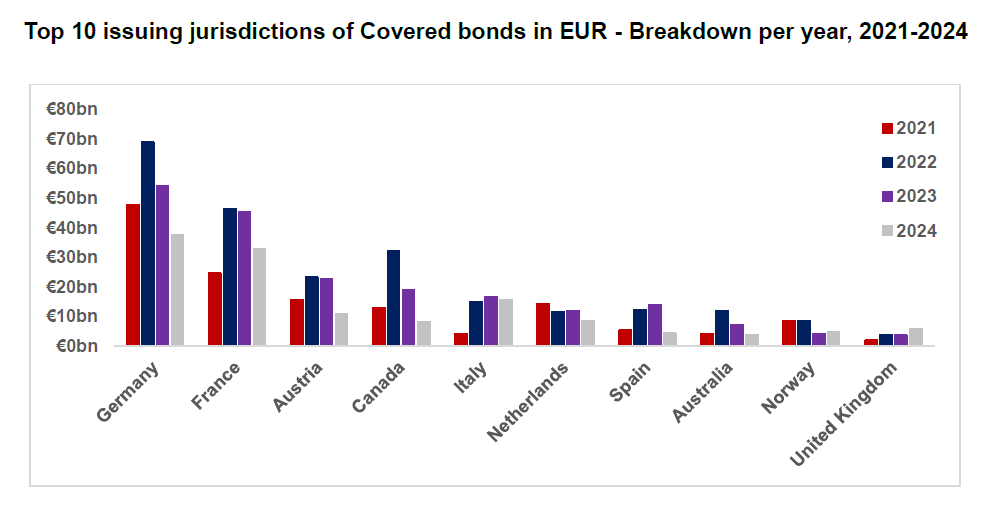

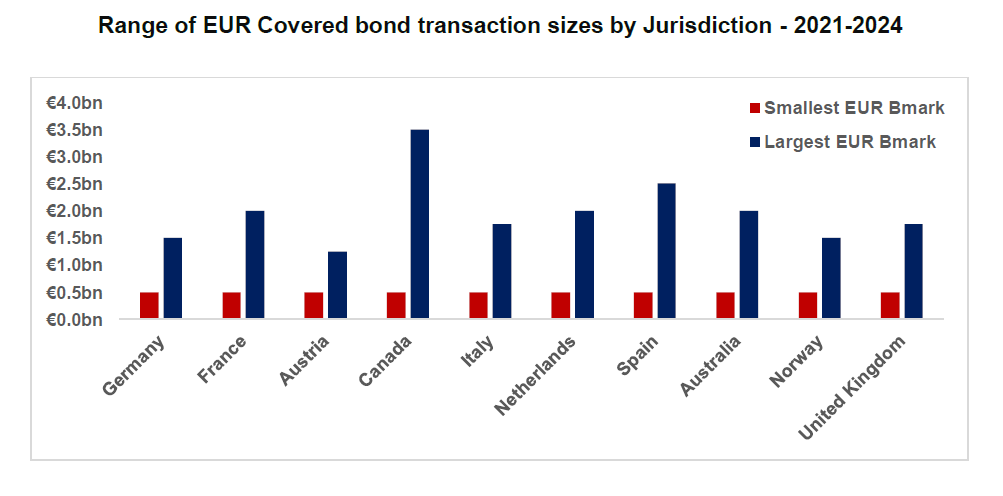

Canadian banks represent the fourth most active issuing jurisdiction and have issued the biggest benchmark sizes in recent years as highlighted below.

United States

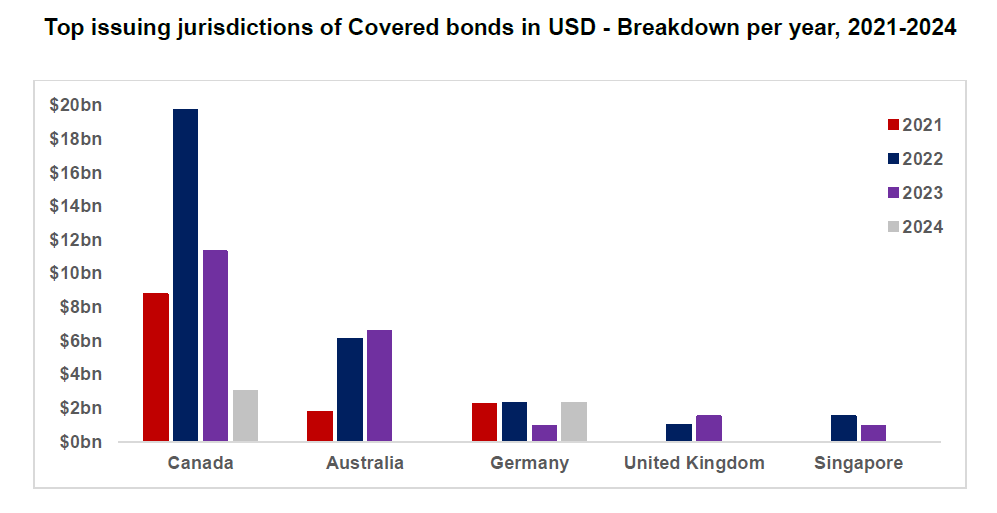

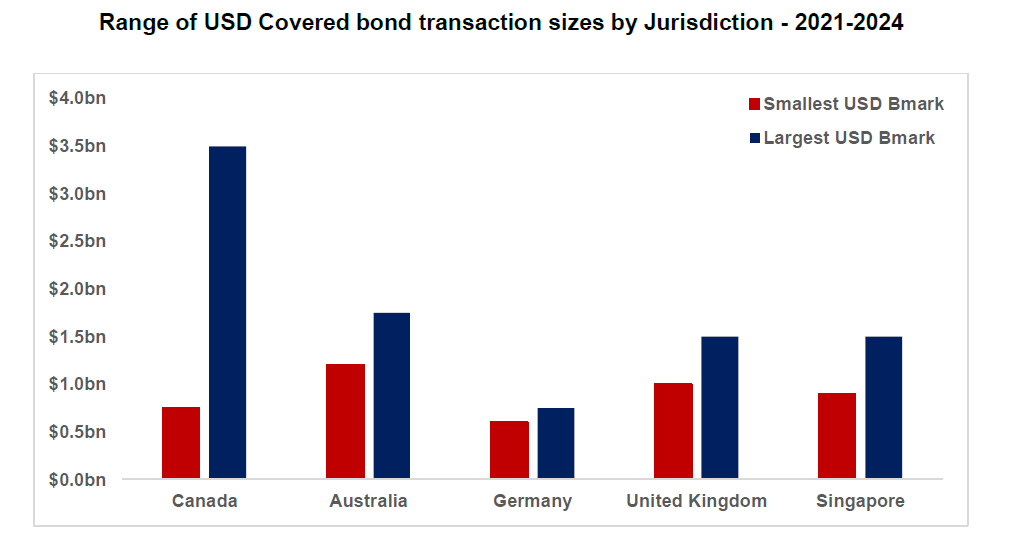

Canadian banks are also the most prominent issuers of USD covered bonds and have issued some of the biggest tranche sizes in recent years as shown below.

Australia

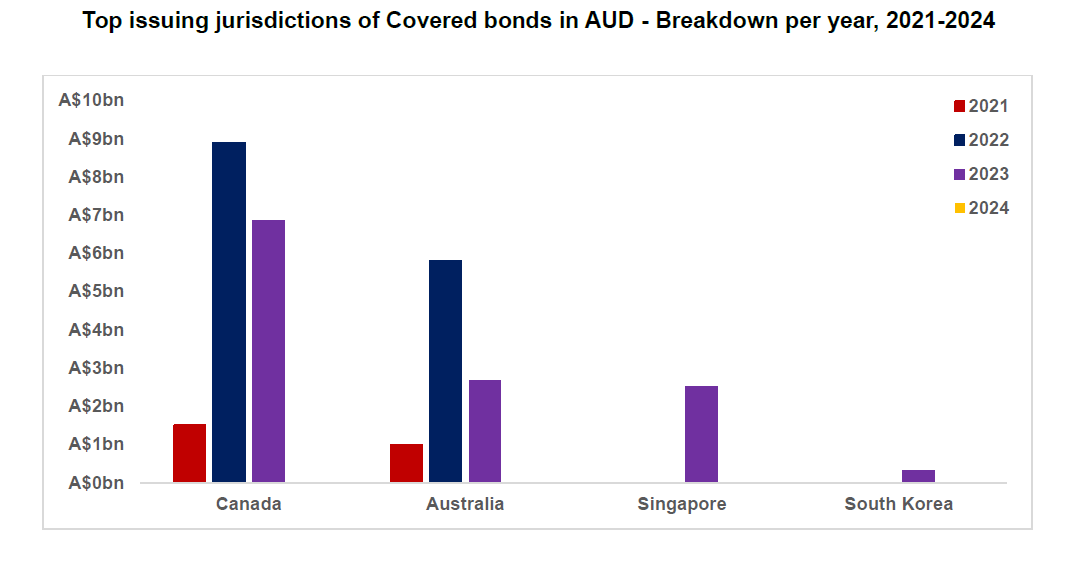

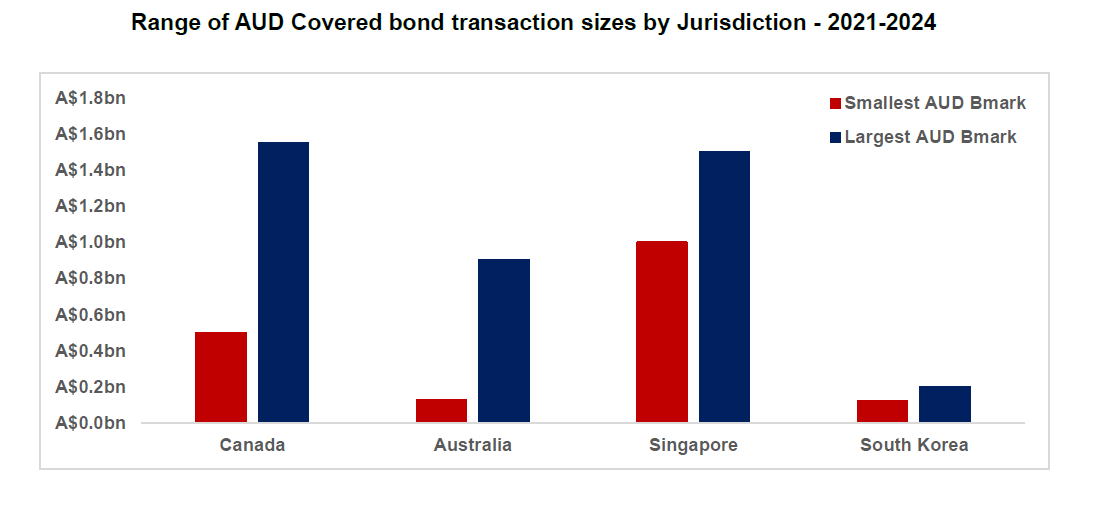

The trend is the same in Australia where Canadian banks are the most prominent issuers of covered bonds in AUD and have printed the largest tranches.

1 The Canadian Bankers Association (CBA) is the voice of more than 60 domestic and foreign banks operating in Canada with over 280,000 employees that help drive Canada’s economic growth and prosperity. The CBA advocates for public policies that contribute to a sound, thriving banking system to ensure Canadians can succeed in their financial goals. cba.ca

2 Canada’s eight largest banks are all members of the CBA. While the Fédération des caisses Desjardins du Québec is not a member of the CBA, its views have been incorporated into this submission.

3 OSFI Guideline B-20, Residential Mortgage Underwriting Practices and Procedures.

4 HSBC, Covered Bond Insight Fixed Income, April 14, 2025.