Article

Fast Facts

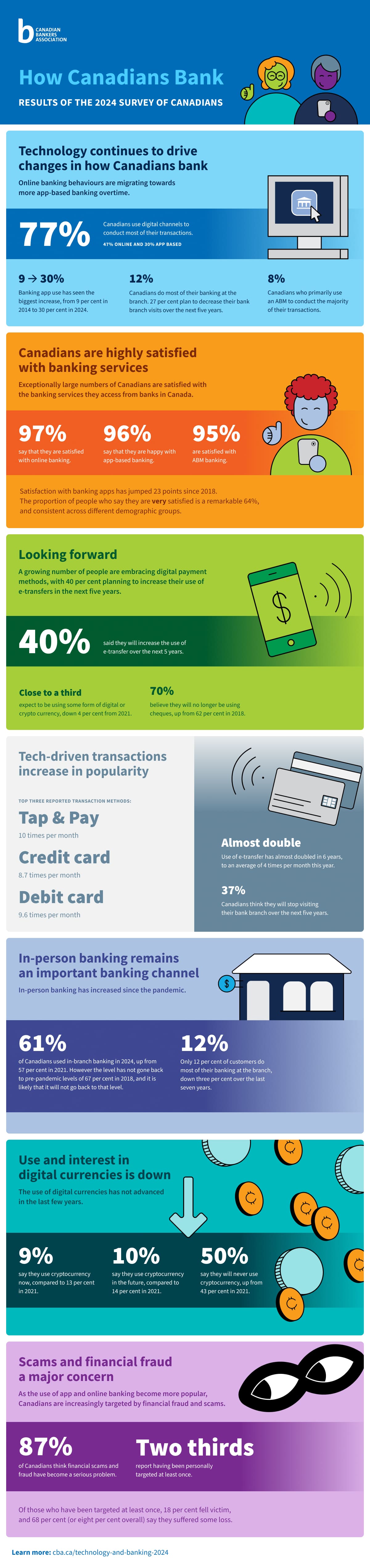

- Digital banking has become the norm in terms of how people do most of their banking. More than 4 in 10 say their use of apps and online banking has been increasing in recent years.

- 87 per cent have banked online in the last year, but online banking behaviours appear to be migrating towards more app-based banking over time.

- 70 per cent have used an app to do their banking, up from 65 per cent in 2021. On average, the number of reported uses of mobile app per month is 7.4 times.

- Young adults (age 18-29) are more likely to be app-centric while older adults (age 70+) do more online banking.

- Phone banking has been declining, and roughly a quarter of the consumers they use in-person services.

- The average number of reported visits to a bank branch per month dropped from 1.8 in 2021 to 1.3 in 2024.

- ABMs are still in use, but frequency of use may be declining. Reported withdrawals from ABMs are, on average, 2.7 times per month in 2023, up beyond the pre-pandemic level of 2.4 times per month in 2018.

- Use of e-transfer has almost doubled in 6 years, to an average of 4 times per month in 2023.

The bottom line

The introduction and rapid adoption of digital banking alternatives in recent years have transformed the way that Canadians conduct their banking. With the widespread use of smartphones, mobile banking apps have become increasingly popular. Canadians can perform many banking tasks using their mobile devices through digital banking platforms that have incorporated robust security measures to protect users’ sensitive and personal information and transactions. As a result, online banking behaviours are migrating towards more app-based banking overtime.

The introduction and rapid adoption of digital banking alternatives in recent years have transformed the way that Canadians conduct their banking. With the widespread use of smartphones, mobile banking apps have become increasingly popular. Canadians can perform many banking tasks using their mobile devices through digital banking platforms that have incorporated robust security measures to protect users’ sensitive and personal information and transactions. As a result, online banking behaviours are migrating towards more app-based banking overtime.

These and other findings form the basis of How Canadians Bank, a biennial study by the Canadian Bankers Association and Spark Insights that examines the banking trends and attitudes of Canadians.

Canadians are highly satisfied with banking services

Exceptionally large numbers of Canadians are satisfied with the banking services they access from banks in Canada.

- 97 per cent say that they are satisfied with online banking.

- 96 per cent say that they are happy with app-based banking.

- 95 per cent are satisfied with ABM banking.

- Satisfaction with these types of banking have all improved in recent years.

Satisfaction with banking apps has jumped 23 points since 2018. The proportion of people who say they are very satisfied is a remarkable 64 per cent, and consistent across different demographic groups.

Looking forward

As financial technology continues to evolve, consumer payment preferences are shifting significantly. A growing number of people are embracing digital payment methods, with 40 per cent planning to increase their use of e-transfers in the next five years. Credit and debit cards remain a staple, as almost everyone anticipates using them in the future.

However, the enthusiasm for digital or cryptocurrency has slightly waned. Meanwhile, traditional payment methods like cheques are rapidly falling out of favour, with 70 per cent of consumers predicting they will abandon cheques altogether.

- 40 per cent said they will increase the use of e-transfer over the next 5 years.

- Almost everyone expects to be using credit and debit cards 5 years from now.

- Close to a third expect to be using some form of digital or crypto currency, down 4 per cent from 2021.

- 70 per cent believe they will no longer be using cheques, up from 62 per cent in 2018.

Technology continues to drive changes in how Canadians bank

Although the pandemic has passed and people’s lives are going back to normal gradually, it has changed the ways we live and work forever. Consumers have gotten used to the convenient ways that they can access their banking needs online and with an app securely.

- Banking app use has seen the biggest increase, from 9 per cent in 2014 to 30 per cent in 2023.

- Only 41 per cent of consumers say their use of online banking has increased in recent years, compared with 46 per cent in 2021.

- 48 per cent of consumers say they have increased their use of an app in the last few years, compared to 37 per cent in 2021.

The reported frequency of use of tap and pay with credit and debit cards remains strong, with apparent rise in the use of debit cards from 2021. The average Canadian reports using Tap & Pay 10 times a month and buys something with their credit card and debit card 8.7 times and 9.6 times a month, respectively. The use of e-transfer has increased to 4 times a month from 2.9 times in 2021. Canadians expect to increase their use of the following top three banking technologies in the next five years:

- Mobile banking apps (41 per cent)

- Interac e-Transfer® (40 per cent)

- Tap & Pay (32 per cent)

In contrast, the use of cheques, while already in decline over the last decade, is expected to continue trending downward, with 70 per cent of Canadians saying they plan to stop using cheques within five years. Further, over a third (37 per cent) of customers think they will stop visiting their bank branch over the next five years.

Online banking is still the most common way people bank but use of apps is increasingly popular

As banks continue to improve banking technologies, online banking continues its leading position as the most common form of banking for most Canadians but some consumers are shifting towards primarily using an app.

- While 87 per cent of Canadians reported using online banking in the last year, close to half of customers (47 per cent) say that online banking is their most common banking method, down from 52 per cent in 2018.

- Online banking is the go-to channel for Canadians aged 60 and older (59 per cent for consumers aged 60-69 and 66 per cent for those over 70).

- For those over 70, only 9 per cent said they use an app to conduct their banking transactions.

- For the age group of 18-29, 39 per cent said they use an app to conduct the majority of their banking transactions, followed by 37 per cent for people aged between 30 and 44.

- 41 per cent of Canadians increased their use of online banking in the last few years, but it’s a drop from last year’s 46 per cent. While online is still the predominant banking method for most Canadians, that dominance is declining over time as an increasing number of customers gravitate to mobile app-based tools.

- In 2024, 70 per cent of those surveyed said that they have used an app to conduct banking and 30 per cent say they use an app for the majority of their banking, up from 23 per cent in 2018.

In-person banking remains an important banking channel

In-person banking has increased since the pandemic.

- 61 per cent of Canadians used in-branch banking in 2024, up from 57 per cent in 2021. However the level has not gone back to pre-pandemic levels of 67 per cent in 2018, and it is likely that it will not go back to that level.

- Only 12 per cent of customers do most of their banking at the branch and 27 per cent plan to decrease their bank branch visits over the next five years.

Canadians still rely on ABMs

Canadians still rely on ABMs primarily to get cash, make deposits and pay bills. Although we have seen a decrease in the use of ABMs to conduct banking needs by Canadians in recent years, Canadians still rely on ABMs primarily to get cash.

- 75 per cent of Canadians report using an ABM in the past year.

- In 2024, only eight per cent of customers say they use ABMs to conduct most of their banking.

- Five years from now, 65 per cent of Canadians expect to still carry cash.

There are close to 70,000 ABMs in Canada, including 18,689 bank-owned ABMs.

Use and interest in digital currencies is down

The use of digital currencies has not advanced much in the last few years.

- Nine per cent say they use cryptocurrency now, compared to 13 per cent in 2021.

- 32 per cent surveyed say that they will use alternative currency five years from now, down from 36 per cent in 2021.

- 10 per cent say they will use cryptocurrency in the future, compared to 14 per cent in 2021.

- Half say they will never use cryptocurrency, up from 43 per cent in 2021.

- The most common reason for using cryptocurrency would be as an investment (41 per cent), followed by keeping transactions private (38 per cent) and convenience (21 per cent).

- Interest in cryptocurrencies is heavily influenced by age, with those over 70, only two per cent say they will use it.

Scams and financial fraud a major concern

Canadians are increasingly targeted by financial fraud and scams.

- 87 per cent of Canadians think financial scams and fraud have become a serious problem.

- Two thirds report having been personally targeted at least once.

- Of those who have been targeted at least once, 18 per cent fell victim, and 68 per cent (or eight per cent overall) say they suffered some loss.

Recognizing the importance of protecting Canadians, the CBA has developed fraud prevention toolkits with the aim to help spot common frauds and help you protect your information and money from financial crime. You can find the tools here.

Methodology

The bi-annual survey was conducted by Spark Insights in January 2024. A total of 4,000 adults were surveyed online and results were weighted according to gender, age, region, education and past federal vote to reflect Canada's population. A comparable probability sample would have a margin of error of +/-1.8 per cent, 19 times out of 20./p>

All data from: How Canadians Bank, Spark Insights, 2024, except ABM transactions statistics and number of ABMs (Source: CBA, 2024).

® Registered trademark of Interac Corp.