Article

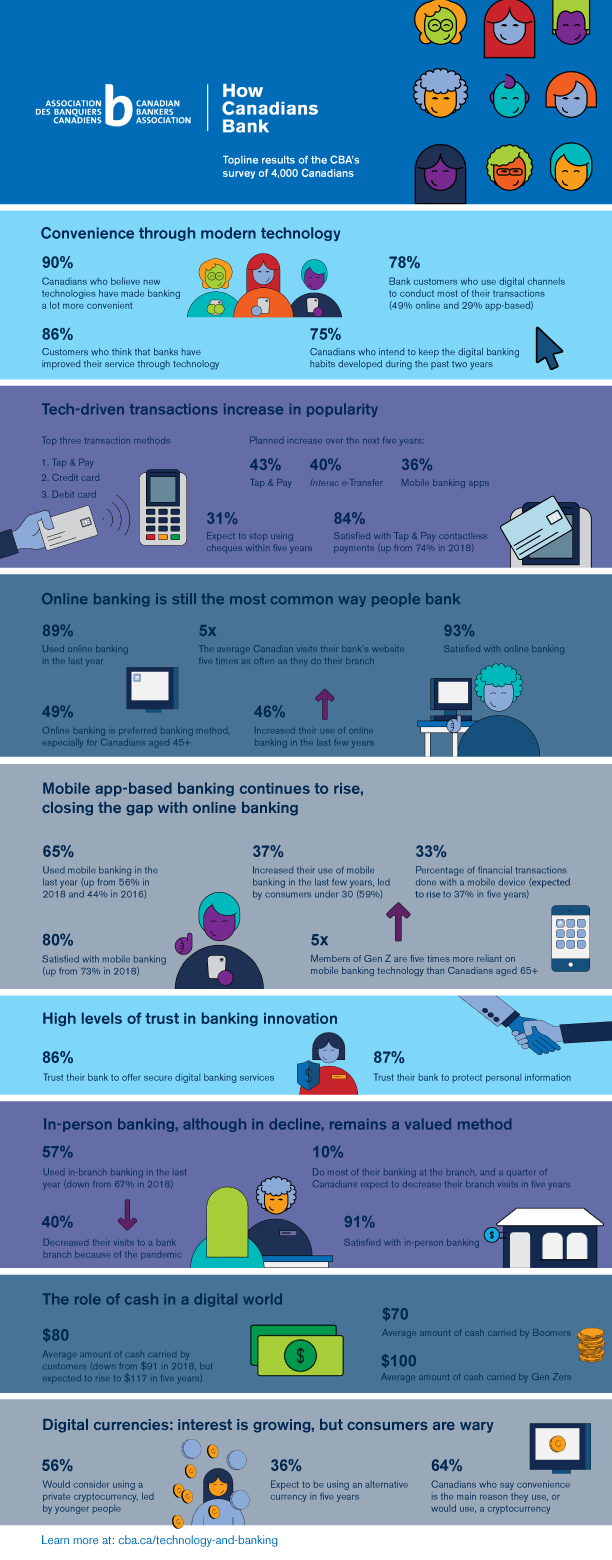

TORONTO, March 31, 2022 – The widespread migration to digital technologies driven by public health measures accelerated changes to the way Canadians bank, as more than three‑quarters of customers (78 per cent) have come to rely on digital channels to conduct most of their banking. This is among the many findings in How Canadians Bank, a recent survey of 4,000 Canadians commissioned by the Canadian Bankers Association (CBA).

Survey highlights:

- 78 per cent of Canadians are using digital channels to conduct most of their banking transactions, up from 76 per cent in 2018 and 68 per cent in 2016.

- 89 per cent of Canadians reported using online banking in the last year.

- 65 per cent of Canadians used mobile app‑based banking in the last year, up considerably from 2018 and 2016 results, at 56 per cent and 44 per cent respectively.

- Three out of four Canadians (75 per cent) intend to keep the digital banking habits developed during the pandemic.

- 86 per cent of Canadians trust their bank to offer secure digital banking services.

"The pandemic proved to be a major catalyst for change as Canadians moved more of their daily activities online, including a large‑scale uptake of digital banking and contactless transaction methods," said Anthony G. Ostler, President and CEO, CBA. "Reliable digital banking solutions were already in place when it mattered most thanks to a long‑standing commitment to strengthening the customer experience through technology. Further innovations were developed in record time to support consumers as their lives changed dramatically. These factors combined helped Canadians do more online than ever before while reducing risks and delivering convenience at a critical time."

Digital by default: Technology and generational influences of younger customers

As technology evolves and changes the way we live and work, the digital expectations of consumers are rising. This is the leading catalyst for continued innovation as banks look for new, easier ways for Canadians to access their banking consistently and securely. And Canadians clearly value the convenience of these innovations and feel better served as a result.

- 90 per cent of consumers believe that new technologies have made banking a lot more convenient.

- 86 per cent of Canadians agree that their bank has improved service through technology. More than one‑third (34 per cent) of Gen Z consumers "strongly agree" that technology is improving their banking experience.

- 84 per cent of consumers are satisfied with Tap & Pay contactless payments, up significantly from 74 per cent in 2018.

The broad‑based shift towards online and mobile banking has gathered momentum during the pandemic, and consumers under the age of 30 are the main drivers of this trend. Indeed, digital‑first customer preferences are likely to become more entrenched in the years ahead.

Ostler adds: "The pace of change in any industry is usually dictated by the customer. And what bank customers want is a digital‑first approach to their financial transactions, in real‑time, from anywhere, on a reliable and secure network. Significant investments in modernization have helped banks in Canada anticipate and meet the evolving preferences of their customers."

Online banking is still the most common way people bank

As banking technologies have come to the forefront, online banking has cemented its position as the most common form of banking for most Canadians.

- Half of customers (49 per cent) say that online banking is now their most common banking method – 20 per cent higher than app‑based banking, the second ranked method, although that gap is closing.

- 46 per cent of Canadians increased their use of online banking in the last few years, particularly among consumers under the age of 30 (58 per cent).

- A large majority (93 per cent) of Canadians are satisfied with online banking.

Though not surprising given recent events, the average Canadian visits their bank’s website five times as often as they do their branch. While online is the predominant banking method for most Canadians, that dominance is declining over time as an increasing number of customers gravitate to mobile app‑based tools.

Mobile app‑based banking continues to rise, led by Gen Z and Millennial uptake

Every Canadian with a smartphone now has a bank in their pocket. Because most Canadians carry these devices, banks offer mobile banking and payment services and apps that allow customers to perform a variety of transactions through their phones. As a result, the number of Canadians banking on the go continues to rise, particularly among younger customers.

- 37 per cent of Canadians increased their use of mobile banking in the last few years, led by bank customers under the age of 30 (59 per cent).

- Nearly half of Gen Z (46 per cent) and well over a third of Millennials (37 per cent) say apps are their leading banking method, as opposed to 29 per cent for all demographics groups combined.

- Members of Gen Z are five times more reliant on mobile banking technology than older Canadians aged 65 and above.

- 80 per cent of Canadians say they are satisfied with mobile banking services, up from 73 per cent in 2018.

High levels of trust in banking innovation

With many digital services available today, trust in the security of personal data and financial information has eroded in many sectors of the economy. However, the opposite seems to be true for the banking sector, where confidence is gaining.

- 87 per cent of customers trust their bank to protect personal information.

- Banks always put their customers at the centre of trusted innovation.

Canada’s banks have earned a strong reputation as pillars of stability, but they are also dynamic and continually anticipate and adapt to evolving customer preferences. Canadians place high trust in banks because they have delivered convenience through technology for decades – always with a focus on security and privacy.

Digital currencies: interest is growing, but consumers are wary

While the end of physical money is not near, a dizzying array of cryptocurrencies has launched in recent years. How are Canadians responding to these innovations?

- Led by younger Canadians, more than half (56 per cent) of consumers would consider using a private cryptocurrency.

- 64 per cent of Canadians say convenience is the main reason they use, or would use, a cryptocurrency.

- One‑third (36 per cent) of consumers expect to be using an alternative currency in five years.

Learn more about these and other findings from the CBA’s How Canadians Bank survey at cba.ca/technology-and-banking

About the Canadian Bankers Association

The Canadian Bankers Association is the voice of more than 60 domestic and foreign banks that help drive Canada’s economic growth and prosperity. The CBA advocates for public policies that contribute to a sound, thriving banking system to ensure Canadians can succeed in their financial goals. www.cba.ca

– 30 –