Article

Fast facts

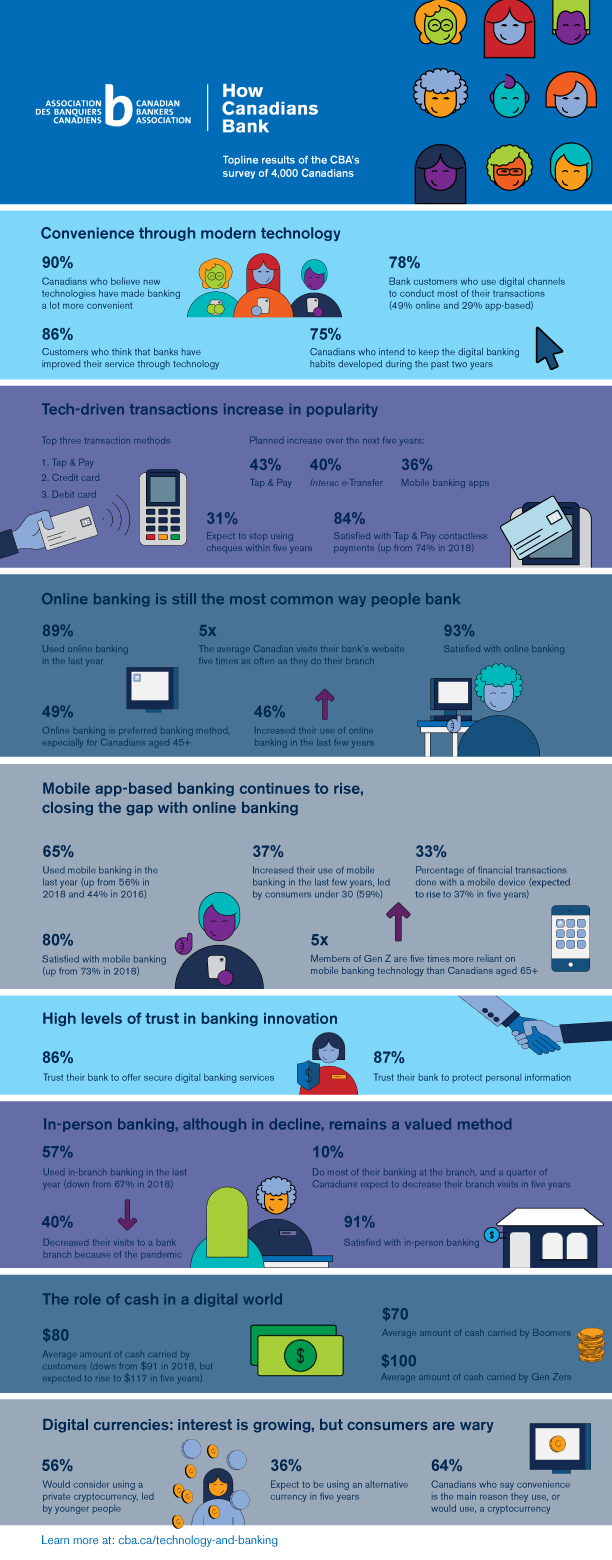

- The large majority (90 per cent) of Canadians believe that banking has become a lot more convenient because of new technologies.

- Eight out of 10 (78 per cent) Canadians are using digital channels (online and app‑based) to conduct most of their banking transactions.

- Nine out of 10 (89 per cent) Canadians reported using online banking in the last year, and half (49 per cent) say it is their most common banking method, making online the most used digital banking channel.

- Mobile app‑based banking continues its ascent, driven by a strong uptake from Gen Z and Millennials. Two‑thirds (65 per cent) of Canadians used a mobile app to do their banking in 2021, up from 56 per cent in 2018.

- Bank customers are highly satisfied with their banking experience online and via app‑based solutions, with satisfaction levels at 93 per cent and 80 per cent respectively.

- Three out of four Canadians (75 per cent) intend to keep the digital banking habits developed during the past two years.

- 86 per cent of Canadians trust their bank to offer secure digital banking services, and 87 per cent trust their bank to protect their personal information.

- 57 per cent of Canadians used in‑branch banking in 2021, down from 67 per cent in 2018. This decline can be attributed to pandemic‑related safety measures and increasing technological convenience.

- More than half (56 per cent) of consumers, led by younger Canadians, would consider using a private cryptocurrency.

The bottom line

Banks in Canada are meeting the evolving preferences of their customers as powerful new technologies change the way people bank and how they pay for goods and services. Banking is transforming at a record pace, bringing innovation and new potential to empower Canadians’ lives in a digital world.

Now more than ever, Canadians value convenient and dependable access to banking technology. To that end, banks are continuing their decades‑long leadership in developing new innovations that make banking more flexible, secure, consistent and accessible for all customers.

Canadians have unprecedented access to tried and trusted channels to meet all aspects of their banking needs. Banks have introduced fast and convenient banking and payments solutions, including online and app‑based banking, contactless payments, mobile pay applications and cheque deposit, online money transfers and more. These technologies were already in place as the pandemic hit, when it mattered most, and further innovations were developed in record time to support customers as their lives changed dramatically. A deep commitment to improving the customer experience will continue as the pace of technological change accelerates and consumer behaviours continue to evolve.

Banks in Canada are building on their strong track record of adapting to what their customers want — and what they want is access to banking services 24 hours a day, in real‑time, from anywhere, on a reliable and secure network.

These and other findings form the basis of How Canadians Banks, a biannual study by the Canadian Bankers Association and Abacus Data that examines the banking trends and attitudes of Canadians.

Technology, the pandemic and generational influences of younger customers are changing how Canadians bank

As technology evolves and the pandemic changes the way we live and work, the digital expectations of customers are rising. This is the leading catalyst for continued innovation as banks look for new, easier ways for Canadians to access their banking safely and securely. And Canadians clearly value the convenience of these innovations and feel better served as a result.

- 78 per cent of Canadians are using digital channels to conduct most of their banking transactions, up from 76 per cent in 2018 and 68 per cent in 2016.

- 90 per cent of consumers believe that new technologies have made banking a lot more convenient.

- 86 per cent of Canadians agree that their bank has improved service through technology. More than one‑third (34 per cent) of Gen Z consumers "strongly agree" that technology is improving their banking experience.

- 84 per cent of consumers are satisfied with Tap & Pay contactless payments, up significantly from 74 per cent in 2018.

- Three out of four Canadians (75 per cent) intend to keep the digital banking habits developed during the past two years.

Canadians are clearly turning to tech-driven and contactless transaction methods amid the ongoing pandemic. The average Canadian uses Tap & Pay 10 times a month and buys something with their credit card and debit card eight times and seven times a month, respectively. Looking ahead five years, Canadians expect to increase their use of the following top three banking technologies:

- Tap & Pay (43 per cent)

- Interac e‑Transfer (40 per cent)

- Mobile banking apps (36 per cent)

Consumers under the age of 30 are expected to be the main drivers of the increased adoption of these digital solutions. In contrast, the use of cheques, while already in decline over the last decade, is expected to continue trending downward, with 31 per cent of Canadians say they plan to stop using cheques within five years.

The shift towards online and mobile banking has gathered momentum during the pandemic. Digital‑first customer preferences are likely to become more entrenched in the years ahead.

Online banking is still the most common way people bank

As banking technologies have come to the forefront, online banking has cemented its position as the most common form of banking for most Canadians.

- 89 per cent of Canadians reported using online banking in the last year.

- Half of customers (49 per cent) say that online banking is now their most common banking method – 20 per cent higher than app‑based banking, the second ranked method, although that gap is closing.

- Online banking is the go‑to channel for Canadians aged 45 and older (54 per cent for consumers aged 45‑64 and 68 per cent for those over 65).

- 46 per cent of Canadians increased their use of online banking in the last few years, particularly among consumers under the age of 30 (58 per cent).

- A large majority (93 per cent) of Canadians are satisfied with online banking.

- Almost 40 per cent of Canadians are planning to increase their use of online banking, more than any other channel.

Though not surprising given the pandemic, the average Canadian visits their bank’s website five times as often as they do their branch. While differences emerge across generations, in‑person banking is now the most common way to bank for only 10 per cent of Canadians and Automated Banking Machines (ABM) at eight per cent. This is a sharp change from CBA’s first public survey almost 20 years ago when 40 per cent said they banked mainly at an ABM, 30 per cent banked in branches and only 16 per cent did most of their banking online.

While online is the predominant banking method for most Canadians, that dominance is declining over time as an increasing number of customers gravitate to mobile app‑based tools.

Mobile app‑based banking continues to rise, led by Gen Z and Millennial uptake

Every Canadian with a smartphone now has a bank in their pocket. As an increasing number of Canadians carry smartphones, banks offer mobile banking and payment services and apps that allow customers to perform a variety of transactions through their mobile devices. As a result, the number of Canadians banking on the go continues to rise, especially among younger customers.

- 65 per cent of Canadians used mobile app‑based banking in the last year, up considerably from 2018 and 2016 results, at 56 per cent and 44 per cent respectively.

- 37 per cent of Canadians increased their use of mobile banking in the last few years, led by bank customers under the age of 30 (59 per cent).

- More than one‑third (33 per cent) of financial transactions are done with a mobile device, and this is expected to increase to 37 per cent in five years.

- Overall, 80 per cent of Canadians say they are satisfied with mobile banking services, up from 73 per cent in 2018.

- Satisfactions levels are high across several measures: Ease of use (79 per cent), convenience (79 per cent), overall value (78 per cent), feeling secure (77 per cent) and protection of personal information (74 per cent).

- Nearly half of Gen Z (46 per cent) and well over a third of Millennials (37 per cent) say apps are their leading banking method, as opposed to 29 per cent for all demographics groups combined.

- Members of Gen Z are five times more reliant on mobile banking technology than older Canadians aged 65 and above.

While satisfaction with banking apps has been improving over time, 20 per cent of Canadians report unsatisfied. This suggests that, as banks continue to introduce updates that improve reliability and simplicity of apps, satisfaction levels will rise in tandem.

In‑person banking, while declining in popularity, remains a valued method to conduct major transactions

Despite the surging use of digital banking solutions during the pandemic, bank branches remain an important part of the banking mix in Canada. Personal interaction will continue to play a role in our online and mobile‑first world as branches evolve into advice and information centres to help customers navigate major transactions.

- 57 per cent of Canadians used in‑branch banking in 2021, down from 67 per cent in 2018.

- Four out of 10 customers decreased their visits to a bank branch because of the pandemic.

- More than 90 per cent of customers are satisfied with in‑person banking.

- Only 10 per cent of customers do most of their banking at the branch, down three per cent over the last seven years, and 24 per cent plan to decrease their bank branch visits over the next five years.

ABMs are still popular for withdrawals, though overall use is declining

Canadians still rely on ABMs primarily to get cash, make deposits and pay bills. While digital banking and payments options rapidly gained momentum because of the pandemic, eight per cent of customers say they use ABMs to conduct most of their banking. This trend is consistent across generations and income groups. The use of ABMs has been trending downward over time, which is likely to continue.

- In 2020, Canadians made approximately 309 million cash withdrawals, 124 million deposits, 30 million bill payments and conducted 12 million transfers at bank‑owned ABMs.

- Overall satisfaction with ABM banking is very high, with 92 per cent of Canadians saying they are satisfied with this technology.

- Looking ahead five years, 20 per cent of Canadians surveyed expect to increase their use of ABM withdrawal and deposits, 16 per cent anticipate decreasing their reliance on ABMs as other tech‑driven alternatives emerge, and the balance foresee no change in use.

There are close to 70,000 ABMs in Canada, including 18,515 bank‑owned ABMs.

The role of cash in a digital world

While Canadians are largely turning to digital channels and electronic payment methods, the demand for and use of cash is still prevalent. Canada may be one of the most cashless societies in the world, but Canadians of all ages still carry cash in their pockets. And who carries the most cash may surprise you.

- On average, Canadians carry $80 in cash on a typical day, which is down from an average of $91 in 2018.

- In five years’ time survey respondents expect to carry an average of $117.

- Interestingly, Boomers reported carrying an average of $70 a day today, while Gen Z reported carrying an average of $100.

Digital currencies: interest is growing, but consumers are wary

While the end of physical money is not near, a dizzying array of cryptocurrencies has launched in recent years. How are Canadians responding to these innovations?

- Led by younger Canadians, more than half (56 per cent) of consumers would consider using a private cryptocurrency

- 64 per cent of Canadians say convenience is the main reason they use, or would use, a cryptocurrency

- One‑third (36 per cent) of consumers expect to be using an alternative currency in five years

High levels of trust in banking innovation

With many digital services available today, trust in the security of personal data and financial information has proven hard to sustain in many sectors of the economy. However, the opposite seems to be true for the banking sector.

- 86 per cent of Canadians trust their bank to offer secure digital banking services.

- 87 per cent of customers trust their bank to protect personal information.

- Banks always put their customers at the center of trusted innovation.

Canada’s banks have earned a strong reputation as pillars of stability, but they are also dynamic and continually anticipate and adapt to evolving customer preferences. Canadians place high trust in banks because they have delivered convenience through technology for decades – always with a focus on security and privacy.

Good value for cost of service

Most Canadians feel comfortable with the cost of different methods of transacting today. In most cases, large majorities feel the transactions are either free, a bargain or reasonably priced. Across the board – from accessing a bank’s website, visiting a branch and using Tap & Pay, to using ABMs, debit cards, mobile apps and Interac e‑Transfer – Canadians feel good about the perceived value for money for the banking services they receive in our increasingly digital world.

All data from: How Canadians Bank, Abacus Data, 2021, except ABM transactions statistics and number of ABMs (Source CBA, 2020).

Methodology

The bi-annual survey was conducted by Abacus Data in December 2021. A total of 4,000 adults were interviewed online, across four demographic groups: Under 30, 30-44, 45 to 64 and over 65. The sample was designed and weighted to reflect Canada’s population according to age, gender, education and region. A comparable probability sample would have a margin of error of +/- 1.8%, 19 times out of 20.