Article

Recommendation 1: We recommend that the Government of Quebec adopt a broader approach on fighting scams and

protecting consumers than the one proposed in Bill 72. Based on our findings, bringing other sectors in to take

responsibility for their roles in scams not only will support the identification, response and prevention of scams,

but it will also ensure that the wider ecosystem has a vested interest in the deterrence of future scams.

Additionally, we recommend that the Government of Quebec and the Consumer Protection Office consult the CBA in

advance of the development of draft regulations, which will enact the terms of application of section 65.2 of the

Consumer Protection Act.

Recommendation 2: We recommend that the Government of Quebec review and revise laws relating to privacy that restrict

organizations from taking reasonable measures to detect and prevent fraud, particularly considering the increasing

use of Artificial Intelligence (AI) by bad actors. Laws should contemplate situations where certain uses and

monitoring of personal information are reasonable as a condition of service for addressing fraud within certain

products, services and/or channels.

Recommendation 3: We urge the Government of Quebec to work closely with the federal government and authorities to

combat money laundering (ML) and terrorist financing (TF). In particular, we urge investments in Quebec’s

enforcement and prosecution of ML and TF and the harmonization of its existing tools with the federal government. A

harmonized approach will ensure efficiency by avoiding compliance duplication across different levels of government.

Recommendation 4: We encourage the Government of Quebec to support the adoption of a financial consumer protection

regime targeted at payment service providers (PSPs), as part of Quebec’s consumer protection framework. Enhancing

standards for financial consumer protection should also extend to entities that embed payments processing for

merchants on behalf of consumers that have the potential to fall outside the federal framework, as they introduce

the same risks as PSPs. We also encourage Quebec to work with other provinces and the federal government to achieve

a consistent market conduct framework across the country for the benefit of consumers and PSPs.

Recommendation 5: We encourage the Government of Quebec to eliminate the Compensation Tax on Financial Institutions

to promote job creation and economic prosperity in the province. Additionally, we recommend the Government of Quebec

undertake productivity-enhancing tax reforms in the province and advocate at the federal level for a comprehensive

review of our country’s tax system. Canada, its provinces and territories, must modernize their tax system and avoid

asymmetrical, sector-specific, and retroactive taxes that ultimately impact consumers and undermine the investment

climate.

Introduction

The CBA is grateful for the opportunity to contribute to the Government of Quebec’s upcoming budget. As the voice of

more than 60 domestic and foreign banks1, we advocate for public policies that contribute to a sound and

safe banking system and help drive prosperity and strong economic growth for Canadians.

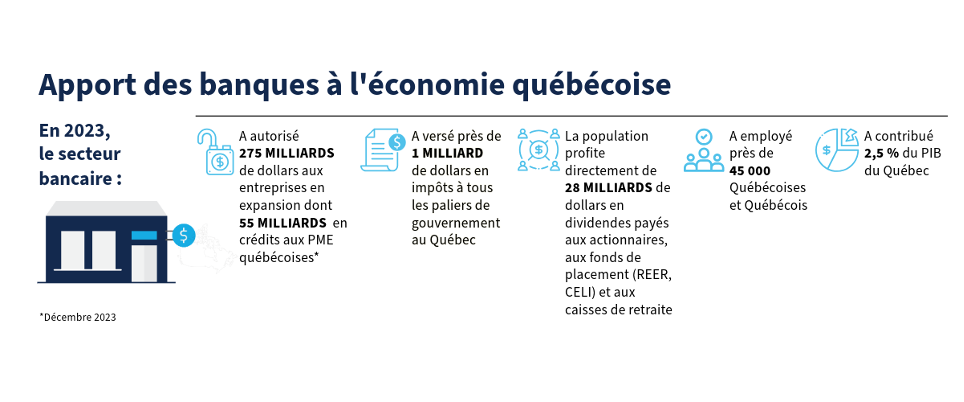

Banks play an important role in Quebec’s economy. In 2023, banks2:

- Contributed approximately $10.9 billion (or 2.5%) to Quebec’s GDP

- Paid close to $1 billion in taxes

- Employed close to 45,000 people, a workforce represented by women (53%) and self-identified visible minorities

(28%)

- Generated over $28 billion in dividend income that went to Canadian (including Quebec) seniors, families,

pensions, charities, and endowments

- Operated close to 950 branches and over 3,500 ABMs in the province

Banks are key in providing access to capital for Quebecers. By the end of 2023, they had:

- Over $187 billion in residential mortgages outstanding

- Over $275 billion in authorized business credit, of which $55 billion went to support small- and medium-sized

enterprises (SMEs)

- Since 2010, small business debt approval rates in the province have consistently been above 80%

annually3

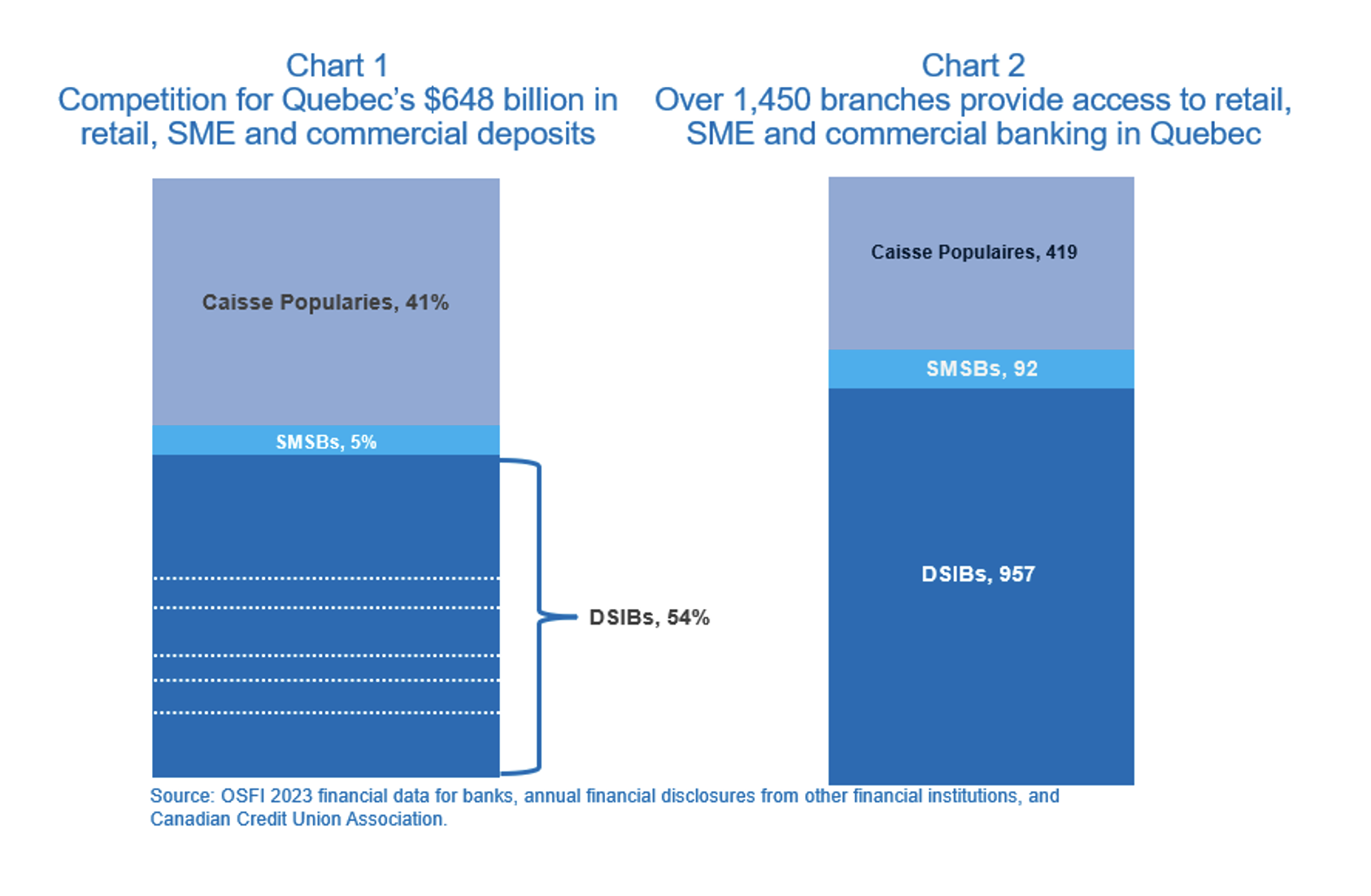

The financial services market is highly competitive in Quebec. For example, in Quebec’s market for retail, SME and

commercial deposits, the six domestic systemically important banks (DSIBs) and over 20 small- and medium-sized banks

(SMSB) compete with over 200 caisse popularies, who 40% of all the deposits in the province (Chart 1). Competition

in the lending market is also high, with 26 banks and federal credit unions able to underwrite insured mortgages to

Quebecers, competing with over 200 caisse populaires and over 30 non-bank financial institutions such as mortgage

finance companies, trust companies, and insurance companies.4 Competition in the market for uninsured

mortgages is particularly high due to mortgage investment companies and private lenders operating in the mortgage

market, in addition to bank and non-bank financial institutions.

Furthermore, while Canadians increasingly prefer digital banking,5 as Chart 2 shows, banks have a

dedicated network of branches providing a local presence and access to in-person banking services that accounts over

70% of all deposit-taking institution branches in the province.

This competition is even more intense when the market is examined from the perspective of all financial services

offered to Quebecers. Market competitors include other deposit-taking institutions, life and health insurance

companies, general insurance companies, trust companies, mutual funds, securities dealers, investment advisers, and

specialized and non-traditional firms entering and expanding the market. This includes large technology platforms

with growing access to consumer data, fintech payment services providers, buy-now-pay-later companies, digital

currency exchanges, robo-advisors, etc.

Amidst the growing competition in the evolving financial marketplace, the DSIBs have invested approximately $120

billion in technology over the past decade. These investments have contributed to making the banking sector among

the most highly productive business sectors in the Canadian economy. Furthermore, the banking sector has seen labour

productivity growth of 2.4% a year since 2007, making the Finance and Insurance sectors the second fastest growing

in the Canadian economy.6

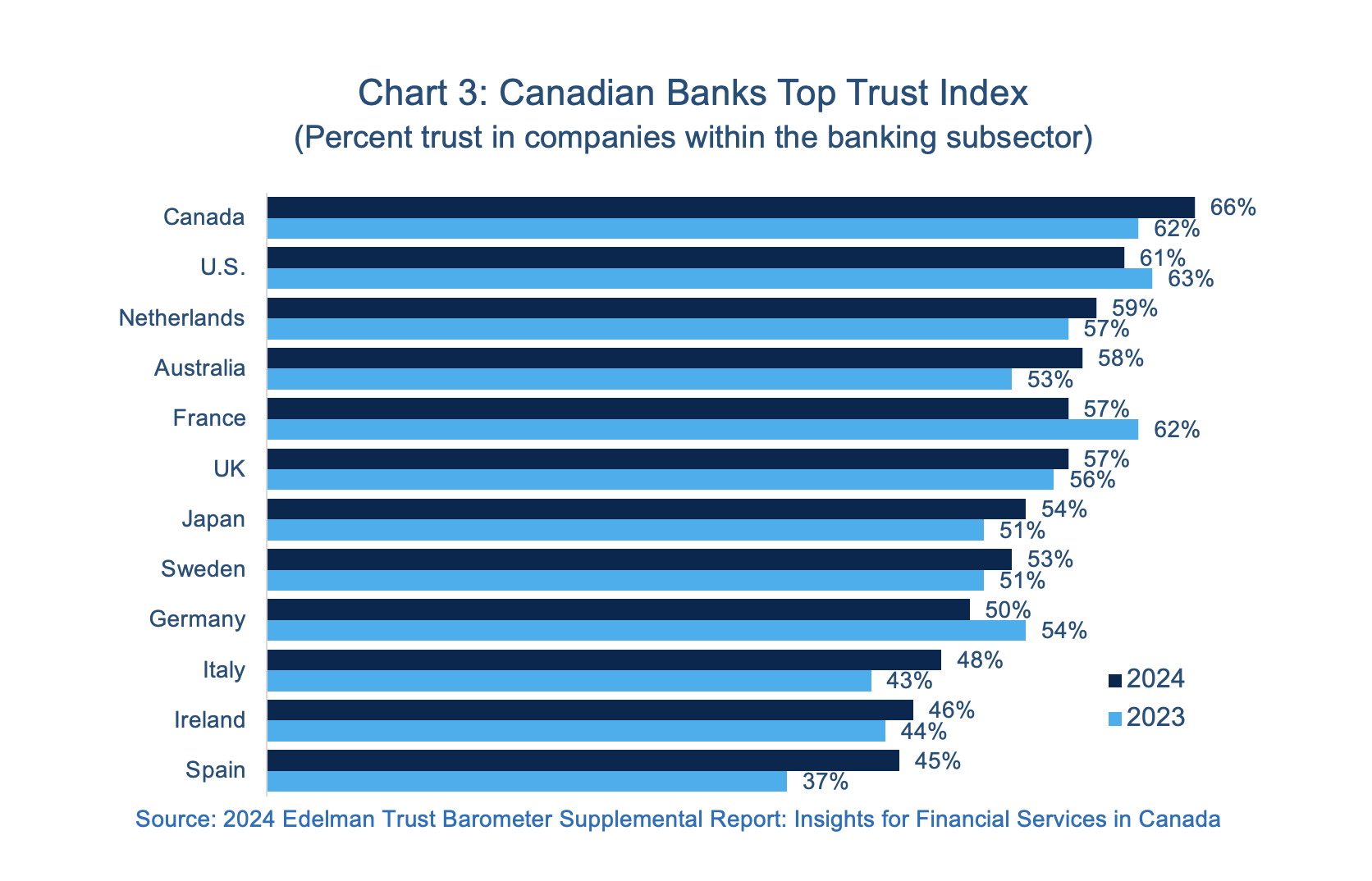

These investments also underpin Canadian banks’ commitment to further consumer trust. Its one of the reasons why five

of the world’s top 15 safest and most dependable commercial banks are Canadian.7According to the 2024

Edelman Trust Barometer, Canadian banks have increased trust with the public over the past two years and Canadian

banks have the leading position in trust with the public compared to banks in other developed countries (Chart

3).8

Recommendation 1

Scams are a growing threat, with scam losses reaching historic highs nationally. 75% of Canadians report encountering

a scam at least once a month and the Canadian Anti-Fraud Centre (CAFC) reported a staggering $638 million lost to

scams by Canadians in 2024. However, actual losses are believed to be significantly higher, as an estimated 90% of

incidents are unreported. As such, the financial impact of scams may be over $12 billion annually (or about 0.5% of

Canada’s GDP).9

Banks are committed to limiting the growing threat of scams and have invested heavily in advanced security systems

and layered fraud detection to protect consumers. However, the majority (65%)10of scams originate outside

of the financial sector’s purview, such as through telecommunications or digital platform channels. Protecting

Quebecers against scams is a shared responsibility that requires a coordinated, cross-sector strategy to effectively

combat the evolving sophistication of scammers and mitigate rising consumer angst.

Therefore, we urge the Government of Quebec to broaden its approach in Bill 72 in favour of a strategy that

proactively identifies and effectively responds to scams throughout their lifecycle. It is imperative that the

Government of Quebec participate in the national conversation on a fraud prevention strategy.

Without greater cross-sector coordination, we believe section 65.2 of the Consumer Protection Act disproportionately

assigns the financial responsibility of scams unto financial institutions, including banks and caisses populaires.

Such an approach will disincentivize other sectors (e.g., telecoms, digital platforms, etc.) from identifying and

monitoring scams at different stages of their lifecycles, and ultimately result in a disproportionate number of

scams in Quebec relative to the rest of Canada. Canadians, governments, financial institutions, telecommunication

companies, online platforms, technology companies, law enforcement, and the courts all have a significant role to

play in this fight to reduce the occurrence of scams.

Only by working together can we identify scammers more quickly and limit the damage they cause. We have to prevent

scams before they occur, while also ensuring that perpetrators face consequences to prevent recurrence.

In addition to cross-sector coordination, our experience in fraud prevention underlines the need for an approach that

considers individual circumstances, encourages responsible consumer behaviour, and bolsters education that will

benefit consumers. For this reason, the CBA is an active supporter of Quebec’s financial education strategy. It is a

successful example of the cross-sector coordination that is required to fight scams.

Recommendation: We recommend that the Government of Quebec adopt a broader approach on fighting scams and protecting

consumers than the one proposed in Bill 72. Bringing other sectors in to take responsibility for their roles in

scams not only will support the identification, response and prevention of scams, but it will also ensure that the

wider ecosystem has a vested interest in the deterrence of future scams. Additionally, we recommend that the

Government of Quebec and the Consumer Protection Office consult the CBA in advance of the development of draft

regulations, which will enact the terms of application of section 65.2 of the Consumer Protection Act.

Recommendation 2

The use of new tools, including those that analyze behavioural patterns, are increasingly necessary to detect and

prevent fraud (e.g., keystroke pattern analysis to detect bots, liveness testing to detect deepfakes, etc.). For

example, if permitted, banks could employ additional measures alongside existing authentication methods such as

passwords, one-time verification codes, Internet Protocol (IP) and device tracking, to authenticate customers and

flag potential instances of fraud or account takeovers. Artificial Intelligence (AI) is quickly evolving, and bad

actors are taking advantage. In response, organizations need to be able to adapt quickly to protect their customers

and themselves from fraud.

However, privacy11 and IT legislation12 in Quebec require individuals to provide their express

opt-in consent for such uses. Generally speaking, many customers do not opt in to such programs.

As a result, organizations find themselves not being able to use the most effective methods to detect and prevent

fraud in the context of digital channels. Objectively speaking, being able to exclude themselves from effective

fraud detection techniques is a clear benefit to bad actors. In addition, there are customer impacts. When

considering responsibility and liability, there should be consideration of whether a customer chose to opt-in to the

organization’s use of a reasonably effective and necessary method of fraud detection.

Should organizations be able to use such reasonable measures in their operations only outside of Quebec, there may be

unintended negative consequences for Quebec’s residents and economy, as organizations would not be able to equally

protect consumers across provinces.

Recommendation: We recommend that the Government of Quebec review and revise laws relating to privacy that restrict

organizations from taking reasonable measures to detect and prevent fraud, particularly considering the increasing

use of Artificial Intelligence (AI) by bad actors. Laws should contemplate situations where certain uses and

monitoring of personal information are reasonable as a condition of service for addressing fraud within certain

products, services and/or channels.

Recommendation 3

It is critical that the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) continues to

comprehensively govern the fight against money laundering (ML) and terrorist financing (TF) across Canada. While the

CBA acknowledges that the PCMLTFA needs to continue its evolution into a risk-based framework that is fit for

purpose, we caution against applying new provincial requirements, reporting or otherwise, to this space. We are

concerned that any fragmentation of the national regime could inadvertently:

- Empower bad actors by creating opportunities for legislative arbitrage in Canada, if regional or provincial

requirements are misaligned with those at the federal level

- Impact the ongoing, important national policy work of the federal government

- Create coordination concerns amongst a growing number of authorities; and

- Potentially exacerbate concerns with high-level, low impact reporting

Instead of considering new requirements to a comprehensively regulated space, the CBA urges the Government of Quebec

to support existing Anti-Money Laundering (AML)/Anti-Terrorist Financing (ATF) tools and invest in law enforcement

to better fight ML and TF. More specifically, the Government of Quebec should:

- Continue to support the federal government’s efforts to evolve the beneficial ownership registry into a single,

pan-jurisdictional Canadian registry that reflects federal, provincial and territorial beneficial ownership

information, as well as beneficial ownership information from other legal ownership structures (e.g.,

partnerships, trusts, and associations) – creating a one-stop shop for users

- Invest in law enforcement to support its investigation and prosecution of ML and TF cases and coordinate that

work with relevant federal authorities; and,

- In coordination with the federal government, seek to enhance and refine the provincial forfeiture regime, such

as the Quebec Act, respecting the forfeiture, administration and appropriation of proceeds and instruments of

unlawful activity. The Quebec Code of Civil Procedure should also be adapted to include the evolution of

predicate offences and ML and be used to recover criminal property

In relation to the second point, we suggest the Government of Quebec provide funding and resources devoted to

prosecutors and the courts in municipalities and regions with high volumes of financial crime. The funds would be

used to establish specialist investigative units that boost the tools and knowledge to pursue financial crime

charges. These municipalities and regions may be identified via a data sharing agreement with the Financial

Transactions and Reports Analysis Centre of Canada (FINTRAC).

We also suggest the Quebec government align its privacy laws with the new federal framework for voluntary

private-to-private information sharing for AML purposes, which includes safe harbour protections (i.e., civil and

criminal) for compliant organizations. The soon to be implemented federal framework (which amends both federal

privacy and AML laws) will enable reporting entities under the PCMLTFA to share information for the purposes of more

effectively detecting and preventing ML and TF, helping to fight financial crime. It is also safeguarded with Codes

of Practice (reviewed by FINTRAC and approved by the Privacy Commissioner of Canada) to protect the privacy of

Canadians. Reporting entities operating in Quebec may not engage in this type of sharing, even when they consider

the purpose is reasonable to detect or deter ML or TF, if there is any risk that such sharing without an

individual’s knowledge or consent may result in fines or penalties under Quebec’s current privacy framework. A gap

in information sharing practices could be exploited by bad actors, putting at risk Quebecers and Quebec’s economy.

The foregoing steps are critical. Taken together, they will bolster the federal regime and help to drive prosecutions

and enforcement and fight financial crime. The CBA and its members are eager to work with the Government of Quebec

on this issue and look forward to consulting on and supporting provincial efforts.

Recommendation: We urge the Government of Quebec to work closely with the federal government and authorities to

combat ML and TF. In particular, we urge investments in Quebec’s enforcement and prosecution of ML and TF and

harmonization of its existing tools with the federal government, in particular introducing safe harbour protections

from provincial civil and criminal liability (including from privacy-related fines and penalties) to support AML/ATF

private-to-private information sharing. A harmonized approach will ensure efficiency by avoiding compliance

duplication across different levels of government.

Recommendation 4

Quebecers, along with all Canadians, continue to adopt new payment methods offered by non-traditional payment service

providers (PSPs), including Big Tech. At present, these PSPs are largely un- or under-regulated.

Globally, the G20 and OECD have recognized that financial consumer protection requires a more targeted set of

principles than general consumer protection. These principles seek to mitigate key risks to consumers in financial

transactions, including, but not limited to:

- Incurring fees that have not been properly disclosed by a provider

- Not having access to funds held by a provider

- Being held responsible for fraudulent transactions; and

- Not having a line of recourse in the absence of a clear complaints-handling process

Failure to address these risks, among others, can decrease consumer trust in the financial system. Financial services

and products have the potential to disproportionately impact the well-being of consumers and must be addressed

specifically rather than through overarching consumer rights across banks and PSPs.

While the Bank of Canada and Finance Canada have developed a federal supervisory framework for PSPs under the Retail

Payment Activities Act to address certain financial and security risks, the framework is silent on market conduct.

Addressing the market conduct gap is important to ensure PSPs provide fair consumer outcomes that encompass consumer

protection. With some 3,000 PSPs currently operating in Canada and expected increases in consumer usage of PSPs once

they are supervised by Bank of Canada, the absence of market conduct regulation is a significant gap in consumer

protection.

It is important that Quebec work to align its market conduct approach with other provinces and the federal government

to provide an overall consistent framework in Canada. This would ensure similar protections for consumers across the

country as well as avoiding duplication or differing rules for Quebec-based PSPs that operate in multiple provinces.

We believe that Quebecers and Canadians should continue to benefit from secure, reliable, and consistent financial

services. Therefore, it is important that un- or under regulated players do not introduce risk into the existing

stable financial system. Ultimately, any market conduct framework would abide by the principle of “same activities,

same risks, same regulations.”

Recommendation: We encourage the Government of Quebec to support the adoption of a financial consumer protection

regime targeted at PSPs, as part of Quebec’s consumer protection framework. Enhancing standards for financial

consumer protection should also extend to entities that embed payments processing for merchants on behalf of

consumers that have the potential to fall outside the federal framework, as they introduce the same risks as PSPs.

We also encourage Quebec to work with other provinces and the federal government to achieve a consistent market

conduct framework across the country for the benefit of consumers and PSPs.

Recommendation 5

Canada’s labour productivity growth has diminished considerably, making production more expensive and Canada less

competitive. This diminished growth impacts Canada’s living standards, ability to pay for government programs, and

economic resiliency. In fact, Canada ranks 18th in productivity among countries in the OECD and last among the

G7.14

Furthermore, the IMF, OECD, and others have urged Canada to implement growth-oriented tax policies to reverse

Canada’s poor productivity trend. Yet, the provincial and federal governments elect to impose specific taxes on the

banking sector, limiting its economic contributions. For banks, such taxes limit the amount of capital they can

deploy to businesses for productivity enhancing measures, reducing Canadians’ ability to save and invest, thereby

increasing investment uncertainty and reducing banks’ ability to attract necessary capital. Indeed, Australia’s

Government Productivity Commission concluded that industry levies must be avoided to establish or maintain sound

foundations for productivity growth.15

These taxes include:

- Quebec’s Compensation Tax on Financial Institutions, which was originally introduced as a temporary measure, yet

has been extended twice beyond its original 2019 expiry date. The tax is applied on bank wages and is therefore

a tax on job creation in the province

- The recent removal of the Dividend Received Deduction, which will negatively impact middle-class Canadians who

hold over 3 million retail market-linked GICs and Notes. These investments allow middle-class households, mostly

approaching or in retirement, to access higher returns and manage downside risk

- The Financial Institutions Tax and the Canada Recovery Dividend, announced in the 2022 federal Budget, which

reduced the amount of capital that can be deployed to businesses and consumers, as every dollar reduction in

retained earnings translates into over $7.50 of foregone new credit capacity. These taxes have also deterred

foreign investment into Canadian banks. In the year before the 2022 federal Budget, international investors made

net purchases of $3.6 billion worth of Canadian bank equity. In the year afterwards, international investors

made net divestments of $11.6 billion in Canadian bank equity

- The federal government has implemented retroactive sales taxes on payment clearing services. Retroactive taxes

undermine the principles of predictability, certainty, fairness and confidence in the tax system needed by

businesses to make investment decisions

Comprehensive tax reform, including removal of sector-specific taxes, is needed to improve Canada’s productivity,

living standard, competitiveness, and economic growth. Given the United States’ desire to substantially cut its

already competitive business taxes to attract investments and threat of tariffs on imports, Canada needs a

comprehensive and competitive tax reform now more than ever to ensure prosperity for all Canadians.16

Recommendation: We encourage the Government of Quebec to eliminate the Compensation Tax on Financial Institutions to promote job creation and economic prosperity in the province. Additionally, we recommend the Government of Quebec

undertake productivity-enhancing tax reforms in the province and advocate at the federal level for a comprehensive

review of our country’s tax system. Canada, its provinces and territories, must modernize their tax system and avoid

asymmetrical, sector-specific, and retroactive taxes that ultimately impact consumers and undermine the investment

climate.

Conclusion

The CBA thanks the Government of Quebec for the opportunity to contribute to its upcoming budget. Our recommendations

address critical areas that impact families and businesses in Quebec and aim to ensure Canada’s banking system

continues to support vibrant and healthy communities across the province.

We welcome further opportunities to discuss our recommendations in more detail and to explore collaborative efforts

to positively impact the future of Quebecers.

1 Provincially regulated caisse populaires and credit unions are not CBA members.

2 Banking contributions provided by CBA.

3 ISED, Credit Conditions Survey, 2010 to 2022.

4 CMHC National Housing Act Approved Lenders.

5 CBA, 2024.

6 CBA calculations and Bennet Jones, Economic

Outlook 2025, Safeguarding a Vital Relationship and Investing in a More Productive Economy. While the

Finance and Insurance produced $93 in real GDP per hour worked, banking and other depository credit intermediation

produced $113.40 in real GDP per hour worked.

7 Global Finance, World’s Safest Banks 2024: Commercial Top 50

8 Edelman Canada, 2024 Edelman Trust Barometer Supplemental Report: Insights for Financial Services in

Canada, 2024.

9 Royal Canadian Mounted Police,

Fraud Prevention Month 2024: Fighting fraud in the digital era, 2024. Figures provided by CAFC for the

period of Jan 1, 2024, to September 30, 2024. This accounts for 11,135 reports filed to CAFC, resulting in 5,531

victims and $ $35,965,368.22 in losses

10 Royal Canadian Mounted Police, Canadian Anti-Fraud Centre, as of December 31, 2024.

11 National Assembly of Quebec, Bill 64: An Act to modernize legislative provisions as regards the protection of personal

information, 2021.

12 Ministère de l’Emploi et de la Solidarité sociale, c-1.1 Act to establish a legal

framework for information technology, updated 2024.

13 Bank of Canada, Future-proofing our payments systems, 2024.

14 OECD Compendium of Productivity Indicators 2023.

16 The White House, Remarks by President Trump at the World Economic Forum , 2025.