Article

Andrew Dickson, Director, Fraud Prevention Awareness & Education, CBA

Financial fraud targeting older adults continues to be a growing concern, not just in Canada, but around the world. Fraudsters are becoming more sophisticated, exploiting vulnerabilities like social isolation, unfamiliarity with digital tools, and the perception that older adults have significant financial assets.

Recognizing the scale and urgency of this problem, Canada’s banks, government agencies, telecommunications companies, digital platforms and law enforcement are working together with a shared goal of protecting Canadians and keeping them safe from scams.

Canadian Bankers Association's commitment

The Canadian Bankers Association is at the forefront of these efforts, helping address the challenge on multiple fronts, including through practical tools and public education. In partnership with Get Cyber Safe, a national cybersecurity campaign, the CBA has released an updated Fraud Prevention Toolkit for Older Adults.

This newly revised Toolkit offers clear, actionable advice to help older Canadians recognize scams, protect their finances, and respond effectively if they suspect fraud. It also includes crucial information on identifying and addressing financial abuse, which often goes unreported.

The new face of fraud: the rise of AI-driven scams

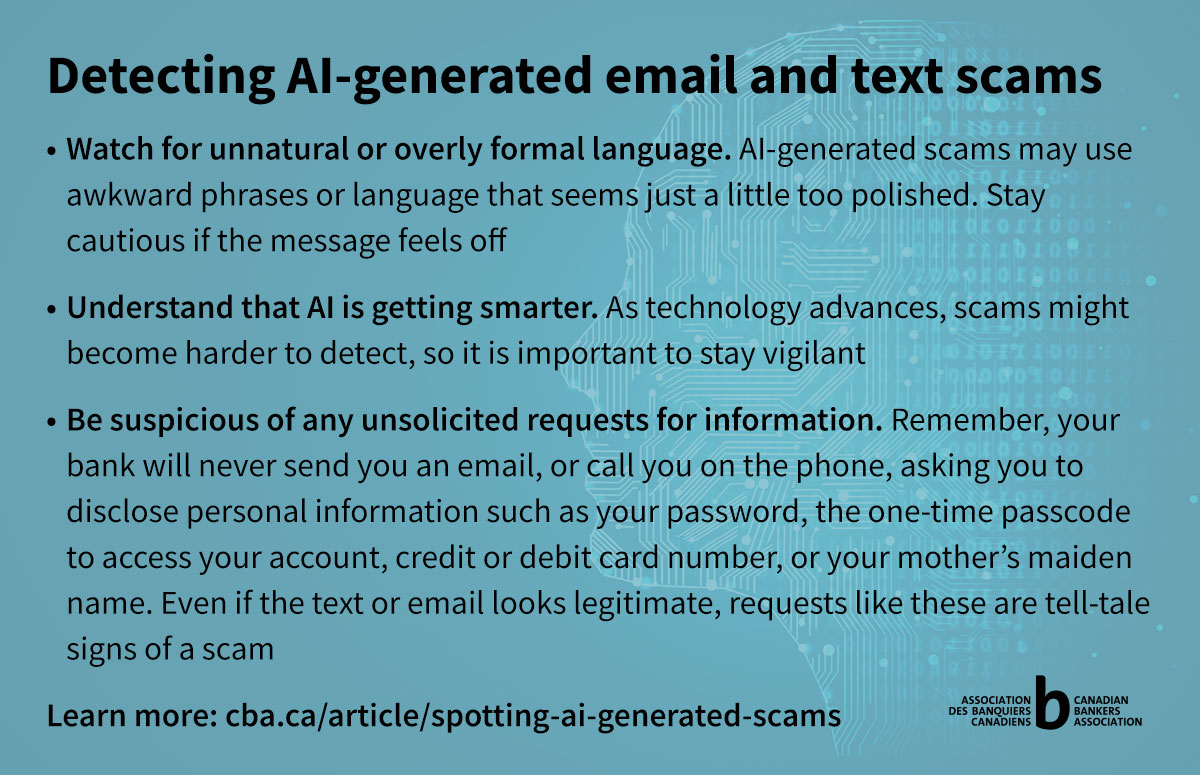

Scammers are continually evolving their tactics, and emerging technologies like artificial intelligence (AI) have made it easier than ever to create highly convincing scams.

Using AI, fraudsters can quickly generate emails mimicking a loved one’s tone, clone voices with increasing accuracy, and fabricate realistic images and videos in minutes. Fraudsters have been quick to use this technology to carry out the grandparent scam, where criminals impersonate a loved one in distress and in urgent need of money.

To help Canadians stay ahead of these evolving threats, our updated toolkit includes new guidance on identifying AI-generated fraud.

Reporting scams: a collective responsibility

Another key update in the Toolkit is an easy, step‑by‑step guide to reporting scams. Encouraging prompt reporting is vital because it makes it harder for scammers to succeed.

When Canadians report scams, they contribute to broader efforts to track criminal organizations, identify fraud patterns, prevent future scams, and raise awareness of new threats. Local police investigate reported incidents, while the Canadian Anti‑Fraud Centre plays a central role by collecting reports and sharing information with police forces across the country.

Empowerment through knowledge

Fraudsters may be persistent, but so are we. By equipping Canadians of every age with the tools and knowledge they need, we can build a safer financial future together, where older adults are not only protected, but also empowered.

Stay a step ahead of scammers

Sign up to receive our free newsletter with tips on how to spot and avoid the latest scams.

Subscribe by filling out the sign up form!