Article

Canada has a strong and competitive banking sector comprised of domestic and foreign banks including 16 U.S.-based bank subsidiaries and branches, which provide a variety of financial services to families and businesses.

Contrary to recent inaccurate statements that U.S. banks cannot operate in Canada, or that foreign banks are unduly restricted, in fact foreign bank subsidiaries have the same ability to undertake banking business in Canada as domestic banks. Because of market forces, particularly the competitive nature of the banking market, foreign banks tend to focus on certain segments of the financial market.

U.S. banks have a long history in Canada, including several that date back to before Canada’s Confederation.1 Since the 1980s, foreign banks have been able to incorporate banking subsidiaries under the Bank Act to operate as banks in Canada with the same powers as domestic Canadian banks. U.S. banks have taken advantage of these powers to specialize in a range of financial services, including credit cards, auto loans, residential and commercial mortgages, commercial and corporate lending, investment banking, and treasury services. They serve not only customers with cross-border business activities but also Canada’s domestic retail market, with offices across the country including Vancouver, Calgary, London, Toronto, Montreal and Halifax. U.S. banks have C$112.8 billion in assets, which make up half of all assets held by foreign banks subsidiaries and branches (C$227.5 billion) in Canada.2

The Canadian banking landscape

Canada has a federal banking model that is national in scope, enabling all domestic and foreign bank subsidiaries and branches to operate across the country. In total, there are 79 banks operating in Canada managing a total of C$9.35 trillion in assets, with an estimated C$5.8 trillion of those assets located in Canada.3

There are three categories of bank licenses in Canada, two of which are devoted to foreign banks. They are:

- Domestic banks – There are 32 domestic banks and three federal credit unions in Canada of all sizes. Banks in this category provide diversified personal and commercial banking services such as deposit, lending, and payments, wealth management, corporate and institutional banking, capital markets, and equipment financing.

- Foreign bank subsidiaries – There are 15 foreign bank subsidiaries in Canada, including from banks with parents based in China, India, South Korea, Spain and Switzerland as well as three based with parents in the United States. Since 1980, the Bank Act has provided these banks with the same powers as domestic banks including deposits that are insured by CDIC. The subsidiary structure, which includes prudential requirements such as dedicated capital and liquidity, is the same as that used by Canadian banks to operate in the U.S.

- Foreign bank branches - There are 29 foreign bank branches operating in Canada, including banks with parents based in China, France, Germany, Japan, Netherlands, Singapore, and United Kingdom as well as thirteen based with parents in the United States. Foreign bank branches are meant to serve corporate, commercial and institutional clients (rather than retail customers), and are limited to taking deposits over $150,000. As a consequence, they have fewer prudential regulatory requirements and are not required to have CDIC deposit insurance. The Bank Act has enabled foreign bank branches to be established in Canada since 1999.

Comparing the businesses of U.S. banks in Canada with Canadian banks in the U.S.

The histories and the resulting structures of the Canadian and U.S. banking systems are fundamentally different.4 The Canadian banking system has favoured a smaller number of large, broadly-held diversified federally-regulated banks that are able to serve customers across the country. On the other hand, historically, the U.S. banking system has favoured more numerous smaller banks focused on particular regions, with a dual banking system with banks regulated at either the federal or state-levels. While the U.S. banking system has evolved with the number of banks having fallen dramatically through the years, it still retains some of its historical characteristics.5

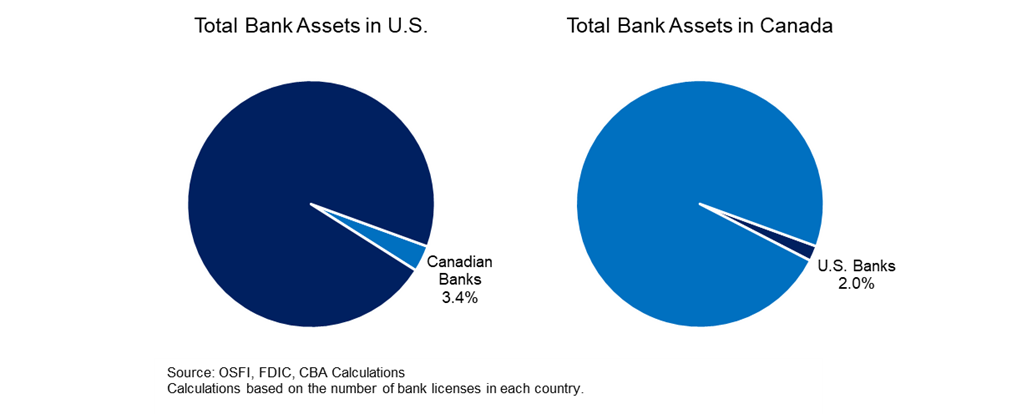

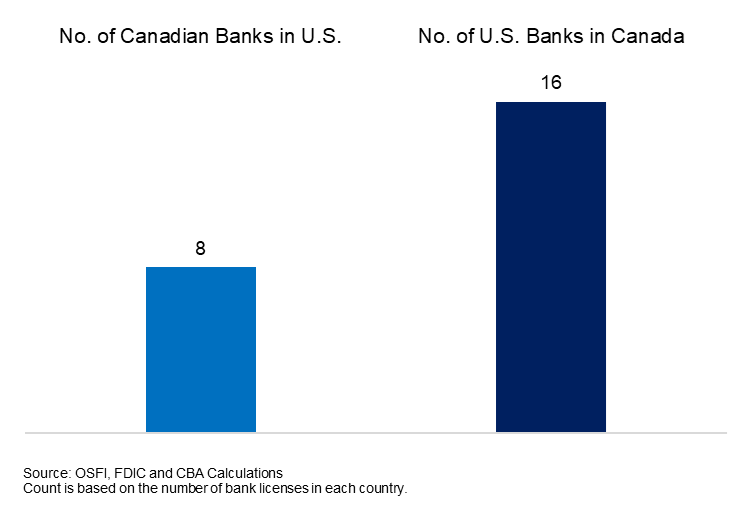

It is within this context that Canadian banks hold 8 bank licenses in the U.S., serving a broad range of families, business and institutional customers. However, they collectively make up around 3.4 percent of total bank assets in the U.S. On the other hand, U.S. banks hold twice as many bank licenses and hold around 2 percent of total bank assets in Canada.

The Canadian banking market, and broader financial services sector, is highly competitive, benefiting families, businesses and the broader economy

The Canadian banking market is highly competitive, benefiting families, businesses and the broader economy. Of the 79 domestic banks, federal credit unions and foreign bank subsidiaries and branches operating in Canada, more than 40 offer financial products and services to retail customers, including bank accounts, credit cards, loans, and investments.

Canadian domestic banks, federal credit unions, foreign bank subsidiaries and branches compete against provincially regulated caisses populaires, credit unions and a provincial government-owned deposit-taking institution in the banking market. These non-bank provincially regulated deposit-taking competitors make up about 12 per cent of banking market assets in Canada.

Furthermore, all of these bank and non-bank deposit-taking financial institutions compete against government-owned lenders, finance companies, life and health insurance companies, general insurance companies, trust companies, mutual funds, securities dealers, investment advisers, and specialized and non-traditional firms entering and expanding the market. This includes large technology platforms with growing access to consumer data, fintech payment services providers, buy-now-pay-later companies, digital currency exchanges, robo-advisors, etc.

U.S. banks operating in Canada

-

Amex Bank

- Citibank

- J.P. Morgan Bank

- Bank of America, National Association

- Bank of New York Mellon

- Capital One, National Association

- Citibank, National Association

- Comerica Bank

- Fifth Third Bank, National Association

- J.P. Morgan Chase Bank, National Association

- M&T Bank

- Northern Trust Company

- PNC Bank, National Association

- State Street Bank and Trust Company

- U.S. Bank National Association

- Wells Fargo Bank, National Association

1A couple of U.S. banks opened their Canadian offices in 1853 and 1858.

2 OSFI Financial data, as at November 2024.

3 CBA calculations, bank financial statements and OSFI Financial data, as at November 2024.

4For further information on the history of Canada’s banking system, see – The Canadian Banking System: Hamilton Approved.

5FDIC. According to the FDIC, there were 14,146 banks in the U.S. in 1934. In 2024, there were 3,928 banks.