As the global financial system was mired in crisis in 2008-09, Canadian banks proved resilient and largely escaped the turmoil that raged internationally. Many who perceived Canada’s banking system as stodgy and risk-averse finally recognized it for its prudent lending practices, diligent government oversight, and sensible regulation based on the core tenets of safety and soundness. In fact, Canada’s banks are ranked among the world’s most stable by the World Economic Forum.

Historically, Canada’s banking system has favoured a limited number of large, broadly held banks with a vast network of branches serving customers across the country. It’s a centrally regulated network with a staunch focus on macroprudential regulation and stability of the system. The Canadian model is widely recognized as a gold standard for other advanced economies around the world.

Historically, Canada’s banking system has favoured a limited number of large, broadly held banks with a vast network of branches serving customers across the country. It’s a centrally regulated network with a staunch focus on macroprudential regulation and stability of the system. The Canadian model is widely recognized as a gold standard for other advanced economies around the world.

Most people would be surprised to learn that the vision behind Canada’s banking system had its beginnings in the United States. The Canadian model is, by and large, the product of a banking framework inspired by Alexander Hamilton, the first American secretary of the Treasury. Adam Shortt, an economic historian who authored a series of articles for the Journal of the Canadian Bankers’ Association at the turn of the 20th century, went so far as calling Hamilton the "father of the Canadian banking system".

Today, our banking model remains true to Hamilton’s ideal. His guiding principles found a home in Canada and laid the foundation upon which our country’s banking framework was built over time. Indeed, his bedrock idea was that connections between nationally focused financial institutions and the government, will, under all normal political conditions, derive stability and inspire confidence and respect at home and abroad.1

Of course, Canada’s banks have evolved considerably over the years. Our country now has a greater number of large national domestic retail banks actively competing in the marketplace than most European countries, Australia and the United States. Today, there are more than 80 domestic and foreign banks operating in Canada and, of those, more than 40 offer financial products and services to retail customers.

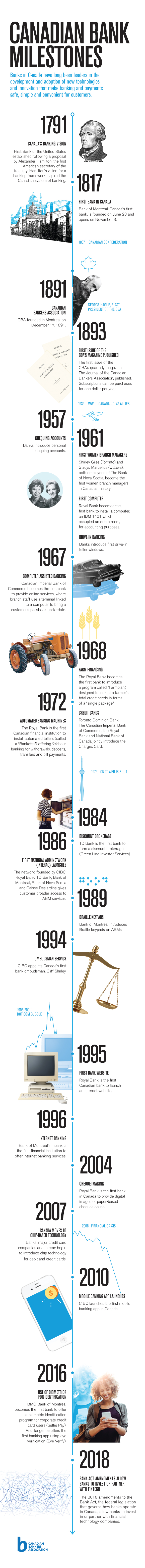

Below is an infographic that highlights some key milestones in the proud evolution of banking in Canada.

To learn more about the Canadian Bankers Association’s own history, visit our history page.

For information on how banks in Canada are meeting the modern preferences of their customers, refer to our How Canadians Bank polling.

1 Adam Shortt, “History of Canadian Currency and Banking, 1600-1880”, p. 14.