Fast Facts

- 75 per cent of all household debt in Canada is made up of residential mortgage debt which helps increase net

worth,

while ten per cent comes from lines of credit and only five per cent is credit card debt1

- Canadians have significant equity in their home, averaging about 75 per cent of the home’s value2

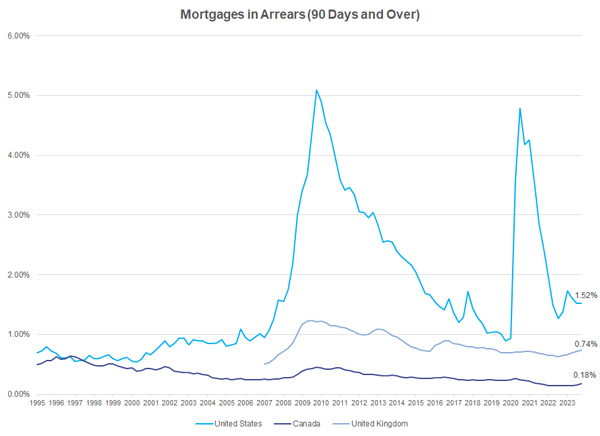

- National mortgage-in-arrears numbers remain very low, at less than a fifth of one per cent since

20223

The bottom line

Banks are closely monitoring household debt levels to ensure that Canadian households can successfully manage their

debts. Canadian banks remain prudent lenders that manage risk carefully, only lending to clients who demonstrate the

ability to repay their loans. At the same time the vast majority of Canadians are responsible borrowers who use

credit

wisely to strengthen their financial futures.

Canadians make wise borrowing decisions

Overall, the vast majority of Canadians are responsible borrowers who use credit wisely to strengthen their financial

futures. It is important to put consumer borrowing into perspective: the majority of Canadian household debt,

75 per cent, is made up of mortgage debt4 – borrowed money used to purchase a home, a high-quality asset which can

increase an individual’s net worth over time. Indeed, this has contributed to 97 per cent increase in aggregate net

worth of Canadian households over the last decade.5

During the pandemic alone, the net worth of Canadian households saw an increase of 38 per cent compared to the levels

at

the end of 2019.6

The statistics show that Canadians are managing their mortgages responsibly. A 2023 study by Mortgage Professionals Canada found that 15 per cent of mortgage holders have increased their mortgage payments and 16 per cent

have made an additional lump sum payment in the last year.7

These stats are supported by a 2024 CMHC survey of mortgage consumers, which found that 39 per cent of buyers are

paying

more than their minimum mortgage payments.9

Canadians also have significant equity in their homes. Canadian homeowners have an average home equity of

75 per cent of their home’s value.10

Lending and borrowing decisions take place in the context of a strong supervisory and regulatory system in Canada.

The

federal government has made regulatory changes to help households manage debt, including such measures as reducing

the

maximum mortgage amortizations and introducing more stringent qualifying criteria.

Responsible credit card use

Credit cards are a convenient payment tool, used responsibly by the majority of Canadians. A Bank of Canada survey

found

that 71 per cent of Canadians pay their balance off in full every month.11 According to Statistics Canada, credit

card

debt only makes up five per cent of total household debt in Canada and credit card debt has remained stable over the

past year.12 Credit card default rates are lower than U.S. levels.

Banks are prudent mortgage lenders

Banks take their role as mortgage lenders very seriously, adhering to prudent standards and ensuring consumers only

take

on manageable levels of debt. This is clearly evident when looking at national mortgages-in-arrears numbers for

Canada’s

ten largest banks, which show that less than a fifth of one per cent of homeowners have gone three consecutive

months or

longer without making a payment, significantly less than in the United States.13

Mortgage debt has been growing and this growth has been driven by a variety of forces in the housing market, notably

a lack of supply, relatively stronger immigration and – until more recently – low interest and unemployment rates.

House

prices have almost doubled in the past decade, requiring home buyers to borrow more to finance their homes.

Banks take the prospect of rising interest rates into account and ensure potential borrowers are able to make future

payments under higher interest rate conditions. Banks require that the borrower qualify using the greater of the

borrower’s mortgage contract rate plus two per cent, or

5.25 per cent. These “stress tests” ensure that borrowers can continue to comfortably make mortgage payments even if

interest rates rise.

Banks provide advice on debt management

Banks are closely monitoring their customers’ borrowing to ensure that debt levels are manageable. Every family has

unique borrowing needs and the amount of debt they feel comfortable carrying can also vary. Banks can provide the

financial advice that is right for each individual customer.

Banks do not want to see their customers in financial difficulty. Canadians who think their debt is becoming

unmanageable are encouraged to speak with their bank as early as possible so they can get the help they need. Banks

are

often able to help their clients work through financial problems by offering advice, debt counselling and flexible

loan

arrangements.

Helping Canadians save

Banks also offer Canadians many different tools to help them save and invest their money for short-term or

long-term needs. From Tax-Free Savings Accounts (TFSAs), First Home Savings Accounts (FHSAs), and Registered

Retirement

Savings Plans (RRSPs) to Guaranteed Investment Certificate (GICs), Exchange Traded Funds (ETFs) and high-interest

savings accounts, banks have their own unique programs to help their customers save and manage their money. Many

banks

also offer services such as savings programs that transfer money from chequing to savings accounts automatically,

savings calculators, online portfolio managers as well as help and advice in achieving specific savings goals.

1 Credit liabilities of households (CANSIM table 36-10-0639-01), June 20242 Annual State of the Residential

Mortgage

Market in Canada, Mortgage Professionals

Canada, December 2020 (Published March

2021).

3 CBA statistics, Residential Mortgages in

Arrears

4 Credit liabilities of households (CANSIM table 36-10-0639-01), June 2024.

5 Statistics Canada. Table 36-10-0580-01

National Balance Sheet Accounts

6 Ibid

7 Semi-annual State of the Residential Mortgage

Market in Canada, Mortgage Professionals

Canada, December 2023

8 Ibid

9 Canada Mortgage and Housing

Corporation, Mortgage Consumer Survey, 2024

10 Annual State of the Residential Mortgage

Market in Canada, Mortgage Professionals

Canada, December 2020 (Published March

2021).

11 Bank of Canada - 2023 Methods-of-Payment Survey Report (released in 2024) (Source for footnote:

Christopher Henry,

Doina Rusu, Matthew Shimoda, 2023 Methods-of-Payment Survey Report: The Resilience of Cash, Bank of Canada Staff

Discussion Paper 2024-8, July 2024)

12 Credit liabilities of households (CANSIM table 36-10-0639-01), June 202413 CBA statistics, Residential

Mortgages in Arrears