Canada’s first bank was created in 1817 and a number of banks followed. By 1891, there were 39 chartered banks with more than 700 branches across the country. During the revision of the Bank Act in 1890, both bankers and the government realized that a more formal banking organization, similar to what existed in the United States and Britain, was required. This need was spurred by a variety of concerns including two major bank failures in the previous five years. Also, the need for a cheque-clearing and settlement process, as well as a banknote monitoring system (at the time, bank notes were produced by each individual bank), was becoming more vital.

The Canadian Bankers Association was founded in Montreal on December 17, 1891 to take on these roles. The CBA was subsequently incorporated by a special act of Parliament in 1900, making the CBA one of Canada’s oldest business associations.

Since then, a lot has changed in the banking sector. Today, there are more than 80 domestic and foreign banks operating in Canada and, of those, more than 40 offer financial products and services to retail customers.

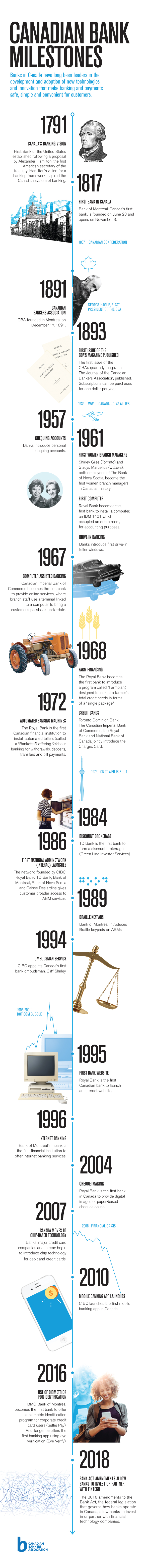

The infographic below celebrates both the CBA and key milestones in Canadian banking.

To learn more about the CBA, visit our history page.