Homeownership is a major goal for Canadians, offering both financial and non-financial benefits that contribute to their overall financial security.

Banks take their role as residential mortgage lenders very seriously, offering a range of mortgage options and professional advice, adhering to responsible lending practices, maintaining high standards for underwriting and risk management, and ensuring customers can manage their debt.

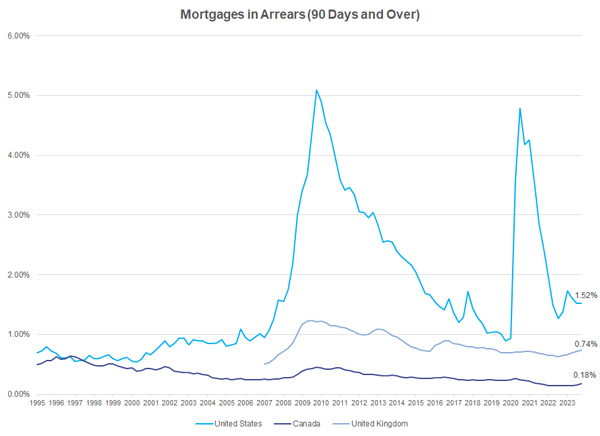

Canada’s mortgages in arrears rate low compared to other advanced economies

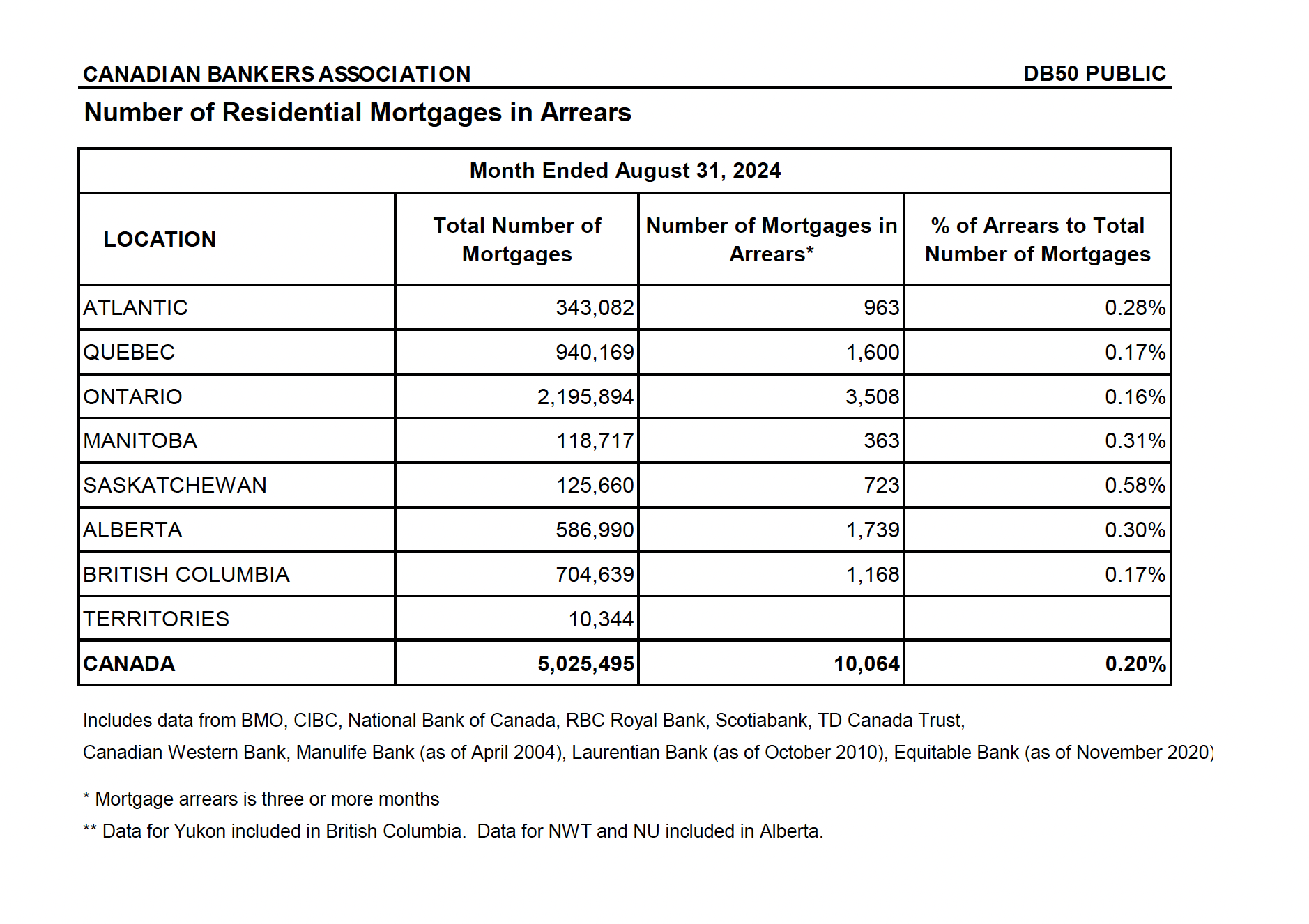

Canadians are also careful borrowers and this is evident when looking at national mortgage delinquency rates in Canada that show that more than 99 per cent of mortgage holders in Canada are in good standing.

Canada’s percentage of mortgages in arrears is also significantly lower than in the United States and the United Kingdom. Despite the current economic environment characterized by higher interest rates, mortgages in arrears in Canada are at the lowest level in decades.

Chart: Number of residential mortgages in arrears as of August 2024

The term "in arrears" is defined as mortgage payments that are overdue by three or more months. Mortgage arrears are considered a lagging economic indicator because they typically relate to events that have happened in the past and take time for their financial impact to be felt.

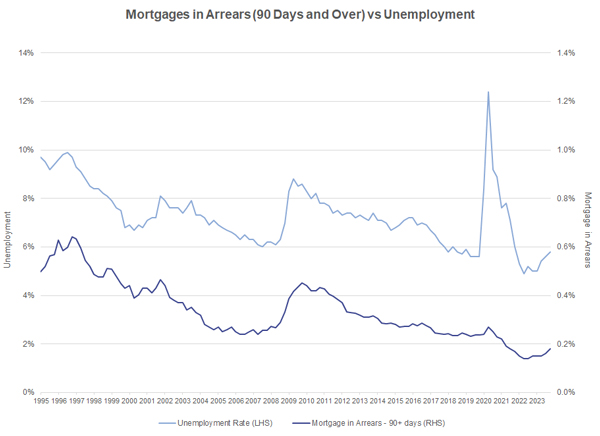

Arrears rates in Canada have remained consistently low over time

Canadian borrowers have consistently maintained low rates of mortgages in arrears even throughout challenging periods such as the Global Financial Crisis and the COVID‑19 pandemic.

Payment arrears are driven primarily by employment conditions and major changes in life circumstance that can cause an unexpected loss to a significant portion of household income.

Support available to Canadians experiencing hardship

Banks do not want to see their customers in financial difficulty and provide a number of resources and supportive measures to assist those who might need help in managing their money and their debt: cba.ca/financialwellness.

Banks actively work with mortgage customers who are experiencing difficulties. Tools are available to assist customers who are experiencing hardship and customers are encouraged to speak to their bank to discuss their situation.